It was asked by the Ahmedabad Bench of the Income Tax Appellate Tribunal ( ITAT ) that the Jurisdictional Assessing Officer (JAO) correct the intimation by the Central Processing Centre because of the rejection of Section 80JJAA of the Income Tax Act, 1961 claim as of the technical default.

The taxpayer Vimalachal Print & Pack Pvt. Ltd., submitted its income tax return for the AY 2020-21 reporting a total income of Rs. 27,66,79,540. Under Section 80JJAA of the Income Tax Act, 1961 the taxpayer asserted a deduction of Rs. 10,10,118.

When processing the ITR under Section 143(1) Central Processing Centre (CPC), Bengaluru rejected the deduction claim. Due to the technical default, the rejection takes place and not due to the ineligibility of the claim.

U/s 80JJAA, the deductions have been permitted to the company in both prior and forthcoming assessment years. The taxpayer dissatisfied with that appealed the rejection to the Commissioner of Income Tax (Appeals) which kept the decision of CPC.

The assessee aggrieved from the order of CIT(A) has appealed to the Income Tax Appellate Tribunal (ITAT) contesting the order of CIT(A). The counsel of the taxpayer has claimed that the measure of CPC was beyond its jurisdiction and the adjustment was prima facie.

At the time of the hearing the eligibility of the company for the deduction was not in question, a single bench led by Suchitra Kamble (Judicial Member) noted.

Indeed it was marked by the tribunal that the rejection emerged from the procedural imperfection instead of the merit of the claim. It was asked by the tribunal that the Jurisdictional Assessing Officer (JAO) correct the CPC’s intimation and perform a new assessment. For statistical objectives, the taxpayer’s appeal was permitted.

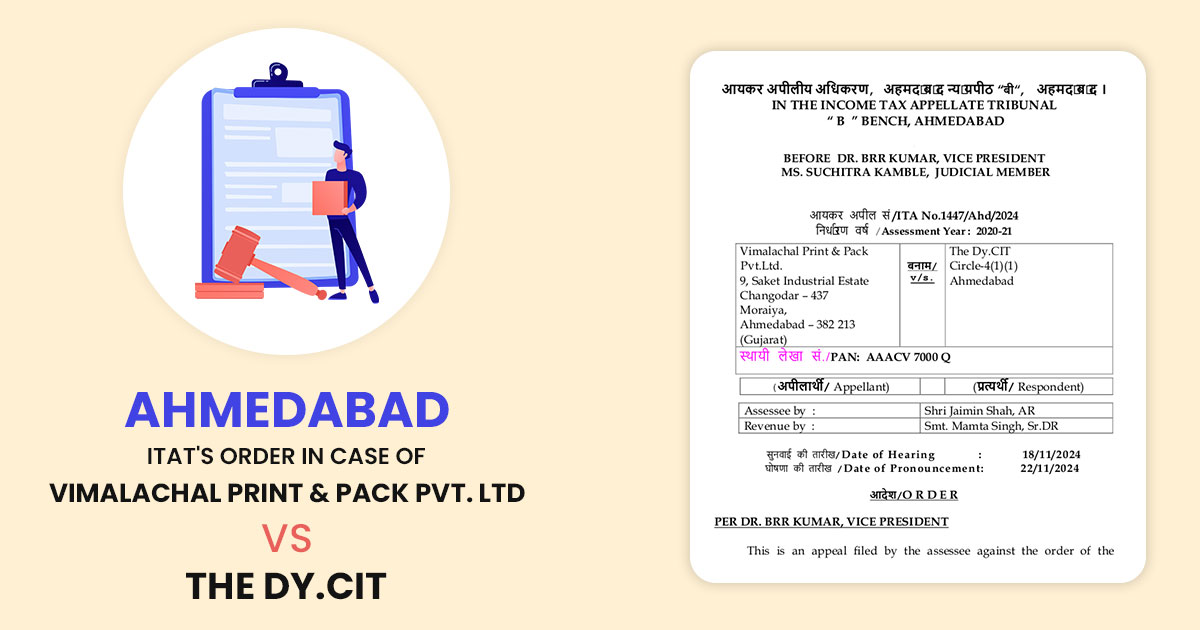

| Case Title | Vimalachal Print & Pack Pvt.Ltd. Vs. The Dy.CIT |

| Citation | ITA No.1447/Ahd/2024 |

| Date | 30.09.2022 |

| Assessee by | Shri Jaimin Shah, AR |

| Revenue by | Smt. Mamta Singh, Sr.DR |

| Ahmedabad ITAT | Read Order |