The GST council has recommended one additional GST return Form, GSTR-1A. A new optional form, lets you change your GSTR-1 for a specific tax period. This means you can:

- Add any sales details you missed in your original GSTR-1 filing.

- Correct any mistakes you made in the reported sales details before the GSTR-3B filing.

- This will help ensure that the accurate tax liability is automatically reflected in the GSTR-3B form.

Latest Updates

- GSTN has implemented new changes in Table 12 of GSTR-1 or GSTR-1A in phases. read more

- HSN Codes- Phase III will be implemented in Table 12 of GSTR-1 and 1A starting from the return period of February 2025. View More

- The GST department has now made it mandatory to include HSN codes in the GSTR-1 and GSTR-1A forms. read more | read PDF

- Manual filing guide and FAQs for GSTR-1A filing form. View more, FAQs, GSTR-1A Filing Guide

- The GSTN department has recently issued a new advisory about the GSTR-1A form. read more

Changes in GSTR-1A Before GSTR-3B Filing

The Form GSTR-1A shall furnish, the flexibility feature in the amendment. GSTR-1A shall permit the assessees to revise or add records within the identical month/same period post-filing GSTR-1 and before filing GSTR-3B. The assessees could not alter GSTR-1 in the identical duration post it has been filed. Any change or missed records should be reported in the GSTR-1 of the next return period.

The obligation revised shall be populated automatically in GSTR-3B, which enables the correct liability release.

Revisions or missed records could be notified in GSTR-1A prior to filing GSTR-3B, which also promotes, effective reporting.

What Does the Term GSTR- 1A Signify?

GSTR-1A authorized a registered assessee to update the details of sales for GSTR-1 which was filed before. Since 2017 the form is no longer in use. The data was derived from the buyer’s GSTR-2A when he altered any data. The seller either accepts or rejects the changes. Changes carried by the seller would have automatically been reflected in the GSTR-1.

In What Way Is GSTR-1A Distinct from GSTR-1?

GSTR-1 is a return that contains all the sales particulars. The seller taxpayer filled it. Information from one’s GSTR-1 will arise in his buyer’s GSTR-2 where he may alter some information. But till now the GSTR-2 and GSTR-3 have been suspended. Therefore, the information from GSTR-1 was passed onto GSTR-2A of the respective buyers.

In What Way Does GSTR-1A Work?

Check the example below for simplification:

- Naveen purchases 100 pencils worth Rs. 500 from Rahul General Store

- Rahul General Store has incorrectly shown it as Rs. 50 sales in his GSTR-1 Form

- The data from Rahul’s GSTR-1 form will stream into the GSTR-2A of Naveen

- Naveen immediately corrects it to Rs. 500

- This change is reflected in Rahul’s GSTR-1A

- When Rahul receives this correction, his GSTR-1 form gets updated automatically

Important Instructions for Filing of GSTR-1A

- It is an additional facility provided to add any particulars of the current tax period missed out in reporting in FORM GSTR-1 of the current tax period or amend any particulars already declared FORM GSTR-1 of the current tax period (including those declared in IFF, for the first and second months of a quarter, if any, for quarterly taxpayers)The form is an optional form without a levy of late fees.

- The FORM will be available on the portal after the due date of filing of FORM GSTR -1 or the actual date of filing of FORM GSTR 1, whichever is later, till filing of the corresponding FORM GSTR-3B of the same tax period. Similarly, for quarterly taxpayers, the FORM GSTR-1A shall be opened quarterly after the filing of the FORM GSTR-1 (Quarterly) or the due date of filing of FORM GSTR -1 (Quarterly), whichever is later, till the filing of FORM GSTR-3B of the same tax period.

- The particulars declared in FORM GSTR-1A along with particulars declared in FORM GSTR-1 shall be made available in FORM GSTR-3B. In case of taxpayers opting for filing of quarterly returns the same shall be made available in FORM GSTR-3B (Quarterly) along with particular furnished in FORM GSTR-1 and IFF of Month M1 and M2 (if filed).

- Amendment of a document which is related to a change of Recipient’s GSTIN shall not be allowed in GSTR-1A.

