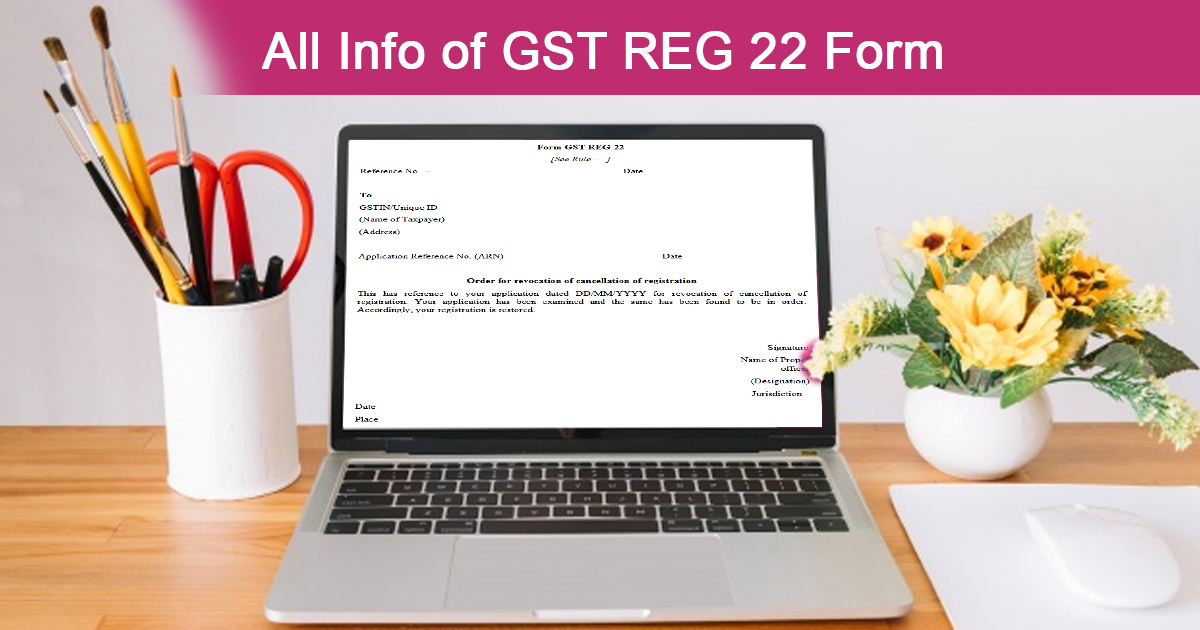

The proper officer gives the order for refusal of cancellation of the GST enrolment in form GST REG-22. The approval will be given only when the proper officer is satisfied with the revocation application furnished by the assessees in form GST REG 22. Hence the refused GST registration of the assessees will get saved if the order is given in form GST REG-22.

This article will mention the reason for the cancellation of GST enrollment, filing the application for the refusal of the cancellation of GST registration, and providing the order of renovation for cancelling the GST enrolment in form GST REG-22.

Reasons for the Abolition of GST Registration

The proper officer or the assessee might cancel the GST enrollment. Below is the stated reason that they might cancel the GST registration

| Grounds for the Abolition of GST Registration by the Assessee. | Grounds for cancellation of GST registration through the proper officer. |

