What is Form 29B?

Section 115JB of the Income Tax Act mentions that Form 29B is significant to evaluate the book profits of the company. Through this form, you are enabled to compute the book profit to claim the Minimum Alternate Tax (MAT) credit. The same form is required to be provided by the Chartered Accountant if your company is counted under section 115JB.

You, as an owner of the business, are required to calculate the MAT and tax obligation and file both under tax provisions. Also, you need to file the MAT amount without losing it if your ordinary tax amount is less than the MAT. This is due to the income tax law stating that a company is required to file a higher tax than the other two. But the Form 29B MAT amount depends on the book profit of your company as declared in Form 29B.

Form 29B Applicability

Every company where the income is lower than 15% of the book profit needs to get a report from a Chartered Accountant in Form 29B. The same report must be received and submitted within 1 month before the deadline for filing the income tax return u/s 139(1) or including the income return provided in answer to a notice under section 142(1)(i).

To comprehend the Form 29B applicability, the company owners must watch the following points-

- Companies, while submitting Form 29B, should comply with the government-approved format to avoid any mistakes that can draw penalties.

- Both the CA and the taxpayer must have access to the e-filing portal via their respective IDs and passwords. Also, the appointed CA must secure a valid Digital Signature Certificate (DSC), which is to be registered on the IT e-filing portal.

- As the owner of the company, you are required to get a certificate via an authorised Chartered Accountant (CA) for Form 29B. It is needed to validate the estimated book profits under the Income Tax Act of 1961.

- As an owner of the company, you must hire a chartered accountant from My CA service. The CA appointed will furnish you with an audit report via Form 29B under the Income Tax Act. However, the CA appointed might not accept your request for an audit report every time, though it is accepted, he is required to file Form 29B.

- Don’t forget to enter the information, like your name. address, company PAN number, assessment year, etc., while filing Form 29B. You ought to cite the profit amount of your company while filing this form.

Form 29B Filing Deadline

Every company should report its book profits for a particular assessment year in Form 29B, as per Section 115JB of the Income Tax Act of 1961. But your report should be certified by a CA. You could file this form both online and offline at your ease.

The deadline for Form 29B is laid out in the notice you get under section 142(1). Also, you could submit the form with the return of income one month before the filing of the return due date as mentioned u/s 139(1).

What is the Tax Penalty If I Forget to E-file Form 29B?

As per Section 271BA, if you are unable to get the audit report and file Form 29B before the deadline, then you shall be obligated to pay a hefty penalty. The late filing penalty of Form 29B can exceed Rs 1,00,000 in some cases.

But Section 273B cited that if you mention the effective cause of failing to submit the form on the deadline, then you are not obligated for any penalty u/s 271BA.