- In addition to the GSTR-2B already generated, GSTR-2B shall also consist of all the supplies declared by the respective suppliers in GSTR-1A. However, supplies declared or amended in FORM GSTR-1A shall be made available in the next open FORM GSTR-2B. For example,

- (i) A supplier issued two invoices INV1 and INV2 in January 2023. Then he furnished the details of the invoice INV1 on 8th Feb 2023 in FORM GSTR-1. However, he misses one invoice INV2 and furnishes the details of the same in FORM GSTR-1A on 15th Feb 2023. In this case, INV1 will go to the FORM GSTR-2B of the recipient for January made available on 14th Feb 2023. Further, INV2 will be made available in FORM GSTR-2B of the recipient for February and made available on 14th March 2023.

- (ii) a supplier issues two invoices INV3 and INV4 in January 2023. Then he furnished the details of the invoice INV3 on 15th Feb 2023 in FORM GSTR-1. However, he declared INV 4 in FORM GSTR-1A on 16th Feb 2023. In this case, both INV3 and INV4 will be made available in FORM GSTR-2B of the recipient for February made available on 14th March 2023.

Procedure to E-file GSTR 1A Form

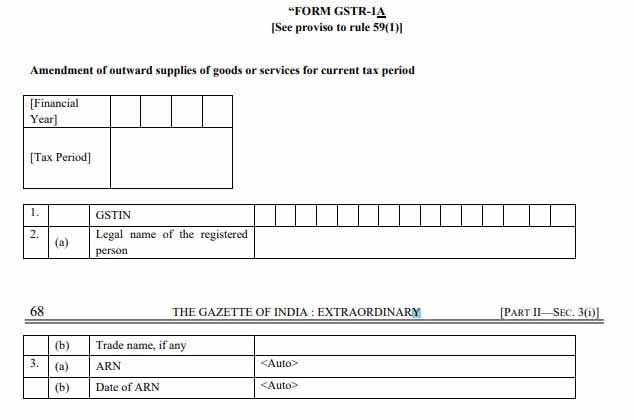

Part 1 to Part 3 – Amendment of outward supplies of goods or services for the current tax period

- GSTIN

- (a) Legal name of the registered person

(b) Trade name, if any - (a) ARN

(b) Date of ARN

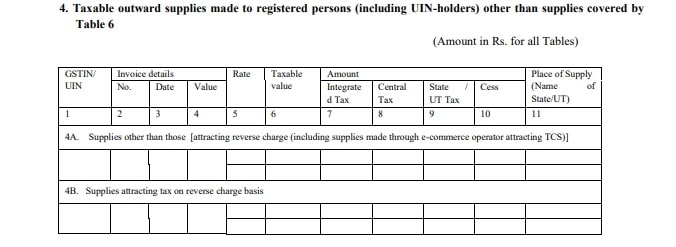

Part 4 – Taxable outward supplies made to registered persons (including UIN-holders) other than supplies covered by Table 6

- 4A. Supplies other than those [attracting reverse charge (including supplies made through e-commerce operator attracting TCS)]

- 4B. Supplies attracting tax on a reverse charge basis

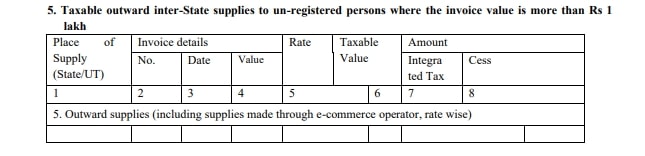

Part 5 – Taxable outward inter-State supplies to un-registered persons where the invoice value is more than Rs 1 lakh

