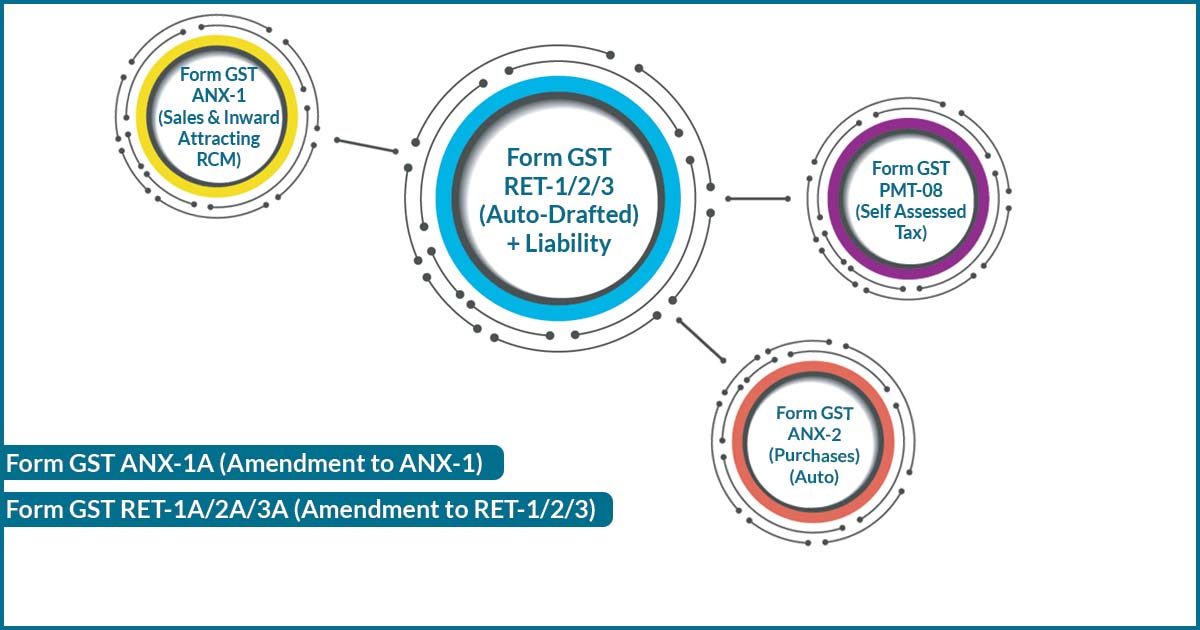

The government had released the three new GST return forms with the name Normal (RET-1), Sahaj (RET-2), Sugam (RET-3) for the taxpayers across the country.

New GST Return Form Applicability Time Table for Regular Taxpayers

These new forms were released to ease the burden of return filing and will be implemented on a trial basis from July 2019 to March 2020 as per the recent notification.

After which all the forms i.e. ANX 1, ANX 2 will be implemented on a regular basis to all the taxpayer from October 2020.

In April 2020, all the taxpayers will have to mandatorily file the new return forms including RET 1 and the older GSTR 3B will be phased out from the system.

There are certain conditions on the basis of turnover which are applicable to the new return forms under GST i.e.

- In case the aggregate turnover exceeds INR 5 crore in the preceding fiscal year than the taxpayer is bound to file monthly return

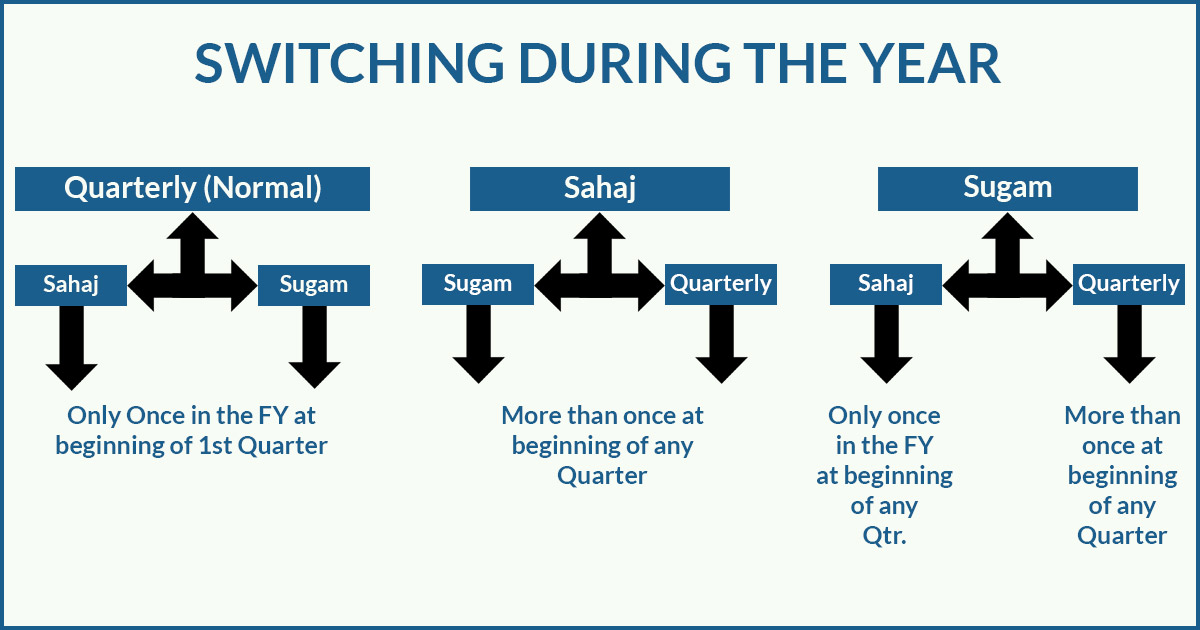

- While in case the aggregate turnover does not exceed the INR 5 crore then there is an option for him to file returns whether monthly or quarterly. Also, he can select Sahaj, Sugam, and Quarterly (Normal) within the quarterly returns as per the nature of transactions.

Compare GST forms i.e. Sahaj, Sugam, and Quarterly (Normal)

| Normal (Quarterly) | Normal (Monthly) | Sahaj | Sugam |

|---|---|---|---|

| Applicable for individual making inward and outward supplies | Applicable for individual making inward and outward supplies | Individuals doing B2C supplies + Inward supplies (attracting RCM) | Individuals doing B2C+B2B supplies & Inward supplies (attracting RCM) |

| Credit (ITC) not allowed for missing invoice | Credit (ITC) allowed for missing invoice | Credit (ITC) not allowed for missing invoice | Credit (ITC) not allowed for missing invoice |

| Not allowed for e-commerce dealing who are deducting TCS u/s-52 | Not allowed for e-commerce dealing who are deducting TCS u/s-52 | ||

| No other types of outward/inward supplies allowed | No other types of outward/inward supplies allowed | ||

| Allowed for making NIL rated/exempted/non-GST supplies | Allowed for making NIL rated/exempted/non-GST supplies | ||

| GST Normal Return Form Filing Procedure | GST Sahaj Return Form Filing Process | GST Sugam Return Form Filing Procedure | |

The above-given information is helpful for all who are new to the GST Returns. Thanking you for it. But I want to know about New GST Returns in detail and please give the details of the IGST.

For a detailed analysis, please click on this link – https://tutorial.gst.gov.in/offlineutilities/returns/NewGSTReturn_Normal.pdf

What does a missing invoice refer in claiming ITC?

Good Question

Missing in 2A.