Form GSTR 7A is the system generated GST form that is acquired by the deductor once he has accurately filed GSTR 7. Details in Form 7A

Form 7 needs to have the entire details of the TDS deducted by the supplier of goods or services. Once the TDS is deducted the same amount is supposed to be mentioned in the credit ledger of the deductee (one who is obtaining the goods or services).

Who needs to get GSTR 7A?

The deductor/supplier of goods and/or services who is deducting the TDS amount needs to get this TDS Certificate (Form 7A).

Read Also:- Easy Filing Procedure to GSTR 7 Form Online for TDS Deductor

Details mentioned in GSTR 7A

Listed below are the major components of GSTR 7A:

- Name of the taxable person

- GSTIN of the Deductor

- The tax period for which GSTR 7 is valid

- Assessment Circle

- TDS Certificate Number

- Contract Details

- Invoice Details/ TDS deduction date

- The payment value on which TDS is deducted

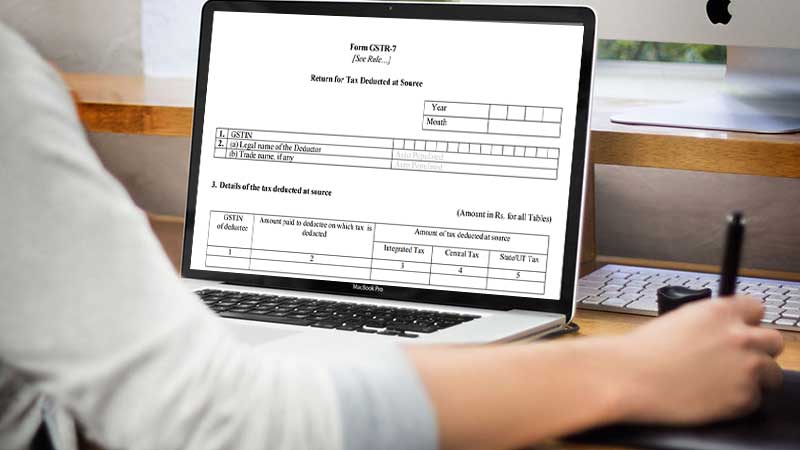

GSTR 7A – Format

Read Also:-Tax Penalties & Deadlines Removed by Govt Due to COVID-19

FAQs for Better Understanding of GSTR-7A

Q.1 – Explain Form GSTR 7A?

GSTR 7A is also known as the TDS Certificate issued once the deductor files Form GSTR 7 and the deductee approves all the details mentioned in GSTR 7 filed by the deductor. TDS certificate will be available to both the parties (Deductor and Deductee).

Q.2 – What is the process of downloading GSTR 7A from the GST portal?

Step Wise guidance to download GSTR 7A from the giant Portal:

- Visit the link www.gst.gov.in and log in using your credentials

- Go to Services, then select User Services

- There are options for Viewing or Downloading the TDS Certificates. Choose as per your needs.

Q.3 – If more than one certificate is available under GSTR 7A. Is there a need to download them separately?

One needs to download the TDS Certificate separately for each GSTIN.

Q.4 Is there a possibility of issuing more than one TDS certificate under a single GSTIN?

No, only one TDS Certificate shall be downloaded under the single GSTIN.

Q.5 Explain the TDS certificate?

TDS Certificate also known as Form GSTR 7A is based on the details of TDS given by the deductor in Form GSTR 7.

Q.6 – What are the prerequisites for generating a TDS Certificate (Form GSTR-7A)?

- Before generating Form GSTR 7A (the TDS Certificate) deductor needs to file Form GSTR 7 on GST Portal.

- GSTR 7 should duly be verified and approved by the deductee. If GSTR 7 is not approved by the deductee, then the certificate will not be generated.

Q.7 – Is it mandatory for the deductor to digitally sign the TDS certificate?

GSTR 7A or TDS Certificate is the digitally generated document that is issued only after both the parties have approved the details of TDS deducted. It requires no further signatures of the deductor for authentication.

Q.8 – Is it mandatory for the taxpayer to file GSTR 7A?

No, it is not mandatory to file GSTR 7A.

Q.9 – Being a deductor or deductee is it possible for me to download and keep a copy of my TDS Certificate for future reference?

Yes, it is possible to download the TDS certificate and use it as a future reference. Both the parties (deductor/deductee) can download the certificate.

I am supplying passenger vehicles with drivers to a Govt department ( Maharashtra Jeevan Pradhikaran) at their thane and Panvel offices. The Thane office only has a 7A registration under GST. their Number being 27PNEO02645G1DJ and Panvel Office 27PNEM0971C1DG.

I charge GST at 12 % on the service rendered.

Which GST number of the recipient should I give credit of the GST charged while filing my GST return

The Govt Department officers are not aware of the procedure and are not ready to accept my bills.

Please advise me whether the govt department may be having a centralised number for taking the Input Tax credit

Kindly contact to GST practitioner for the same

Kya hame gstr7a manually file karna padta he ki system hi generate kar deta he?? or jo ham gstr7a file nahi kiya to kitni penalty hoti he…

GSTR 7 return to file kiya ho tab ki bat he

GSTR 7A basically is for TDS credit which could be credited to your cash ledger when you file the same

TO KYA HAME GSTR7A MANUALLY FILE KARNA PADTA HE?

7A Yes

me as a deductor hu to bhi mujhe gstr7a file karna padega?

no

Superb.