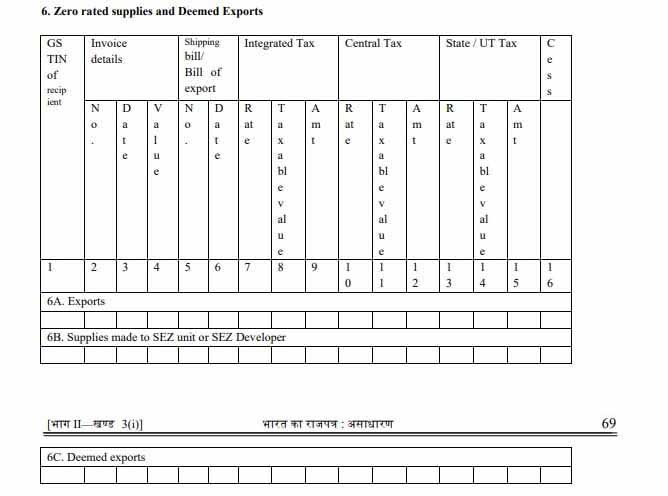

Part 6 – Zero-rated Supplies and Deemed Exports

- 6A. Exports

- 6B. Supplies made to SEZ unit or SEZ Developer

- 6C. Deemed exports

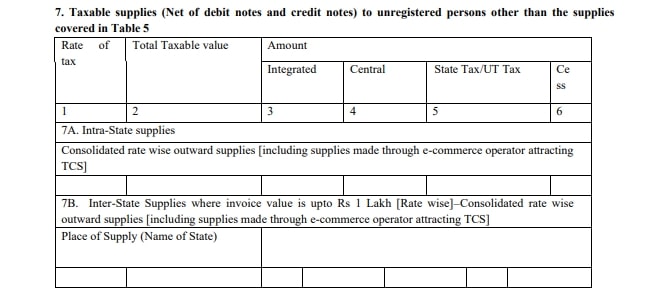

Part 7 – Taxable supplies (Net of debit notes and credit notes) to unregistered persons other than the supplies covered in Table 5

- 7A. Intra-State supplies Consolidated rate-wise outward supplies [including supplies made through e-commerce operators attracting TCS]

- 7B. Inter-State Supplies where invoice value is upto Rs 1 Lakh [Rate wise]–Consolidated rate-wise outward supplies [including supplies made through e-commerce operators attracting TCS]

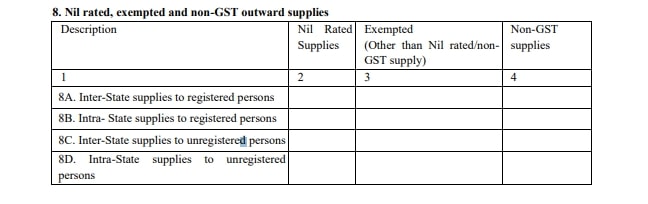

Part 8 – Nil-rated, exempted and non-GST outward supplies

- 8A. Inter-State supplies to registered persons

- 8B. Intra- State supplies to registered persons

- 8C. Inter-State supplies to unregistered persons

- 8D. Intra-state supplies to unregistered persons

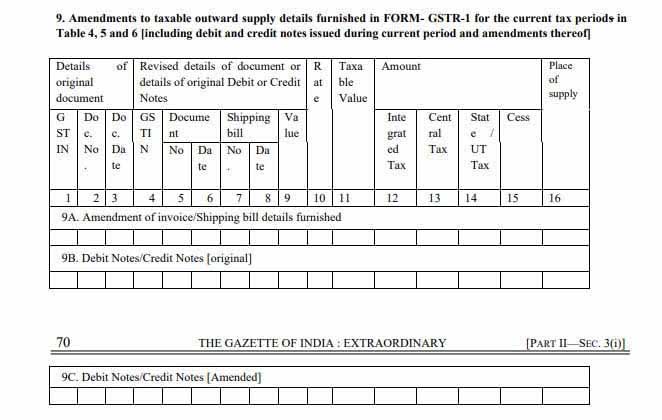

Part 9 – Amendments to taxable outward supply details furnished in FORM- GSTR-1 for the current tax periods in Table 4, 5 and 6 [including debit and credit notes issued during the current period and amendments thereof]

- 9A. Amendment of invoice/Shipping bill details furnished

- 9B. Debit Notes/Credit Notes [original]

- 9C. Debit Notes/Credit Notes [Amended]

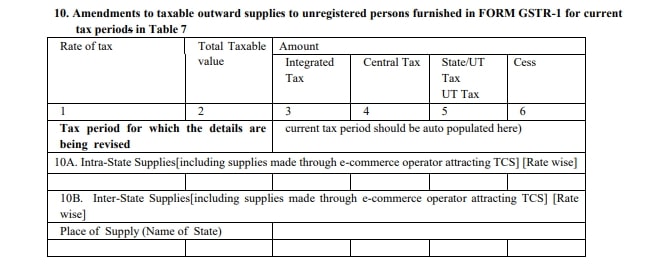

Part 10 – Amendments to taxable outward supplies to unregistered persons furnished in FORM GSTR-1 for current tax periods in Table 7

