The panel head and Finance Minister Nirmala Sitharaman declared that there will soon be alterations in the GST rates for various goods and services that are expected to be the yearly affair rather than a subject of frequent amendments. Further stating strong defiance against the process of frequent amendments in GST rates she said that it has become an inverted rate structure where the rates of raw materials are higher than the finished goods which have also resulted in the imbalance in tax refunds. “Therefore, when the rate of tax of one item is brought down, a whole lot of other ripple effects are created. With that ripple effect, the refund is affected,” said FM.

Due to the cascading affect businesses operating in India are unable to plan their tax funds which they need to keep aside for the whole year. On the other end, the administration (State and Central Level) is finding it difficult to evaluate the national revenue from GST for the entire year. “Therefore, when the rate of tax of one item is brought down, a whole lot of other ripple effects are created. With that ripple effect, the refund is affected,” Continuous amendments in the tax rates result

Since the implementation of GST, there have been a lot many rate cuts leading to the remarkable deficit in Centre’s revenue and it is for the first time that the government has spoken on bringing down the frequency of GST rate cuts. Being a sensitive issue, rate cuts are likely to convert into a political issue pushing the government to revise the rates prior to elections.

Amendments in the rate structure being a yearly affair will lead to certainty in the system after which the businesses can get rid of tracking the new rate structure after every GST council meeting

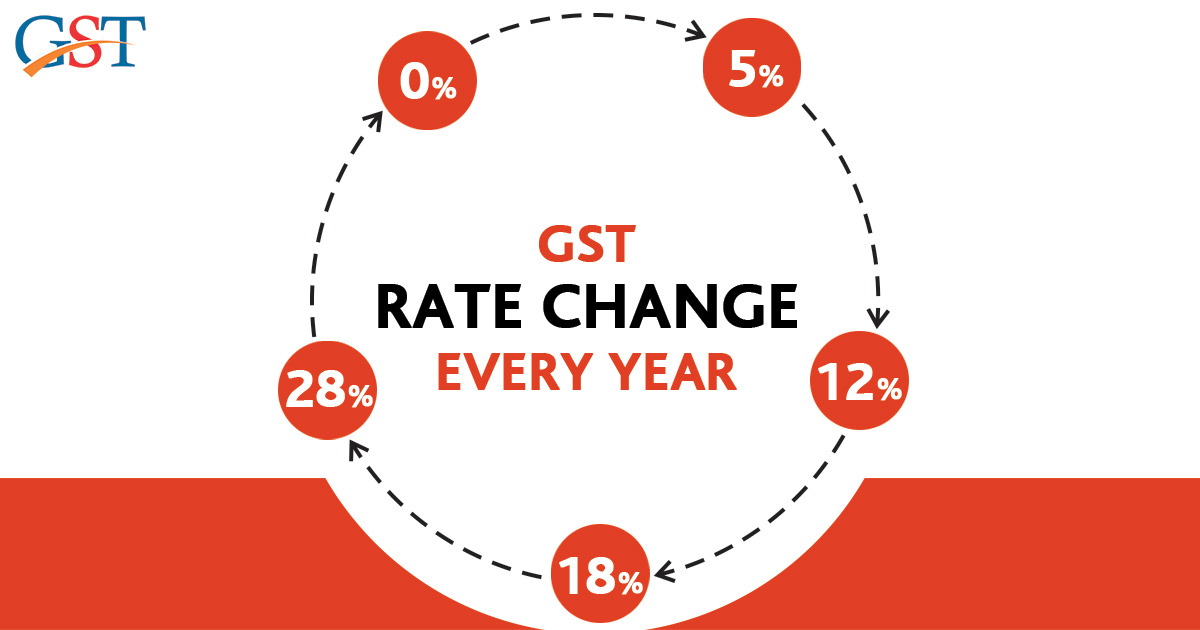

In December, FM Nirmala Sitharaman stated that the Council is constantly working on re-designing the tax rate structure to have three basic slabs. Currently, it has four slabs (5%, 12%, 18% and 28%). Apart from that, the tax rates of several commodities and services are still a subject of discussion with the government. The GST Council in December restricted the rise of GST rates as the consumer goods output declined considerably to 18% in October. State ministers also proposed to restrict the rise in tax rates saying that it is not the right time to do so.

Read Also: GOI May Plan to Increase 1% on Current 5% GST Rate

FM Nirmala Sitharaman pushed various industries to be upfront with their State administration related to their concerns on rate revisions which in turn will be brought to the Council by State Representatives in Council Meetings. The Centre alone can’t recommend tax rate cuts until the States won’t raise their concerns related to the rate cut, said Sitharaman. It is also fair if the states through their ministers bring in their concerns to the Council, she further added.