The proper office will deliver the show cause notice Form GST REG-23 if he is not satisfied with the refusal application furnished by the assessee. There is a need to display the cause relied on which he thinks that the refusal of the application so furnished is entitled to get rejected.

The situation beneath which the notice in Form GST REG-23 is to be given by the proper officer the receipt to reply along with the final act of the proper officer as well as the giving the notice in Form GST REG-23.

The Situation where Notice in Form GST REG-23 is to be Provided Through the Proper Officer

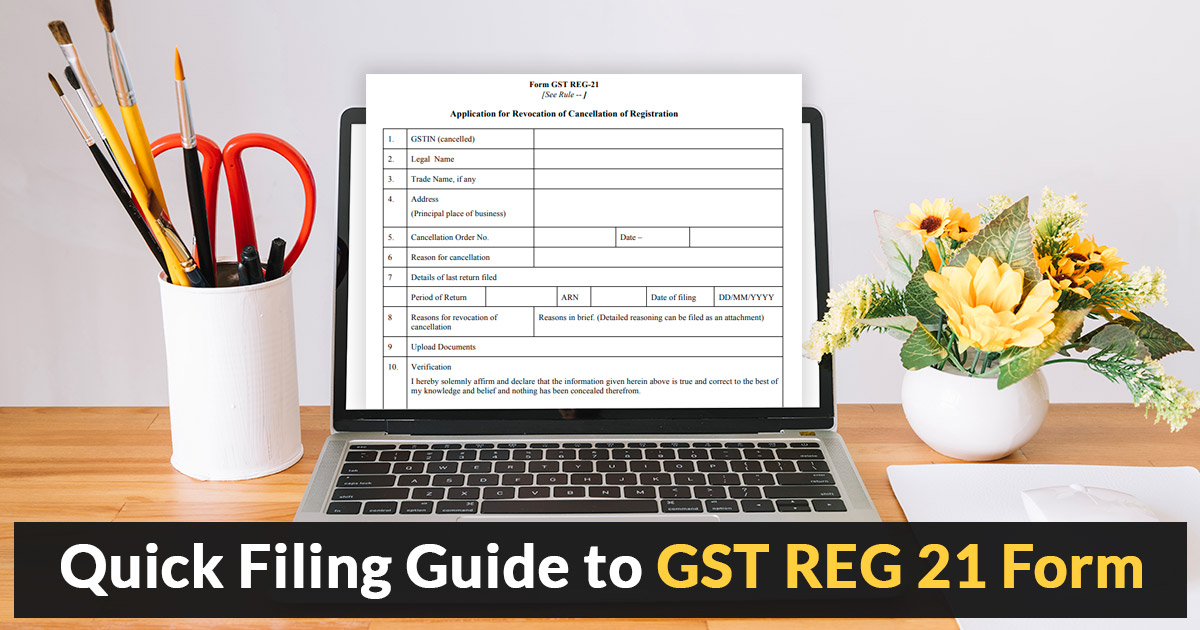

The assessee against which the enrollment gets canceled by the proper officer has a choice to file the application for the revocation to cancel the GST enrollment in form GST REG 21

If in form GST REG-21 the revocation application is furnished by the taxable individual then the proper officer is required to find out the causes where the revocation is been applied by the assessee.

On the examination basis if all the reasons given by the assessee are seemed to be effective that is examined by the proper officer then he will give an order in Form GST REG-22 where refusal to cancellation of GST registration

But if any mistake is caught by the proper officer which finds him unsatisfied then he will give the order for Form GST REG 05 not accepting the application furnished for revocation of cancellation of GST enrollment. According to the procurement of Rule 23(3) of the Central Goods and Services Tax Rules, 2017, before issuance of the order for Form GST REG-05, and the officer is needed to provide the notice in Form GST REG-23.

By giving the notice to the assessee in Form GST REG-23 the proper officer will ask the assessee to tell the reason why the refusal application furnished by him will not be rejected. Also, it is necessary that the proper officer mentioned the reason that he thinks that the enrollment of the assessee is entitled to get canceled and also this should not be repealed.

In short through the notice in Form GST REG-23, there is a chance that is given to the taxable person to provide the reasons that about not to cancel the GST enrollment. Hence the assessee whose enrollment gets canceled through the proper officer must receive the notice seriously in Form GST REG-23.

Proper Officers Reply, Receipt of Answer if Any

The assessee who has taken notice in Form GST REG-23 is needed to furnish the answer properly inside Form GST REG-24 under 7 working days within the due date of the issued notice.

However, if there is satisfaction seen from the proper officer’s side with an answer to the assessee he will then give an order to approve the revocated application. But if the assessee is unable to furnish the reply or the proper officer is not satisfied with the reply furnished by the taxable person then he will give an order to reject the revocated application.

The Conclusion of the Issuance of Notice in Form GST REG-23

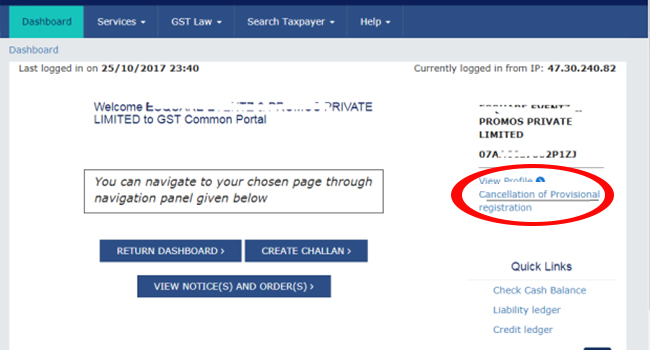

Activities revolving around is stated below:

- The proper officer, on his own consideration, eliminates the GST registration

- The assessee on feeling distressed by the cancellation of GST enrollment furnished the application to the refusal of cancellation of GST registration in Form GST REG-21.

- Not satisfied with the application of revocation furnished by the assessee in Form GST REG-21 the proper officer will provide the notice in Form GST REG-23.