GST ANX-1 and GST ANX-2 form have been added under the newer GST return filing system (GST 2.0). These forms will work as a supplement to the main returns forms, i.e., GST RET 1/RET-2/RET-3 under GST 2.0. These forms are apparently similar to the GSTR-1 and GSTR-2A forms that are used in the present GST return filing system and plays a crucial role in the filing of main returns.

This article will provide every slender detail about both these annexure forms, i.e., GST ANX 1 and GST ANX 2 introduced under the new GST Return Mechanism:

Note:

“Latest return format i.e. (Annex1/2) now discarded while the revision will be taking place in the already going return format. The fresh return type GSTR2B is having the ITC related details of the second party.”

GST ANX-1 & ANX-2: Proper Reporting of Supplies

Under GST ANX 1, all outward supplies, inward supplies under reverse charge, and imports made during a particular tax period will need to be reported by the registered taxpayers.

Under GST ANX 2, details related to all the inward supplies from registered persons, supplies received from an SEZ unit/developer, and imports made by registered taxpayers will be reported.

Once a particular supplier uploads the documents related to supply in GST ANX 1, the recipient can also easily view those supply documents in his GST ANX 2. The recipient would also have the facility to take any action against these documents by either accepting them or rejecting them or put them in pending state with action to be taken at a later date.

Trial Rollout: GST ANX-1 and GST ANX-2

Currently, both GST ANX 1 and GST ANX 2 has been launched on a trial basis and will be officially implemented from October 2020. Every registered taxpayer (irrespective of their annual turnover) would be required to fill and file both these annexure forms correctly. Although for the month of April and May 2020, GST ANX 2 would be available in viewing facility only for taxpayers; hence taxpayers would not be allowed to take any action against this annexure.

Note: New return system now to be introduced from October, 2020 in order to give ample opportunity to taxpayers as well as the system to adapt and accordingly specifying the due date for furnishing of return in FORM GSTR-3B and details of outward supplies in FORM GSTR-1 for September, 2020. Read Official Press Release

All details related to inward/outward supplies can be uploaded by suppliers in GST ANX 1 Form on a real-time basis under the new GST return filing system The government of India and GST Council has introduced the GST 2.0- A New Filing System in order to simplify the GST return filing process. The main reasons for the introduction of this new return filing mechanism, i.e., Goods and Service Tax 2.0. Read More. All Invoices uploaded in GST ANX 1 by suppliers would be auto-populated in GST ANX 2.

The feature to match details of inward supply invoices in GST ANX-2 with the purchase register, and take appropriate actions (accept/ reject/ mark as pending)) has also been added for taxpayers under new GST system. The recipient of supplies would be eligible to accept an invoice if all particulars get matched and can also claim ITC for the same.

On the other side, if particulars do not match, the recipient can reject an invoice; otherwise, he would not be eligible to claim ITC

Even though GST ANX 1 allows the continuous upload of invoices by the supplier on a real-time basis, tax filers should keep in mind the cut-off dates that have been specified for each tax period.

GST ANX-1 allow continuous invoice upload facility to suppliers, but they should keep the cut-off date in mind for each specified tax period.

On the Suppliers Side:

- For Monthly Return Filers: The suppliers should upload all the B2B invoices by the 10th of the following month.

- For Quarterly return Filers: Quarterly filers should upload all B2B invoices till 23rd of the succeeding month following the given quarter.

On the Recipient side:

- For Monthly Return Filers: They can take action on uploaded invoices in the GST ANX-2 till 20th of the following month.

- For Quarterly return Filers: They can take action on uploaded invoices in the GST ANX-2 till 25th of the month following the quarter.

In some case, the recipient might have an invoice on hand, but the same may not be reflecting in his GST ANX-2. This can be because the associated supplier has not uploaded the same invoice in his corresponding GST ANX 1.

Such invoice is termed as a missing invoice. The facility to claim ITC on missing invoices would be available for the recipient on a provisional basis. The recipient should follow up with his supplier for uploading of such invoices.

What happens if a particular supplier fails to upload the missing invoices after a prescribed period?

In such a scenario, the recipient would be required to reverse the provisional ITC claimed by him in his GST RET-1

The specified period to upload invoices for suppliers is:

- T+2 (two months after the tax period) for monthly return filers

- T+1 (one quarter after the tax period for quarterly return filers

This will create difficulties for genuine recipients who pay the tax portion to the supplier on time but cannot claim ITC due to a delay from the supplier’s side.

Here is an example to explain the Same:

Mr X is a monthly return filer. He is unable to find an invoice in his GST ANX-2; hence, he has claimed ITC on a provisional basis for the month of November. Even after continuously follows up with his supplier for uploading the missing invoice, his supplier fails to do the same and missed the two month deadline period, i.e. till January.

Now, Mr X will have to reverse the provisional ITC (claimed in November) in January GST RET-1 Return. He, now also has to upload the missing invoice in January’s GST ANX-1.

How will the Provisional Credit Facility under the new GST system help the Government?

The provisional credit process is a cumbersome process for taxpayers (recipients), but the data will help the Government immensely to rectify the number of cases in which genuine recipients are unable to convince their suppliers for uploading or reporting of invoices. Also, the cases where the recipient has reversed the provisional ITC claimed would be exposed in front of the Government.

Read Also: Full Comparison Report – New GST Return RET 1, RET 2 & RET 3

Interesting Point to Note: In case when a supplier uploads invoices in GST ANX-1, but does not file his GST return for two consecutive tax periods, the recipient would be allowed to view these invoices in his GST ANX-2. Although the recipient would not be allowed to accept such invoices and can only reject or keep them pending. In this scenario too, claiming ITC would be difficult for recipients.