|---|---|

|

|

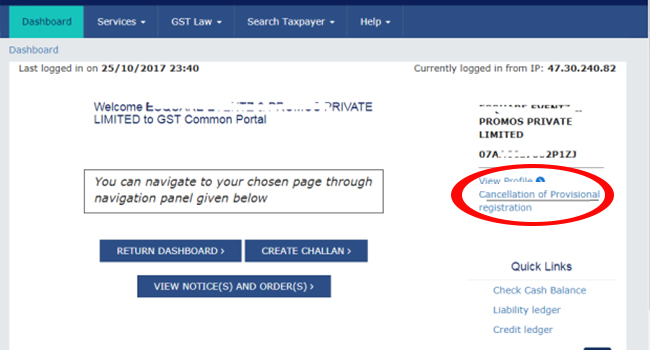

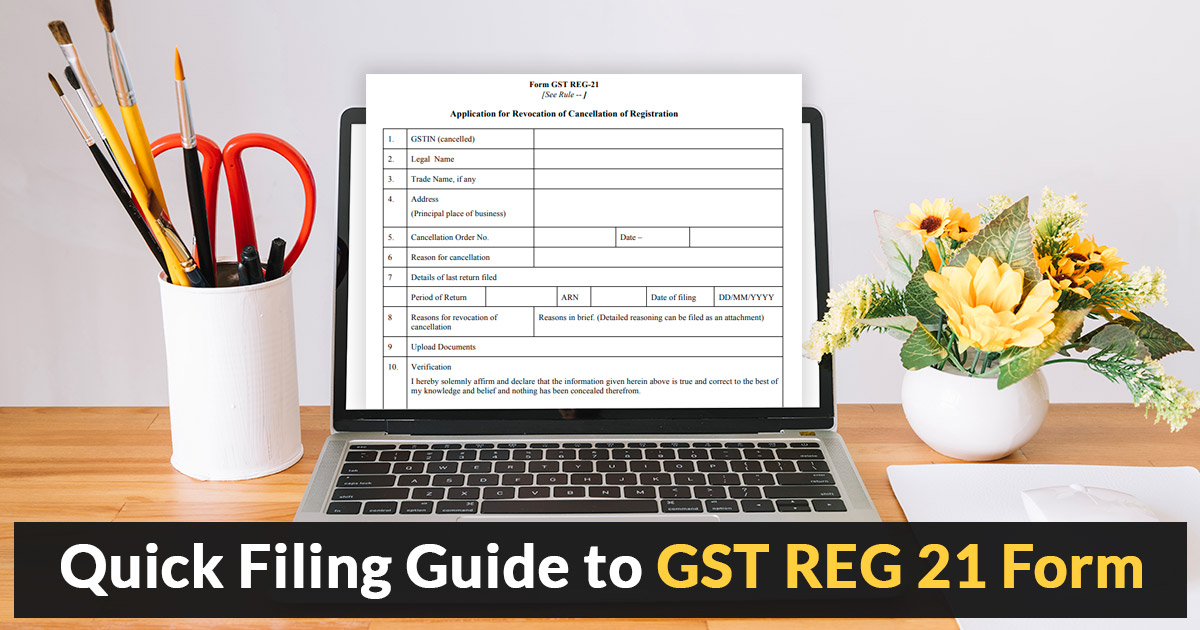

Furnishing the Application for Refusal or Cancellation of GST Enrollment

The proper officer can not accept the GST enrollment of the assessee relied upon the above-mentioned reason. The average assessee can file the revocation application.

As per section 23(1) of the Central Goods and Services Tax Rules, 2017, the assessee is needed to furnish the application for the refusal of cancellation of GST enrollment for form GST REG 21

Order in Form GST REG-22 Abolition of the Cancellation of GST Enrollment

The proper officer will verify the application of the revocation in Form GST REG-21 that is filed before. The major steps will then be taken by the proper officer as stated below:

| Steps if the proper officer is satisfied with the revocation application | Steps if the proper officer is not satisfied with the revocation application |

|---|---|

| If the proper officer is satisfied with the application of revocation he will record the cause in writing. In 30 days the proper officer just needs to provide the order from the date of racing the revocation receipt. This order of revocation to the refusal of GST registration is to be given in Form GST REG-22. | But if the proper officer does not satisfied with the application then he will give the Form GST REG-23 in which he asks why he will not reject the application. On the basis of the reply furnished by the applicant and is satisfied then the proper officer gives the order for revocation of cancellation of GST enrollment for Form GST REG-22. |

The GST enrollment of the applicant has been saved on issuing the order in Form GST REG-22 and as per that the rules and regulations of the GST law shall also get applied to the applicant on their own.