Section 14A of the Income Tax Act, 1961 was a Non-Obstante clause that can be applied prospectively from 01.04.2022 and quashed the order of PCIT, the Surat Bench of the Income Tax Appellate Tribunal ( ITAT ) ruled.

The taxpayer Meri Life Sciences Private Limited is a company that furnishes an income tax return for the Assessment Year 2018-2019 and declared income of Rs. 39,24,06,630. The matter was chosen by the Assessing Officer (AO) to complete the investigation and accept the total income.

A notice under section 263 of the Income Tax Act has been issued by the Principal Commissioner of Income Tax ( PCIT ) and asked for an explanation from the taxpayer based on the disallowance of Rs 98,88,137 u/s 14A of the Income Tax Act.

A response of the taxpayer has been filed however PCIT does not consider the explanation of the taxpayer. Hence PCIT carried that the assessment order was wrong and set aside the order. The AO asked to pass a fresh assessment order. The taxpayer dissatisfied with the PCITs order has submitted a plea to the ITAT.

The taxpayer’s counsel claimed via relying on distinct decisions such as Keti Construction Ltd.,(2024), Era Infrastructure (India) Ltd., (2022), etc., which held the section 14A of the Income Tax Act amendment in the Finance Act, 2022 can be applied solely prospectively.

Read Also: All Details About 5 Non-taxable Income As Per CBDT Dept

While the revenue counsel claimed that the disallowance u/s 14A of the income tax shall be drawn despite when the exempt income was not made in the year. On the PCIT decision, the counsel has relied.

The two-member bench Pawan Singh ( Judicial Member ) and Bijayananda Pruseth ( Accountant Member ) noted that the decisions of Keti Construction Ltd.,(2024), Era Infrastructure (India) Ltd., (2022) which carried that the amendment to section 14A of the Income Tax Act was a Non-Obstante clause and it took effect from AY 2022-2023. While the present case relates to the AY 2018-2019.

Hence the tribunal carried that the PCIT decisions could not apply to the existing case and set aside the PCIT order. The appeal was permitted.

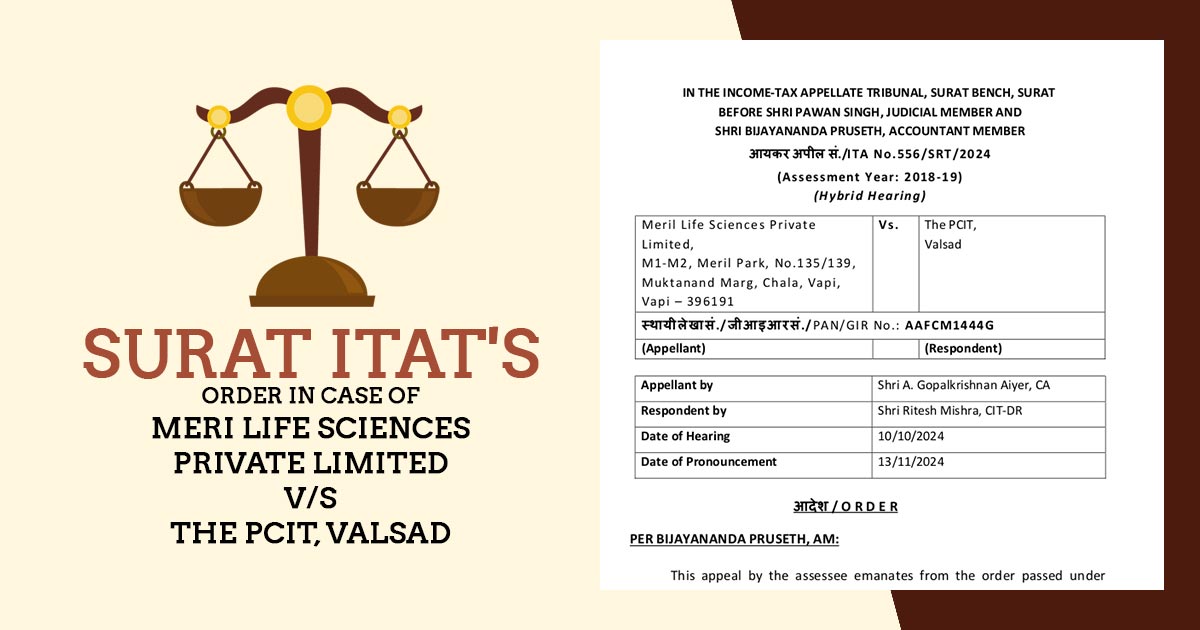

| Case Title | Meri Life Sciences Private Limited vs. The PCIT |

| Citation | ITA No.556/SRT/2024 |

| Date | 13.11.2024 |

| Appellant by | Shri A. Gopalkrishnan Aiyer, CA |

| Respondent by | Shri Ritesh Mishra, CIT-DR |

| Surat ITAT | Read Order |