The Madurai bench of the Madras High Court held that the personal delivery or e-mail notice of the Goods and Services Tax (GST) order must be furnished before providing the GST portal or newspaper. It held that without this personal delivery, it breaches the provision of Section 169 of the GST Act, 2017.

In a series of writ petitions, the petitioners claimed that the notices and orders were uploaded only to the web portal, avoiding other service modes specified under section 169 of the Act.

Various applicants claim that their dependence on practitioners for GST compliance left them clueless about the notices furnished via the portal. In various matters, the practitioners have registered their contact details, resulting in the applicants being unaware of updates.

It was urged by the applicants that the service modes u/s 169(1)(a) to (f) must be read conjunctively claiming that the failure to follow the initial modes (personal delivery, registered post, or email) shall comprise a breach of natural justice. They claimed that just publishing the notices on the portal was not enough and unjust, provided the absence of direct communication with the taxpayers.

Additional Government Pleader opposing these mentioned judicial precedents to claim that the service via the portal is valid. He said that the GST act makes the taxpayers liable to check the portal for updates. He also mentioned that the said modes u/s 169(1) are disjunctive, permitting the State to select any one mode for serving notices.

The bench of Justice K. Kumaresh Babu after analyzing arguments directed to earlier rulings on similar provisions under the Tamil Nadu General Sales Tax Rules and GST Rules. It concluded that under Section 169(1)(a) to (c) the modes are alternative but obligatory, and failure to follow these necessitates resorting to the following modes under clauses (d) to (f).

It was carried by the court that only portal publication without prior compliance with personal delivery, registered post, or email notice disobeys Section 169 and natural justice principles.

Therefore it set aside the impugned assessment orders and asked the applicants to submit the response to the Show Cause Notice (SCN) by January 31, 2025. It was directed to the authorities to furnish a hearing opportunity and pass fresh orders under the law.

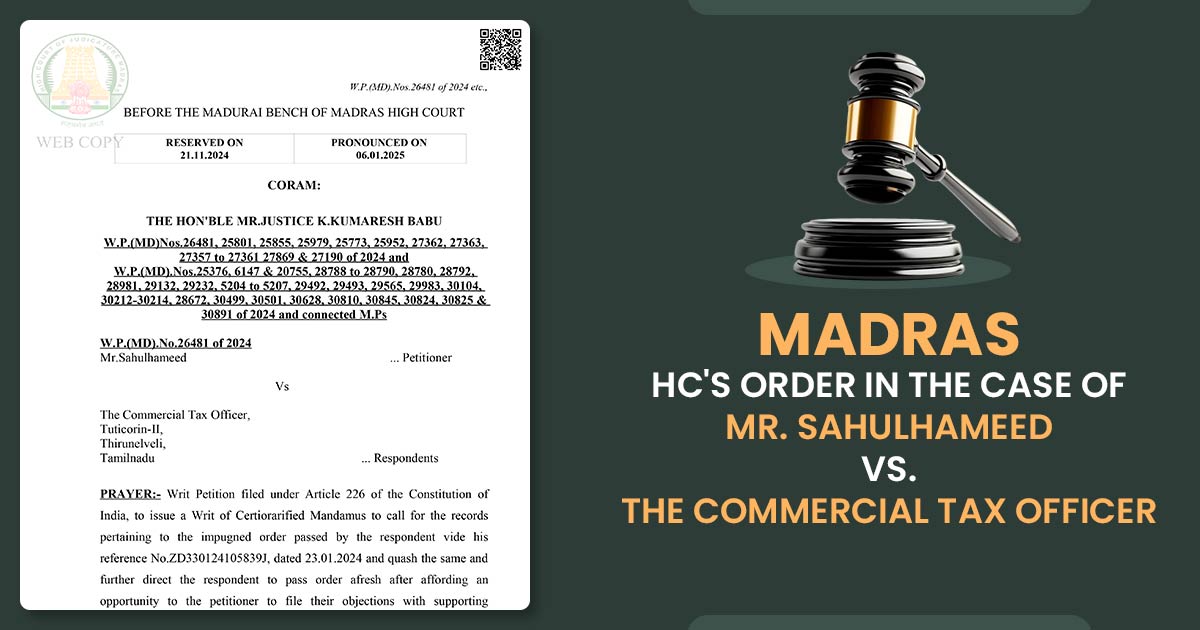

| Case Title | Mr.Sahulhameed vs. The Commercial Tax Officer |

| Citation | W.P.(MD).No.26481 of 2024 |

| Date | 06.01.2025 |

| For Petitioner by | Mr.M.Iniyavan, Mr.C.Gangaiamaran, M/s.R.Hemalatha, M/s.G.Vardini, and M/s.P.Subathra Devi |

| Respondent by | Mr.R.Suresh Kumar, and Mr.J.K.Jeyaseelan G.A |

| Madras High Court | Read Order |