The term revocation states the reversal where the goods and service tax GST application for the revocation inside the Form GST REG-21 signifies that the reversal of cancellation of GST enrolment. The assessee is the only person to whom the proper officer cancels the GST registration, which will be applied for reversal of the denial of GST registration for form GST REG-21.

The current article specifies the applicability of reversal procurement and the procedure to file for the reversal application and the acceptance or non-acceptance of the application for reversal of cancellation.

Latest Update

- “The CBIC has added the advisory about the new functionality of restoration of canceled registration under GST via REG-21.” Read More

- “CBIC has showcased an advisory related to the Aadhaar authentication for filing of GST refund/Revocation of canceled applications of registration from 1st January 2022. Read more“

- The CBIC has added the eighth amendment rules, 2021 related to GST Reg.21 under rule 23 and RFD-01 under rule 89. Read Circular

- “CBIC shared the latest update about upcoming functionalities for the taxpayers on the GST official portal in July 2021 month.” Read PDF

- “Seeks to prescribe Standard Operating Procedure (SOP) for implementation of the provision of extension of time limit to apply for revocation of cancellation of registration under section 30 of the CGST Act, 2017 and rule 23 of the CGST Rules, 2017” Read Circular

Eligibility of Cancellation Provisions

According to the provision for section 30 in the Central Goods and Services Tax Act, 2017, the assessee whose enrollment by the proper officer has not been accepted can apply for the reversal of cancellation of the GST enrollment. Hence the reversal applicant is applied only when the proper officer cancels the GST enrollment in form GST REG-21.

According to section 30 of the Central Goods and Services Tax Act, 2017 held with the law 23 that the Central Goods and Services Tax Rules, 2017, the assessee can file the revocation application in Form GST REG-21 if he feels something wrong is implemented to the proper officer. The application of reversal of cancellation to the officer should be written within 30 days from the cancellation of the GST registration

If in case the proper officer cancels the GST registration for non-furnishing of the GST return

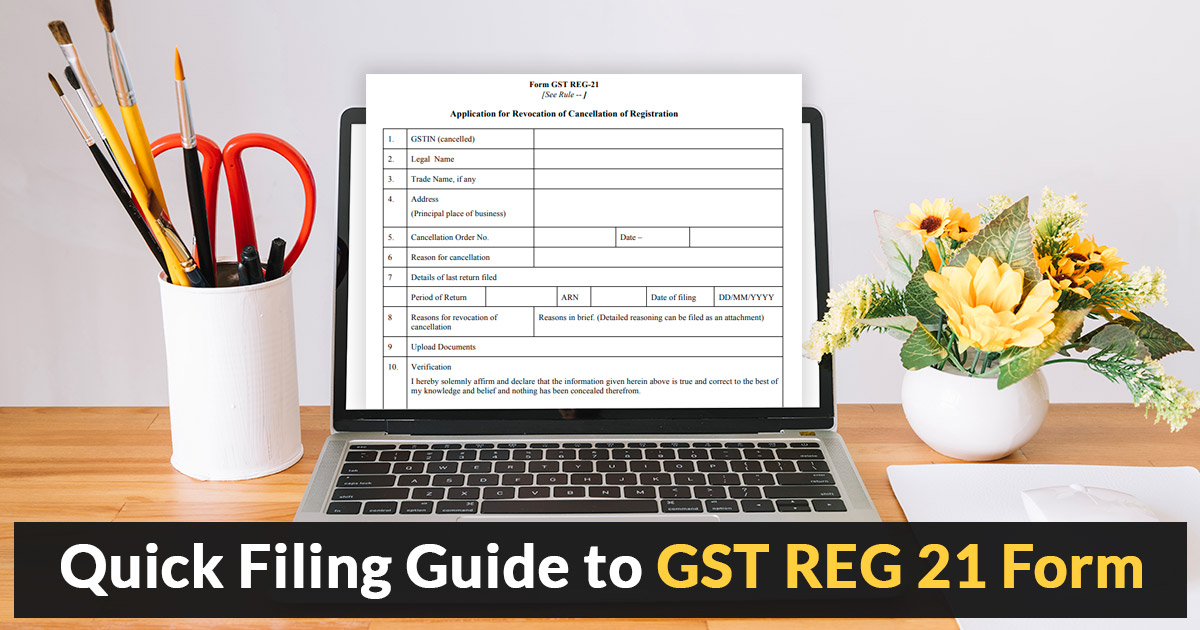

The measures to furnish the revocation of application for Form GST REG -21:

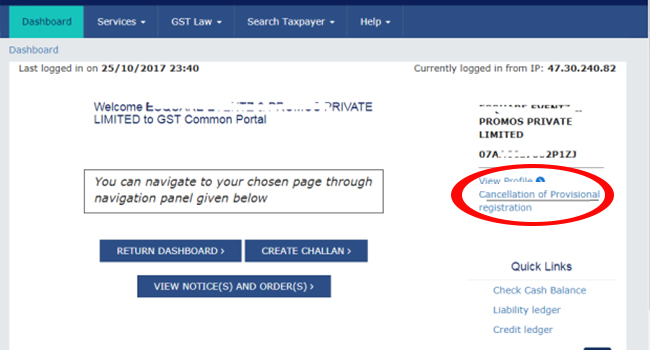

Step 1 – Go to the https://www.gst.gov.in/ and tap ‘Login’

Step 2 – Insert the suitable login details i.e., Username, Password, and Characters shown

Step 3 – Tap on login

Step 4 – Navigate Services > Registration > Application for Revocation of Removal of Registration

Step 5 – Inscribe all the important details and causes to revocate for the cancellation. Upload the credentials, if any

Step 6 – File the revocation application in form GST REG-21

Acceptance or Non-Acceptance of Reversal of Application

It totally depends on the proper officer that he is satisfied with the application furnished or not for the revocation of cancellation. Below are the steps which state both the conditions:

Measures that are needed to be taken care of if the proper officer is satisfied within the application for revocation in form GST REG-21 furnished by the assessee-

- The proper officer cancels the application that he has canceled.

- In form GST REG-22 the proper officer will give the order to revoke the cancellation of GST enrollment. These orders are required to get cancelled in 30 days from the receipt date of reversal application in form GST REG-21.

- Communication will be done within the assessee for the order in form GST REG-22.

The measure is to be brought if the proper officer is not satisfied with the revocation application furnished by the assessee in form GST REG-21

- A notice will be given by the proper officer in form GST REG-23. Post receiving the above notice the assessee is then required to answer within 7 working days for form GST REG-24.

- If from the reply of the assessee the proper officer is satisfied in Form GST REG-24, then the proper officer will give the order to revoke the cancellation of GST enrolment in form GST REG-22.

- But if the proper officer is not seeing the relevance in the answer furnished by the assessee then the proper officer will not accept the revocation application and pass the form GST REG-05

I want to learn GST knowledge & IT. knowledge without any cost if You possible , I am interested

Please go through this link https://www.gst.gov.in/help/helpmodules/ to enhance your knowledge