India’s national treasury is estimated to be in the deficit of INR 5 trillion which is approximately 40% of the total Goods and Service Tax (GST) collection target. The aforesaid loss is due to cases of tax evasion and irrelevant ITC claims by businesses, as declared by Fifteenth Finance Commission (FFC).

FCC in its presentation to the GST council marked that the loss caused to the government is as massive as 2.4% of the country’s Gross Domestic Product (GDP). The calculation comes out to Rs. 5 trillion if the first advanced estimate of normal GDP for FY 2020 is concerned. The loss is equivalent to 40% of the aggregate GST collection target

The State and Central government is able to accumulate more than Rs. 9 trillion in the course of nine months to December 31 and hope to acquire another 3.55 trillion by March-end.

Concerned over current stats given by FFC, the tax administration is all set to cope with the loss through enforcement of strict laws to check tax frauds and assuring that the revenue target is achieved. As calculated by FFC, India’s current tax-to-GDP ratio is 17.2% which was supposed to be somewhere near 22.6%. Clearly, the department is lagging behind by 5.4% out of which 2.4% is due to the tax evasion and unscrupulous ITC claims.

Economists from the International Monetary Fund (IMF) gave presentations to FFC on resource mobilization over the next five years. The attention was again diverted to the need for improving the revenue realization from GST. IMF stated that the current collection lies nowhere near the estimated revenue collection. It was further discussed that the rationalization of rate structure and enhancements in the tax compliance and collection efficiency may lead tax administration closer to fulfilling its collection targets, FFC.

The gap in the collection and target revenue is due to the falling consumption, the threshold limit for GST registration

Indira Rajaraman (economist and former member of the thirteenth Finance Commission) said that falling revenue collection and economic slowdown have given a clear view of what small businesses have witnessed under the GST regime.

The stir of Indian Economy and job generation depended intensely on these small businesses, said Rajaraman. The breaking of bonds between these smaller businesses and their potentially larger counterparts due to reasons like the threat of entering into the formal system and having to deal with legal authorities led to the economic slowdown and slump in GST revenue.

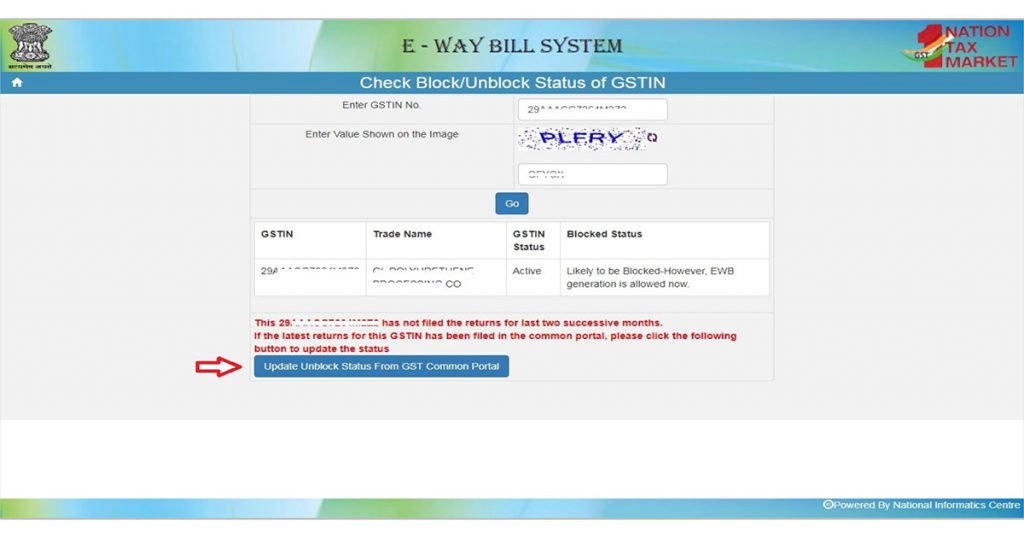

The government has initiated to work for revenue enhancement like restricting the e-way bill facility

The legal authorities have poked around 40,000 firms claiming excess tax refunds or ITC claims. The committee of ministers headed by Kerela FM Thomas Issac is finding out ways to eliminate tax evasion on gold. As a result, the transportation of metals now requires an electronic permit.