Government is thinking of bringing the service providers like electricians, beauticians under the purview of Goods and Services Tax. The Department for Promotion of Industry and Internal Trade (DPIIT) is planning to make it mandatory for online marketplaces such as UrbanClap, Housejoy to associate only with those people who have GST numbers or GTINs.

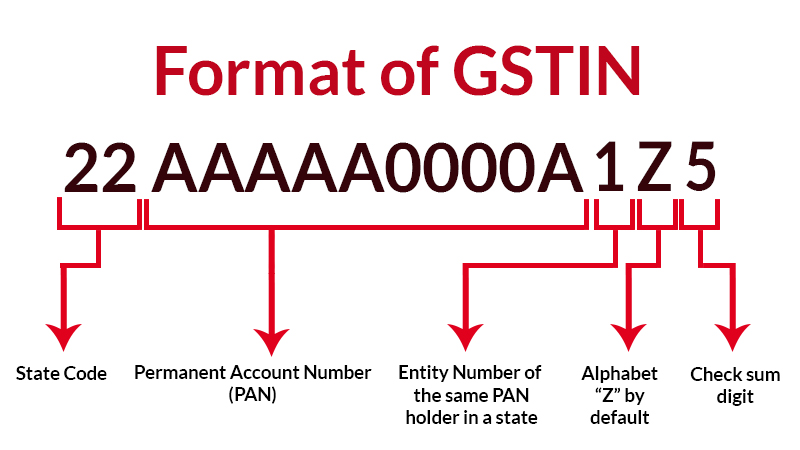

However, the electricians, plumbers and fitness trainers, who are using such online platforms, will be kept out of the GST ambit as their annual turnover will be less than INR 40 lakh. However, the government’s move to make GSTIN (GST Identification Number)

According to a senior government official, currently, people are offering such services working from their homes and there is no way to identify them. They will neither bound to pay GST nor to file quarterly returns, but, if they get registered on the GST network, it will become feasible for the GST department to monitor them. He also informed that companies like UrbanClap can be ordered to keep a list of such people on its platform.

UrbanClap refused to comment on this and said that it has not received any formal information from the government regarding the issue.

Another government official told that they are considering many issues like consumer safety and protection of the rights of these workers and for this GST registration is voluntary.

In the current fiscal year, the government is also planning to introduce a new e-commerce policy. According to this new policy, the current provisions implied on data sharing might be relaxed a bit. Adding to this, the existing rules and regulations around the online marketplace, inventory and hybrid model can also be clarified.

The government is also planning to introduce regulations for providing social security to people offering services like fitness training, plumbing, and electric repair, etc. Further, health and monetary benefits might also be added to these people.

Many countries have already made provisions to provide various social security benefits to people offering such kind of services. California, US was the first city across the globe who have passed legislation to provide employee status to people who are working with companies like Uber.

Can I get adhar verified with my phone number today itself for registration issue it no t processing futher to fill application form nd laste date is 9th March plz kindly request to look forward into it for the NEET competitive exam🙏

Mobile no verification along adhar card