The Ahmedabad Bench of the Income Tax Appellate Tribunal (ITAT) quashed the revisionary order passed by the Principal Commissioner of Income Tax (PCIT), ruling that the assessment order was not incorrect.

Chandrakant Vallabhbhai Koladia has submitted his income tax return for the AY 2018-19, declaring a total income of Rs 1,23,69,720. Based on the survey, the taxpayer revealed an additional income of Rs 55,14,000 in his return.

The assessing officer (ao) has completed the assessment under section 143(3), accepting the declared income and taxing it under the regular provisions. PCIT invoked revisionary powers u/s 263 of the Income Tax Act.

The PCIT alleged that the AO was unable to analyze the nature and source of the additional income, and had not invoked provisions under Sections 69A and 115BBE for charging the unexplained money at a higher rate.

The taxpayer, dissatisfied with the order of the PCIT, submitted a plea before the ITAT. The taxpayer’s counsel furnished that the AO has performed an inquiry in the assessment proceedings.

Also, the council said that the AO had called for comprehensive information, pertinent to the impounded material, disclosure of income, trading activities, and corresponding parties. The taxpayer has furnished the explanations and supporting documents, which the AO has analysed.

The revenue counsel said that the Assessing Officer does not consider that if a survey measure shall have been performed then the taxpayer may not have revealed the income.

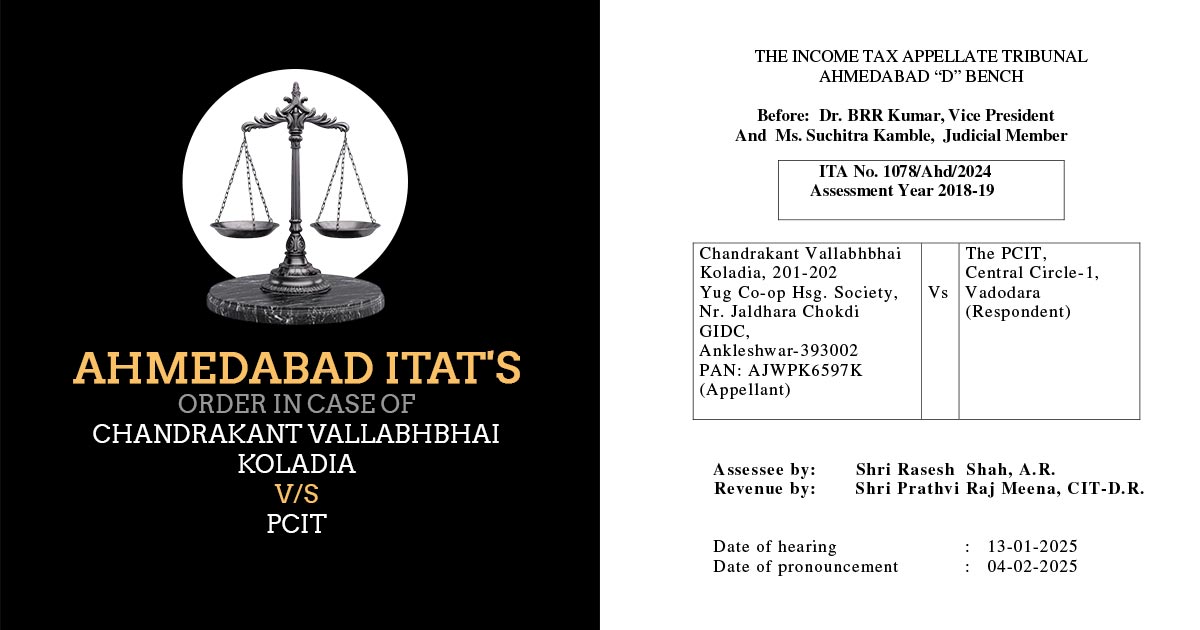

The two-member bench, including Dr B.R.R. Kumar (Vice President) and Ms Suchitra Kamble (Judicial Member), noted that the AO decision has been made after due verification, which cannot be revised by the PCIT.

The tribunal noted that the scope of Section 263 of the Income Tax Act does not allow for a review of the merits of the assessment order made by the Assessing Officer (AO) after verifying the evidence. The tribunal emphasized that the Principal Commissioner of Income Tax (PCIT) should determine whether the assessment order is incorrect or prejudicial to the revenue.

The tribunal relied on the judgment of the Hon’ble Gujarat High Court in PCIT vs. Dharti Estate, in which it held that the revision u/s 263 could not be invoked where the AO performed inquiries and made a reasoned assessment.

Recommended: No Separate Disallowance Under Section 40A(3) of the IT Act When Income is Estimated

The tribunal ruled that the AO validated the case effectively and also ruled that the assessment order was not wrong. The taxpayer’s plea was hence permitted.

| Case Title | Chandrakant Vallabhbhai Koladia vs. PCIT |

| Citation | ITA No. 1078/Ahd/2024 |

| Date | 04.02.2025 |

| Assessee by | Shri Rasesh Shah, A.R. |

| Department by | Shri Prathvi Raj Meena, CIT-D.R. |

| Ahmedabad ITAT | Read Order |