- 10A. Intra-State Supplies[including supplies made through e-commerce operator attracting TCS] [Rate wise]

- 10B. Inter-State Supplies[including supplies made through e-commerce operator attracting TCS] [Rate wise]

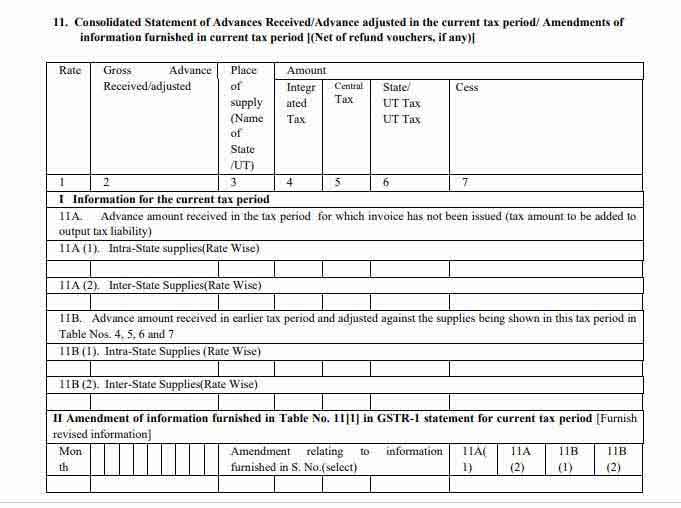

Part 11 – Consolidated Statement of Advances Received/Advance adjusted in the current tax period/ Amendments of information furnished in the current tax period [(Net of refund vouchers, if any)]

I Information for the current tax period

- 11A. Advance amount received in the tax period for which invoice has not been issued (tax amount to be added to output tax liability)

- 11A (1). Intra-State supplies(Rate Wise)

- 11A (2). Inter-State Supplies(Rate Wise)

- 11B. Advance amount received in an earlier tax period and adjusted against the supplies being shown in this tax period in Table Nos. 4, 5, 6 and 7

- 11B (1). Intra-State Supplies (Rate Wise)

- 11B (2). Inter-State Supplies(Rate Wise)

II Amendment of information furnished in Table No. 11[1] in GSTR-1 statement for the current tax period [Furnish revised information]