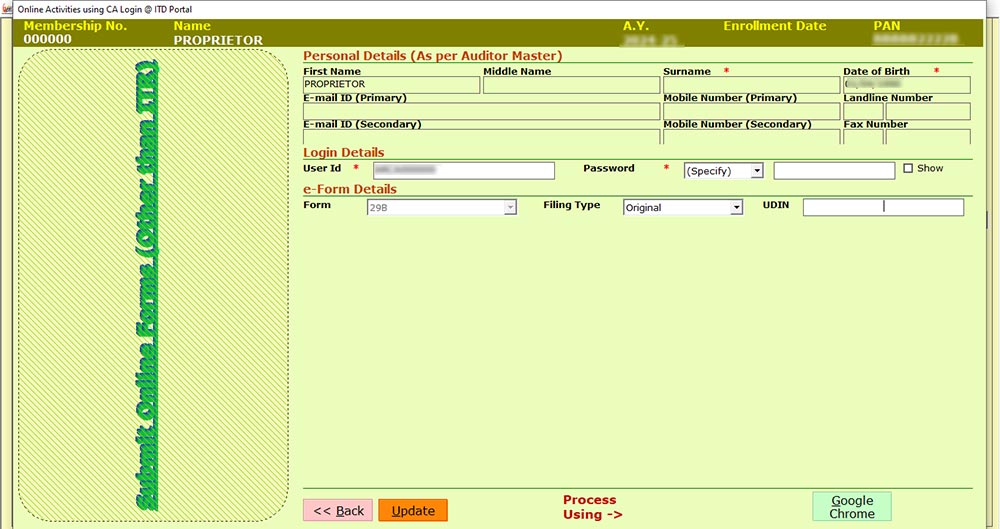

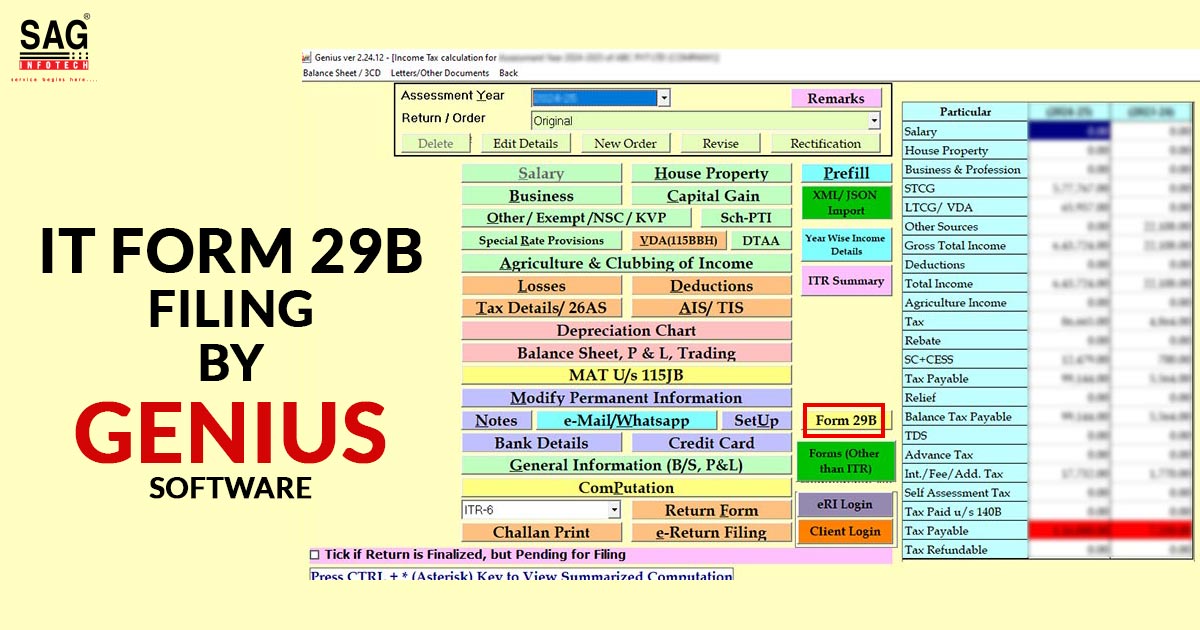

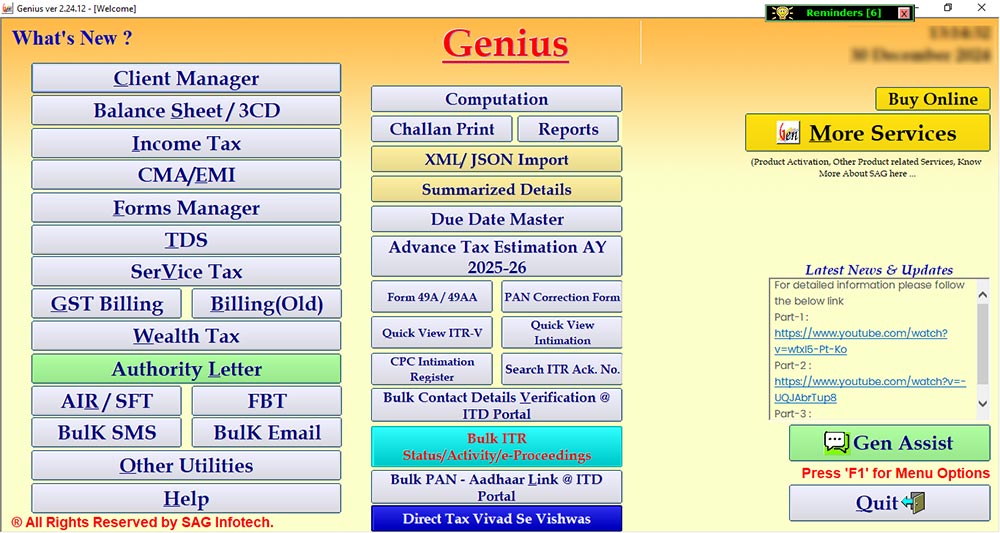

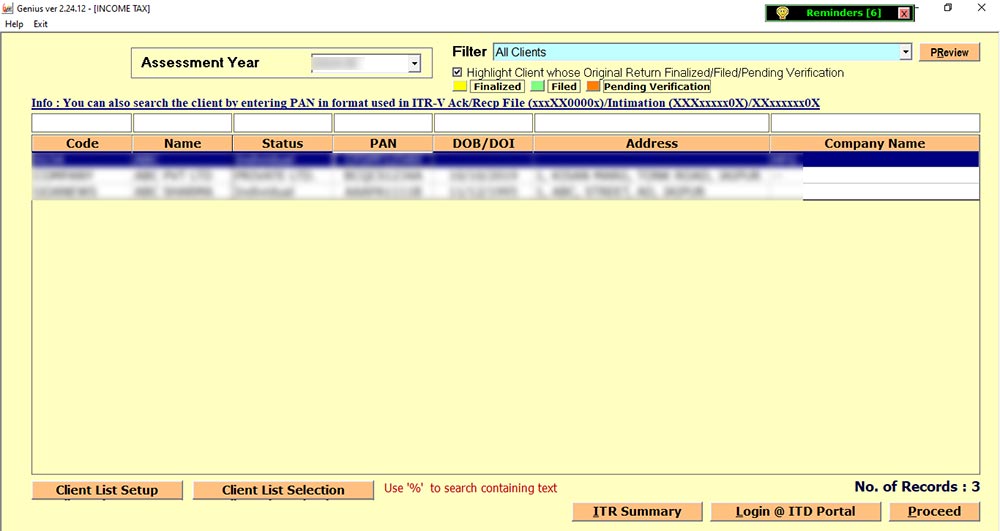

Easy Steps to E-file Form 29B Using Genius Software

Here we have mentioned some main steps to e-file Form 29B through the Genius tax return filing software:-

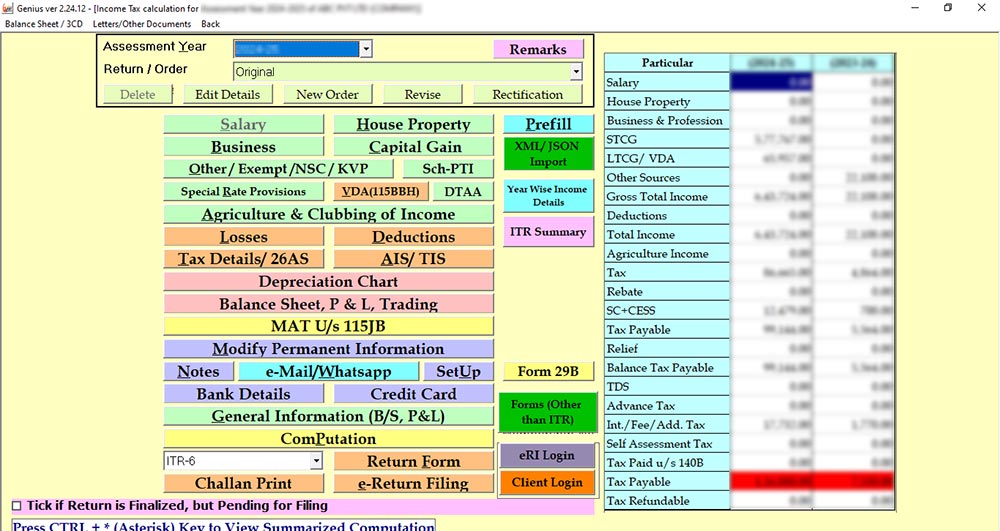

