As per Goods and Services Tax Network (GSTN), starting from the July 2025 tax period, Table 3.2 of GSTR-3B related to inter-state supplies made to unregistered persons, composition taxpayers, and UIN holders, will once again be auto-populated and non-editable on the GST portal.

After a temporary relaxation that authorised manual editing, introduced in answer to widespread concerns from taxpayers over technical difficulties in filing returns, the same move has arrived.

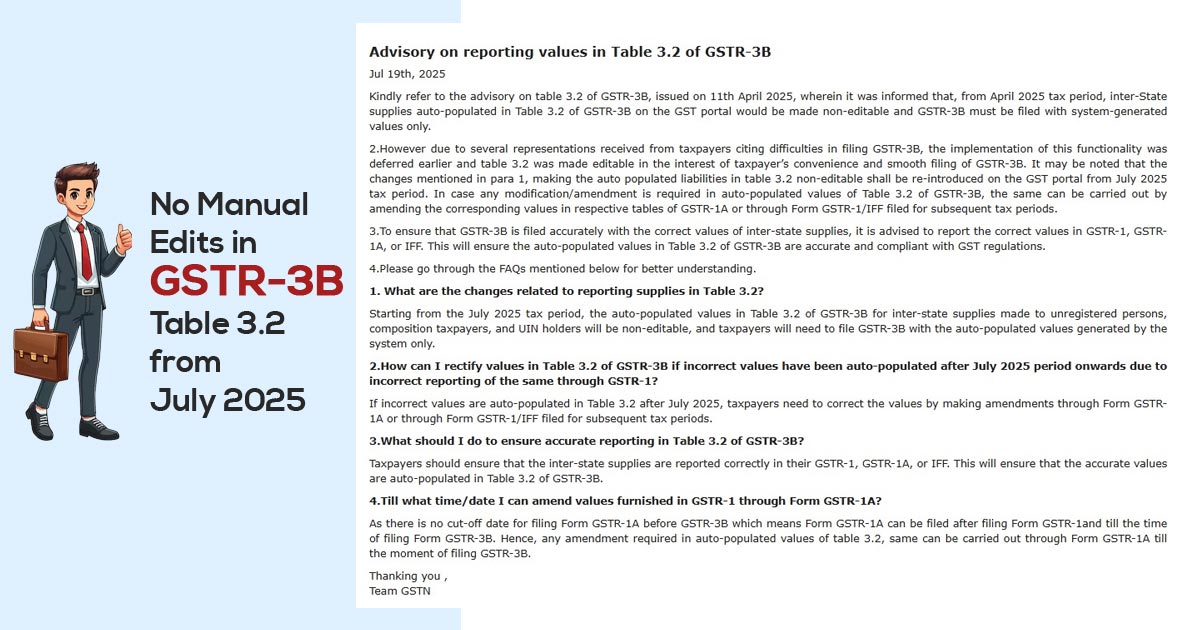

Advisory Official Copy

The issued advisory on 11th April 2025, on table 3.2 of GSTR-3B, should be referred to. It reports that from the April 2025 tax period, interstate supplies auto-populated in Table 3.2 of GSTR-3B on the GST portal would be made non-editable, and GSTR-3B should be filed with system-generated values only.

But the taxpayer furnishes representations quoting issues in GSTR-3B filing, the implementation of this functionality was postponed earlier, and Table 3.2 was made editable for taxpayers’ convenience and smooth filing of GSTR-3B. Such amendments in para 1 make the auto-populated obligations in table 3.2 non-editable and shall be reintroduced on the GST portal from the July 2025 tax period.

If any modification/amendment is needed in the auto-populated values of Table 3.2 of GSTR-3B, it can be performed via amending the related values in the respective tables of GSTR-1A or through Form GSTR-1/IFF filed for subsequent tax periods.

Reporting of the appropriate values in GSTR-1, GSTR-1A, or IFF is recommended to ensure that GSTR-3B is filed accurately with the correct values of inter-state supplies. The same ensures the auto-populated values in Table 3.2 of GSTR-3B are correct and compliant with GST regulations.

For effective understanding, go through the following FAQs.

Till what time/date can I amend values presented in GSTR-1 via GSTR 1A Form?

As no cut-off date is there to file Form GSTR-1A before GSTR-3B, which signifies Form GSTR-1A can be filed after filing Form GSTR-1and till the time of filing Form GSTR-3B. Therefore, any modification needed in auto-populated values of Table 3.2, same can be performed through Form GSTR-1A till the moment of filing GSTR-3B.

What are the changes in reporting supplies in Table 3.2?

W.e.f July 2025 tax period, the auto-populated values in Table 3.2 of GSTR-3B for inter-state supplies made to unregistered persons, composition taxpayers, and UIN holders will be non-editable, and taxpayers should file GSTR-3B form with the auto-populated values generated via the system only.

In what manner can I correct values in Table 3.2 of GSTR-3B if incorrect values have been auto-populated after the July 2025 period onwards due to inaccurate reporting of the same via GSTR-1?

Taxpayers would be required to correct the values via doing amendments through Form GSTR-1A or Form GSTR-1/IFF submitted for the following tax periods, if the wrong values are auto-populated in Table 3.2 after July 2025.

What should I do to ensure accurate reporting in Table 3.2 of GSTR-3B?

Taxpayers need to ensure the correct reporting of the interstate supplies in their GSTR-1, GSTR-1A, or IFF. It will ensure that the correct values are auto-populated in Table 3.2 of GSTR-3B.