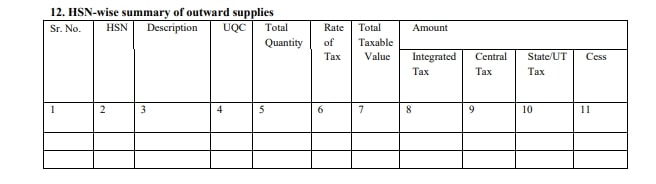

Part 12- HSN-wise summary of outward supplies

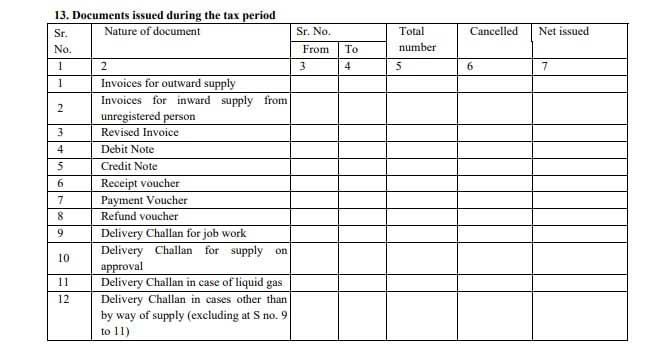

Part 13- Documents issued during the tax period

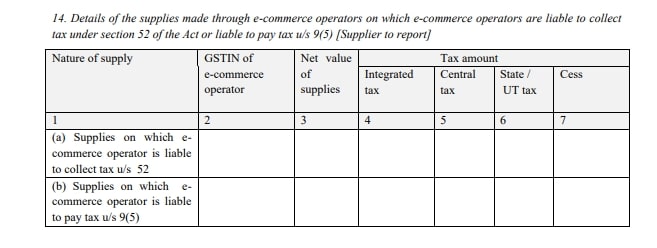

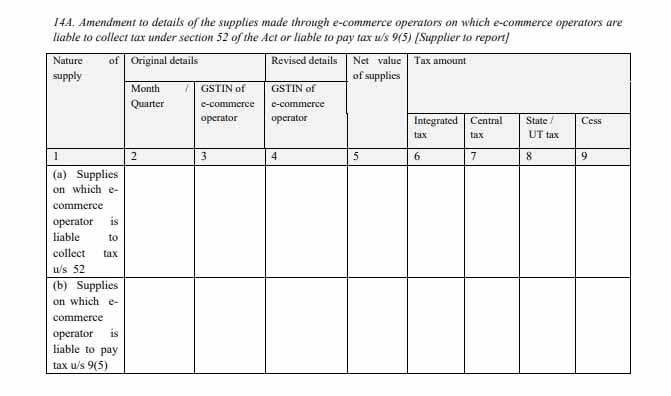

Part 14 – Details of the supplies made through e-commerce operators on which e-commerce operators are liable to collect tax under section 52 of the Act or liable to pay tax u/s 9(5) [Supplier to report]

- 14A. Amendment to details of the supplies made through e-commerce operators on which e-commerce operators are liable to collect tax under section 52 of the Act or liable to pay tax u/s 9(5) [Supplier to report]

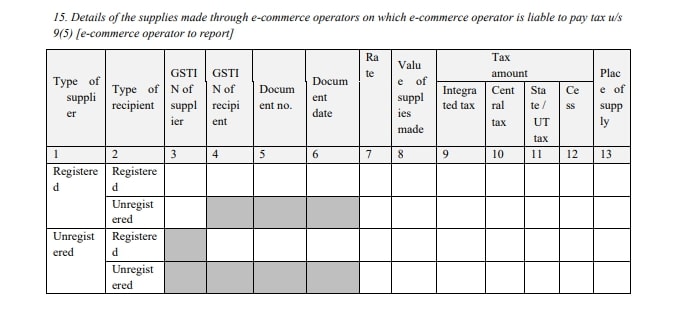

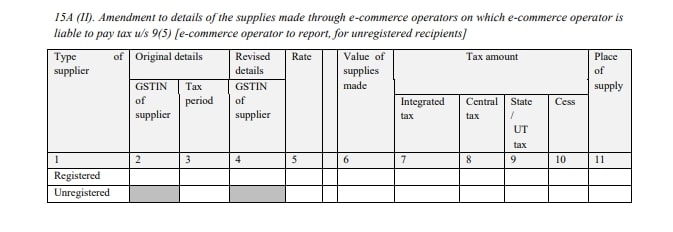

Part 15 – Details of the supplies made through e-commerce operators on which e-commerce operator is liable to pay tax u/s 9(5) [e-commerce operator to report]

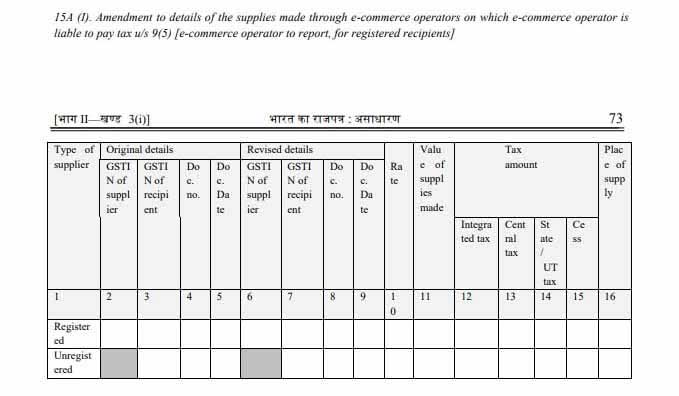

- 15A (I). Amendment to details of the supplies made through e-commerce operators on which e-commerce operator is liable to pay tax u/s 9(5) [e-commerce operator to report, for registered recipients]

- 15A (II). Amendment to details of the supplies made through e-commerce operators on which e-commerce operator is liable to pay tax u/s 9(5) [e-commerce operator to report, for unregistered recipients]

Hi, As per Your Example, Naven Correct the amount is GSTR1A, If Naveen Again Wrongly enter, What We do?.. Example, Naveen Enter Rs.400 Instead of Rs.500, How Reflect in GSTR1A

Currently GSTR-1A is not in Existence