The revenue council on Monday specified that people are not paying the returns despite they have been founded with turnover in crores and declares that for the honest assessees while also stating that there will be no major amendment in the reporting of GST turnover data in Form 26AS.

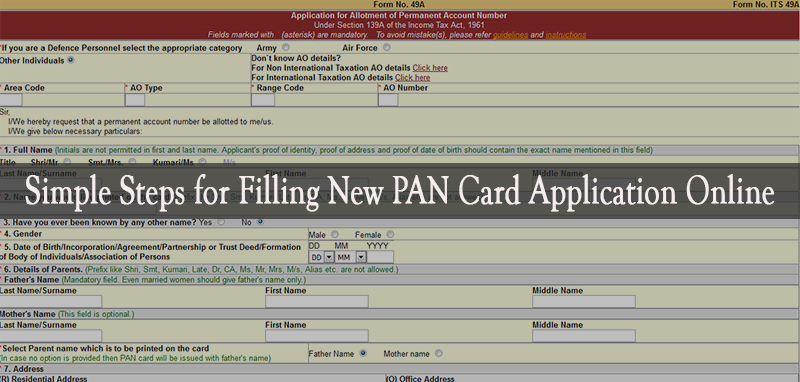

There is no more load on the assessee to follow the GST turnover mentioned in Form 26AS that is a yearly consolidated tax statement that might be executed via income tax portal through the assessee by utilizing the Permanent Account Number (PAN)

“The GST turnover is being shown in 26AS just for the information of taxpayers. DoR acknowledged that there may be some differences in GSTR-3Bs filed and the GST shown in the Form 26AS but it can’t happen that a person shows turnover of crores of rupees in GST and doesn’t pay a single rupee of income tax. There are quite a few such cases that have been detected in data analytics,”

DoR specified that the ITR for FY 2020-21

“There would be no change in the reporting requirement with the display of information of GST turnover in Form 26AS because the honest taxpayers are already furnishing GST returns and Income Tax Return and reporting their turnover correctly,”

It will also reveal the turnover arrived for the Goods and Services Tax (GST) return Form GSTR-3B.

It will also constitute several details like cash details withdrawal or deposit from saving the bank accounts, sale/purchase of immovable property, time deposits, credit card payments, etc. which are inscribed by the entities in the financial statement.

Form 26AS provides details

It is a mandatory step taken in the context of “Transparent Taxation – Honoring the Honest” as it will ease in reporting the GST turnover in the time duration of the ITR

“The display of information of GST turnover in Form 26AS, at the same time, would force dishonest taxpayers (who earlier used to evade income tax by under-reporting their turnover in the income tax returns as compared to turnover reported in the GST returns) to report their correct turnover and consequently force them to pays the correct income-tax,”

This will circulate easy compliance as the details with context to the turnover given in GST returns

My IT Form 26AS shows GST Taxable Turnover the same as Total Turnover. I have been filing my GSTR3B regularly and paying applicable GST promptly. So, the total turnover should include the GST but the Form does not show that. I am confused as to which Turnover is to be shown in my ITR-4. Honest tax-payers are thus offered additional confusion by this added compliance requirement.

Total Taxable amount is to be considered as Total turnover (tax portion is not included in the Turnover calculation)