Kerala Finance Minister Thomas Issac is currently on a mission to stop tax evasion on Gold. Gold is one of the most sought after items in South districts and therefore has a peek sales. So naturally, the GST fraud in the sector would lead to a huge loss in the state’s tax revenue. To curb tax evasion

The council including influentials such as Bihar deputy CM Sushil Kumar Modi met in New Delhi. The council discussed the matter to curb tax evasion in the gold sector and asked for suggestions from companies that import gold as well as the IT Department. The meeting is a result of a sudden commendable fall in the GST collection which was supposed to get acquired from the gold sector in Kerala. This gave rise to the curiosity of the state government. Earlier, gold supply required no e-way bill but now the government is trying to find out if they can adopt any policy like the e-way bill on the supply of Gold.

Kerala, being the prime consumer of gold, is able to collect Rs. 600 crore before GST entered the scenario. After the commencement of GST, the gold collections went steep down leaving the administration doubtful of the unscrupulous jewellers. The state administration is now on a mission to find out the tax evasion in the gold industry via data collected from various sources.

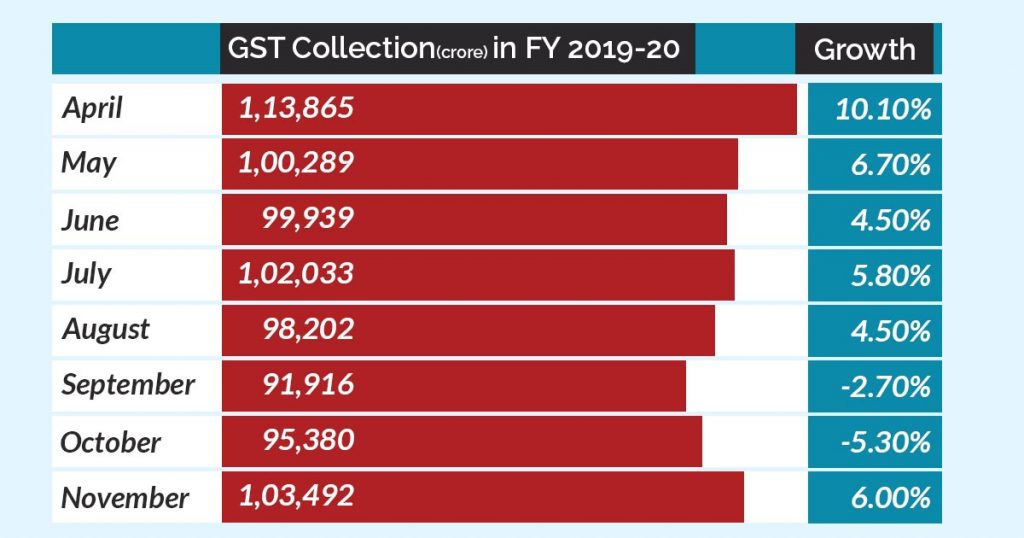

Another committee of ministers led by Sushil Modi discussed on various channels that can be used to settle un-appropriate taxes on inter-state supplies. This seven-member panel is also exploring the ways to sort out concerns raised by Tamil Nadu, Puducherry, Punjab, and Delhi in settling this amount. The main GST panel will soon be discussing the issues suggested by the local ministerial council. GST council meeting is estimated to be held after the Union Budget presentation i.e. 1 February. The Council would discuss fixing the loopholes in GST and increase revenue collections