Government Take on the New GST System: Claiming of ITC will be a simple task!

The Government has said that if the invoices flow is properly from supplier’s end, claiming of ITC would be too easy for the recipient. However, achieving this without taking the help of technology is a bit difficult. The use of such a technology-driven process makes sure that ITC is not blocked, and mismatches are quickly identified & rectified under the new GST return filing system. .

General Queries on GSTR ANX-1 and ANX-2 Form

Q.1 Does the availability of new Forms ANX-1 and ANX-2 on the common portal signify the time & need to file these forms?

No, the availability of new forms ANX-1 and ANX-2 on the common portal doesn’t signify the time & need or permission to file these forms. The new forms ANX-1 and ANX-2 were made available on the portal from July 2019 just for a trial basis.

According to the conclusions made at the 37th GST Council Meeting on 20 September 2019, the implementation of the new GST return system and all the GST forms is postponed from October 2019 to April 2020 for all the taxpayers. However, suppliers can upload the Invoices on a real-time basis in ANX-1 which can simultaneously be accessed in ANX-2 by the individual claiming the input tax credit on these invoices but the action is allowed only after December 2019.

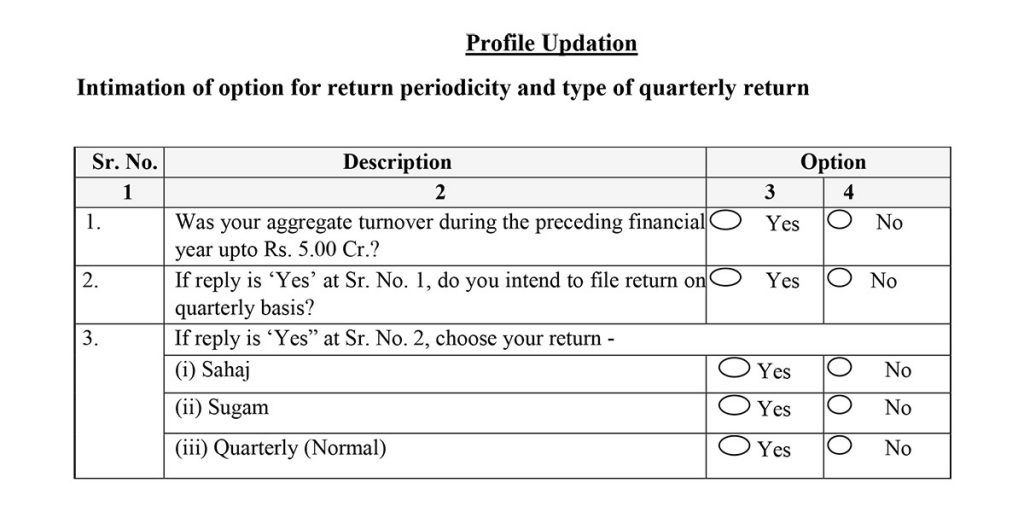

Q.2 Can the period of filing the returns be changed from monthly to quarterly and vice versa by the taxpayer?

Yes, the period of filing the returns be changed from monthly to quarterly and vice versa by the taxpayer as they get an option to change the period but only once while filing the first return of that fiscal year.

Q.3 Which returns are available for a small taxpayer who wishes to file returns every quarter?

Sahaj, Sugam and Quarterly (Normal) returns are available for a small taxpayer with an aggregate turnover of up to Rs. 5 crores in the last year.

Q.4 What actions can be taken by the recipient of supply w.r.t the documents uploaded by the supplier?

The recipient can either accept or reset (unlock) a document up to the 10th of the subsequent month i.e. the due date for the supplier to upload documents when filing monthly return. 10th of the month following the quarter is the due date for the supplier to upload documents when filing quarterly returns. Post this date the recipient can either accept or reject the document or can keep it pending.

Q.5 When does the supplier get notified about the rejection of the document which he uploaded by the recipient?

The supplier is notified about the rejection of the document which he uploaded by the supplier only after the filing of return by the recipient.

Q.6 Can the amendments be made in documents uploaded by the supplier before their rejection by the recipient or when they are kept pending by the recipient?

No, the amendments can not be made in documents uploaded by the supplier before their rejection by the recipient or when they are kept pending by the recipient. A document has to be rejected by the recipient to let the supplier make any amendments in them.

Q.7 What is the source of auto-population of some details in Form RET-1?

The source of auto-population of some details in Form RET-1 is the previously furnished information in the related Form ANX-1 and Form ANX-2.

Q.8 Can Form RET-1 be filed via SMS? If yes, when?

Yes, the Form RET-1 can be filed via SMS. It is possible only in case of a Nil return i.e. when supplies have neither been made nor it is received.

Q.9 What is the use of Form ANX-1A?

Yes, filing an ITR is mandatory. Government of India (GOI) has made the e-filing of income tax returns (ITR) mandatory for all the assessees who are earning an annual Income above INR 5 Lakhs.

Q.10 What are the advantages of Income Tax Return filing?

Form ANX-1A is used for altering the details uploaded for the previous tax periods in Form ANX-1.

Q.11 Is there any quick fix if the correct documents are entered under the wrong table of Form ANX-1?

After the rejection of the documents by the recipient, a facility to move the documents from an inappropriate table to the relevant table is given. The facility must be used as it is a quick fix over amending each & every document.

I have filed Nil return. How can I see the content of Annexure 1 and Annexure 2?

ANX-1 & ANX-2 abolished by GST system

need get, it’s software

Now, it is dumped from GST site