The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) permitted the appeal filed via the taxpayer contesting the false rejection of Section 80IC of the Income Tax Act,1961 deduction claim due to a village name discrepancy.

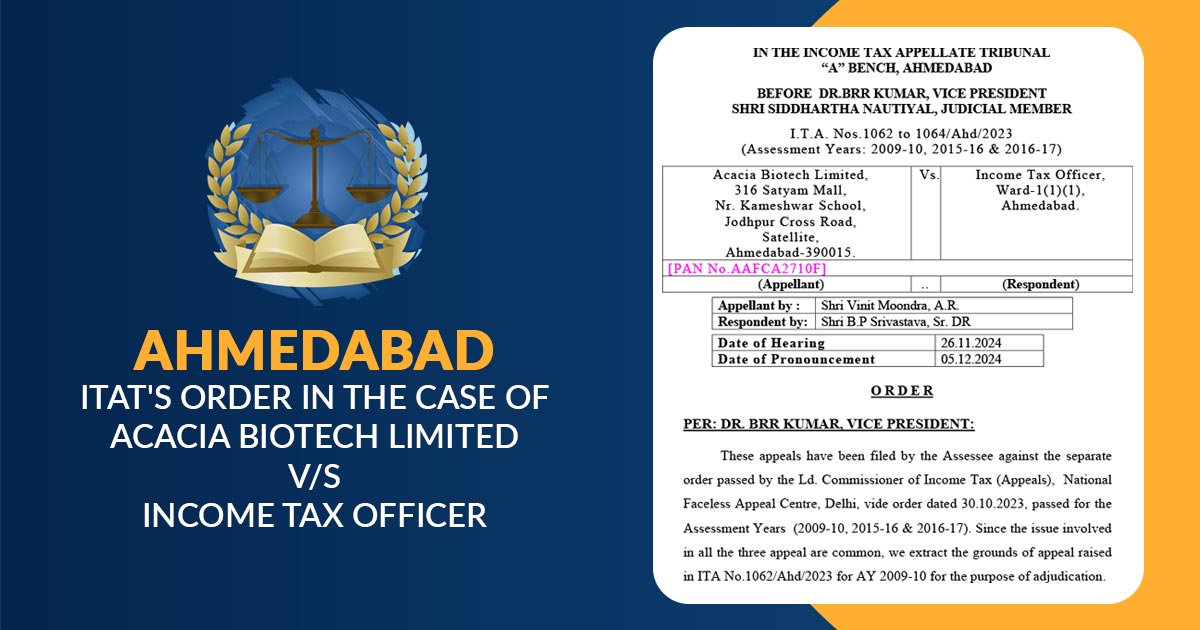

The applicant Acacia Biotech Limited, contested the order dated 30.10.2023 passed by the Commissioner of Income Tax (Appeals) for the Assessment Year (AY) 2009 -10.

The Assessing Officer (AO) rejected the claim for a deduction u/s 80IC, remarking that the unit was not in the eligible location according to the notification of the Central Board of Direct Taxes (CBDT).

The taxpayer furnished a 10CCB report with the address “Khasra No.373, Village Rudrapur, Dist. Udham Singh Nagar, Uttranchal,” while the actual location was Village Kalyanpur. The taxpayer dissatisfied with the AO order appealed before the CIT (A) who thereafter dismissed the appeal and then appealed to the tribunal.

The counsel of the taxpayer cited that the problem for AY 2011-12 to 2013-14 was due before the CIT(A) and has the disallowance of the section 80IC claim as of the name difference between Rudrapur and Kalyanpur.

The counsel revenue carried the decisions of AO and Commissioner of Income Tax (Appeals) stating that the claim has been denied in those years. As per the counsel, the name must have been Rudrapur, as both villages are part of the same area.

The taxpayer submissions and records from the revenue have been analyzed by the two-member bench comprising Siddhartha Nautiyal (Judicial Member) and Dr.BRR Kumar (Vice President).

Read Also: Ahmedabad ITAT Disallows Tax Deductions U/S 37(1) for Expenditures on Freebies to Doctors

It discovered that the distance between Rudrapur Centre and Kalyanpur was 6.1 km. Directing to CBDT notification No. 283/2006, it confirmed that Kalyanpur and Kichha were suitable areas for the Section 80IC deduction.

A certificate has been given to the taxpayer from the State Infrastructure and Industrial Development Corporation of Uttarakhand (SIDCU) depicting the plot in Kalyanpur. It concluded that the confusion arose from the taxpayer wrongly listing Rudrapur instead of Kalyanpur in Form 10CCB. The tribunal allowed the appeal as Kalyanpur was eligible.

As per the appellate tribunal, the matter specifies the poor judgment of the officials affecting the tax system integrity. The same has directed delays higher litigation costs, and frustration for both the taxpayer and the Revenue.

It mentioned that the tax officials must lay on the facts and focus on the major aspects of the tax collection. The tribunal mentioned that the measures of AO and CIT(A) must be analyzed to keep the responsible officials accountable. The taxpayer’s filed appeal was allowed.

| Case Title | Acacia Biotech Limited vs. Income Tax Officer |

| Citation | I.T.A. Nos.1062 to 1064/Ahd/2023 |

| Date | 05.12.2024 |

| Appellant by | Shri Vinit Moondra |

| Respondent by | Shri B.P Srivastava |

| Ahmedabad ITAT | Read Order |