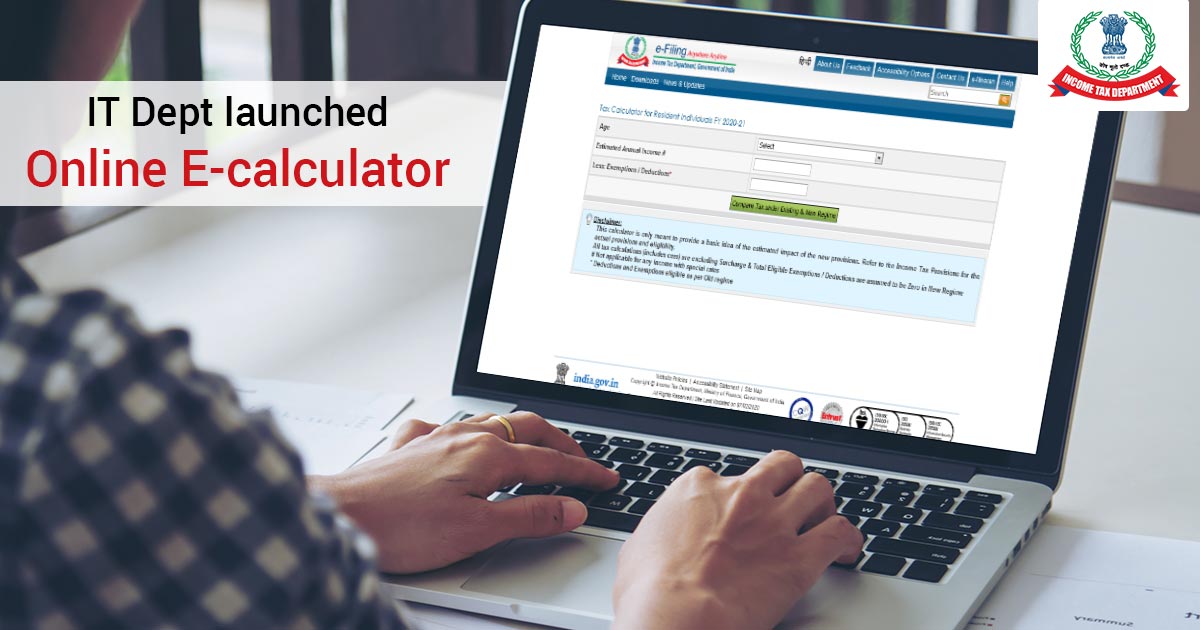

Recently the income tax department has launched the e-calculator for the taxpayers to find out the benefits on their income tax received by the individuals. The taxpayers can find out their tax liability through the e-calculator and was also announced that the individual can change their tax slabs as per their wish.

The e-filing website of income tax department (https://www.incometaxindiaefiling.gov.in) has now been showing the table to compare the old and new tax scheme for all the Indian resident taxpayers for the financial year 2020-21.

The website helps the taxpayers in filing income tax returns via online

The table requires the taxpayer to input total eligible deductions and exemptions on the basis that the portal shows the difference between the two tax slabs scheme.

Also, the e-calculator takes the latest eligible exemptions and deductions from the Budget memorandum 2020. As per the latest income tax slab

While there will be 10 percent, 15 percent, 20 percent and 25 percent at every INR 2.5 lakh increase in the income tax. And a staggering 30 percent income tax on the income over INR 15 lakhs. The new tax slab offers a standard deduction of INR 50,000 with INR 1.5 lakh investment in saving scheme.

Please tell me On Which Challan you will paid on Demand Amount of Viivad Se Viswas Act 2020.