Step 1: First, install the Genius Return Filing Software, then select Income Tax-> Computation option.

Step 2: Then you have to select the client from the client list.

Step 3: After selecting the client, please go to Form 29B.

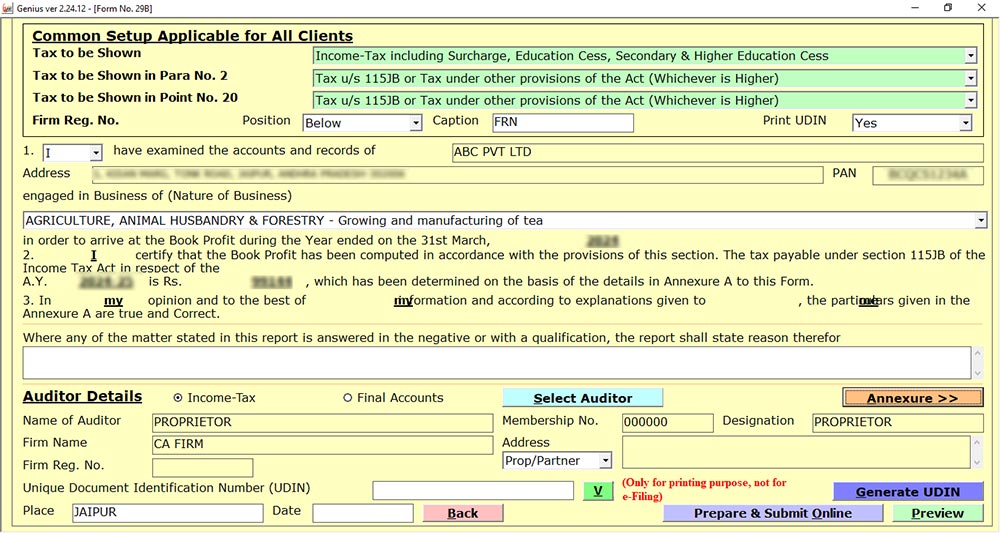

Step 4: Fill in the required data in the Form.

Step 5: After filling in all the data, -> Click on Prepare & Submit Online.

Step 6: Select Filing Type and then Proceed.