In the matter of Sumit Maheshwari vs. Income Tax Officer (ITAT Delhi), the appeal emerged from a penalty levied u/s 271(1)(b) of the Income Tax Act, 1961 for non-compliance with a notice issued u/s 142(1) of the Act. The issue was whether the penalty was explained given the possibilities covering the service of notices by the Income Tax Department.

Background and Statements:

The taxpayer, Sumit Maheshwari, contested the penalty charged on the basis that notices, including notice under section 142(1) and subsequent proceedings, were sent to his old address at 31, Chanakyapuri, Meerut. However, the taxpayer had long since diverted to a new address at 94-95, Chanakyapuri, Meerut, and had duly informed the Income Tax Department by filing his ITR for both the AY 2011-12 and 2012-13 with the updated address.

Even after the address modification is on record via such filings, the notices were constantly sent to the old address. Therefore the taxpayer argued that as the notices were not obtained as of the wrong address being employed by the department, under section 271(1)(b) the penalty was not justified.

Proceedings and Conclusions:

- Tax Penalty and Assessment Imposition: The Assessing Officer concluded the assessment u/s 144/147 of the Act on 12.12.2019. Thereafter, a penalty u/s 271(1)(b) was charged for non-compliance with the notice u/s 142(1) issued dated 31.07.2019.

- Opinions Before ITAT: The taxpayer at the time of the petition before the Income Tax Appellate Tribunal (ITAT), repeated that even after furnishing the new address, the notices were sent to the old address, hence not furnishing the taxpayer a chance to answer or comply.

- ITAT’s Judgment: The facts are being analyzed by ITAT and it noted that at the time of passing the penalty order on the new address of the taxpayer (94-95, Chanakyapuri, Meerut), there was no conclusive finding either via the Assessing Officer or the CIT(A) for the service of the notice u/s 142(1) of the Act.

- ITAT remarked that the load to prove service of notice is in the income tax department. As there was no proof that the notice on 31.07.2019 was served on the taxpayer at either the old or the new address, the ITAT concluded that it cannot be assumed that the taxpayer intentionally evaded compliance.

- ITAT stresses that the taxpayer has furnished his correct address via his ITR for the related assessment years. Hence any failure to adhere to the notices sent to the old address was not because of the ignorance of the taxpayer, but instead because of the failure of the department to update its records and communicate appropriately.

- Lawful Precedents Mentioned: On the judgment of the Jurisdictional Allahabad High Court in the case of Suresh Kumar Sheetlani vs. ITO, the taxpayer laid on where it was ruled that a notice had been served at the incorrect address renders the reassessment proceedings not valid. It was key in finding that the penalties levied in the same matter were not justified.

Closure: Established on the aforesaid considerations, ITAT permitted the petition of the taxpayer, removing the penalty levied u/s 271(1)(b) of the Income Tax Act for the assessment year 2012-13. The decision shows the importance of effective service of notices via the department and holds the principle that penalties could not be levied when there is no proof of willful non-compliance and where the department is unable to satisfy its responsibility to communicate with the taxpayer.

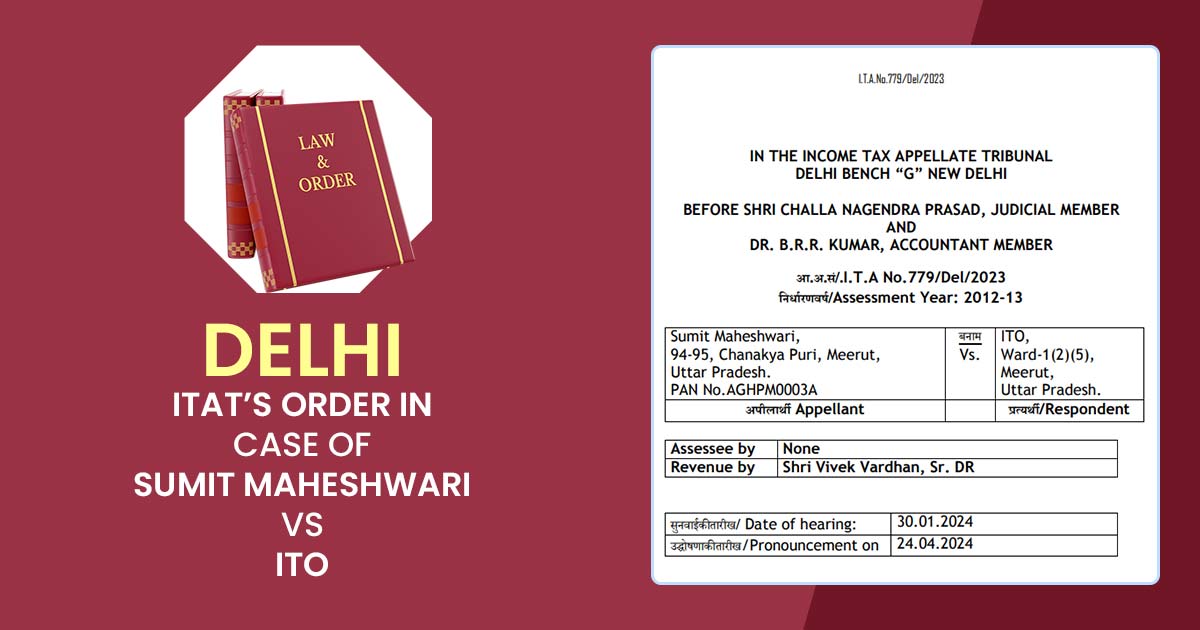

| Case Title | Sumit Maheshwari Vs ITO |

| Case No. | I.T.A No.779/Del/2023 |

| Date | 24.04.2024 |

| Assessee by | None |

| Revenue by | Shri Vivek Vardhan, Sr. DR |

| Delhi ITAT | Read Order |