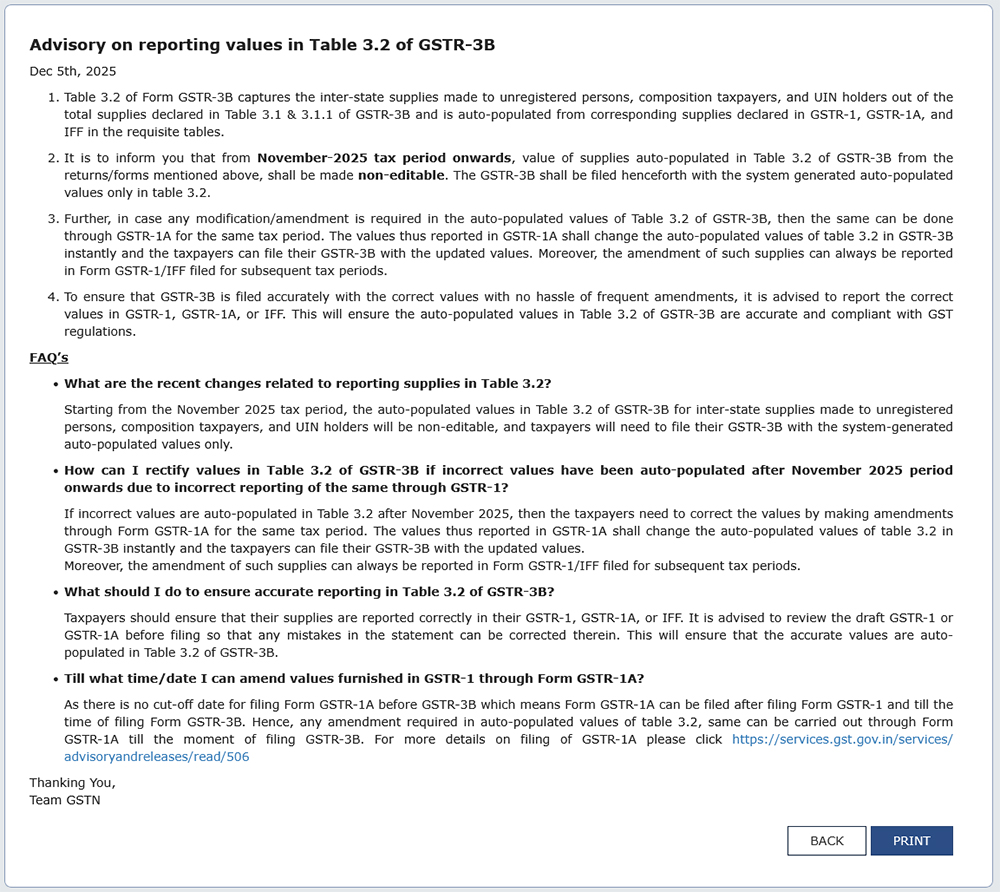

The Goods and Services Tax Network (GSTN) for easing GST compliance and rectifying data precision has issued a new advisory regarding the reporting of inter-state supplies in Table 3.2 of Form GSTR-3B, effective from the November 2025 tax period (filed in December 2025).

What is Amended?

Table 3.2 of GSTR-3B, which records inter-state supplies to unregistered persons, composition taxpayers, and UIN holders, shall now be auto-populated and made non-editable. These values will be pulled directly from the corresponding entries in GSTR-1, GSTR-1A, or the IFF (Invoice Furnishing Facility).

Therefore, the taxpayer shall no longer manually edit the values in Table 3.2 of GSTR-3B. The system-generated values are to be filed as-is.

What is the Method for the Rectifications?

If wrong values emerge in Table 3.2 because of the earlier mistakes in GSTR-1-

- Corrections are to be made via Form GSTR-1A, or

- By filing amendments in GSTR-1 or IFF in the following tax period.

The taxpayers shall be unable to do any revisions directly in the GSTR-3B Form.

What is Significant to Perform?

To ensure the precision filing-

- Use Form GSTR-1A to revise inaccurate entries before filing GSTR-3B.

- Verify all inter-state supply details at the time of filing GSTR-1, GSTR-1A, or IFF.

- Remember, Form GSTR-1A can be filed at any time before filing GSTR-3B.

As always, GSTN helps make important changes in GST return forms to ease compliance for chartered accountants and tax professionals, enabling them to file these forms without mistakes. The renowned taxation software company, SAG Infotech Private Limited, has implemented these changes in the Gen GST Software.

Read the Advisory to Know More

Important FAQs for Table 3.2 of GSTR-3B

Q1. What’s the transformation?

Table 3.2 of GSTR-3B will be auto-filled and locked for editing from November 2025.

Q2. What is the method to correct errors in Table 3.2?

Make modifications in GSTR-1A or GSTR-1/IFF of subsequent periods.

Q3. What is the method to ensure precise reporting?

Before filing, Double-check interstate supplies in GSTR-1, GSTR-1A, and IFF.

Q4. Till what point in time can I file GSTR-1A?

- You are enabled to submit GSTR-1A anytime before filing GSTR-3B.

- The same procedure can improve the consistency between returns and reduce mismatches, thereby enhancing overall GST compliance.

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."