The GST portal over the last six months has witnessed several changes and updates. All the new updates are rolled out on a regular basis to help and assist the taxpayers in smoothly and effectively filing their GST returns. The timely updation leads to the maintenance of compliance. The taxpayers are required to stay up-to-date to keep apace with the compliance which abolishes notice being issued to the taxpayers.

Get Free Demo of Gen GST Software

GSTN New Features to Search Taxpayers Using Mobile Numbers

A new feature has been enacted by the Goods and Services Tax Network (GSTN) that permits users to investigate for the assessee via their mobile numbers. The improvement has the motive to facilitate the procedure of determining taxpayer data and make it more efficient and user-friendly.

Guide to Use the New GSTN Feature

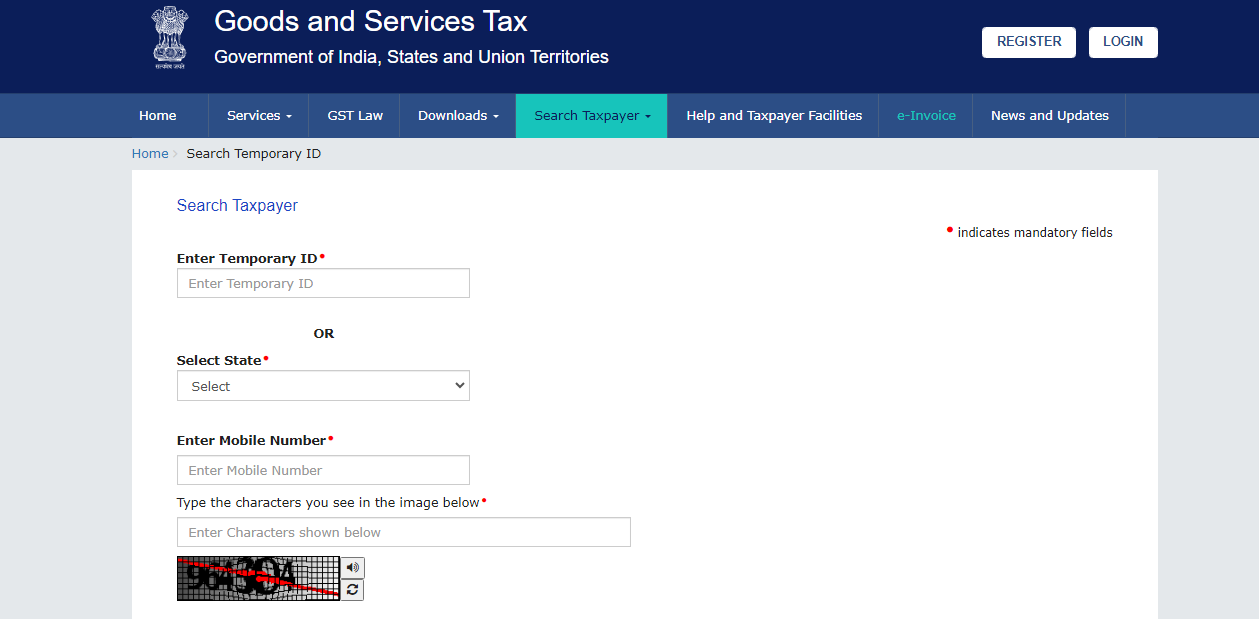

- Go to the website gst.gov.in

- On the homepage, locate and click on the “Search Taxpayer” option.

- In the “Search Taxpayer” section, choose the “Search Temporary ID” option.

- From the dropdown menu, select the state associated with the taxpayer you are searching for.

- Input the mobile number linked to the taxpayer.

- Type the characters displayed in the CAPTCHA image to verify you are not a robot.

GSTN-backed updated feature eases the procedure to determine the information of the taxpayer. Enabling the searches from the mobile numbers assures to have faster and more precise access to the required information. The same advancement shows the devotion of the GSTN to improve the user experience and efficiency.

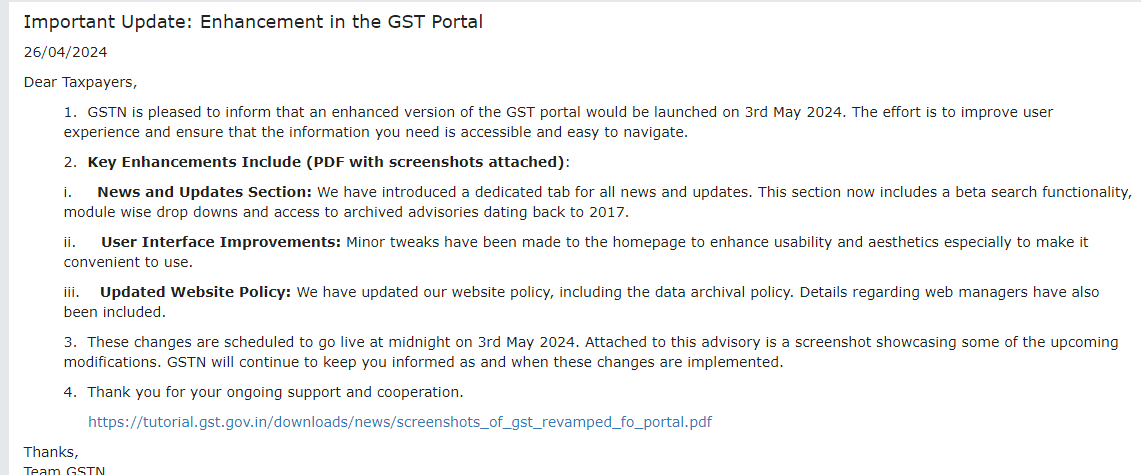

GSTN New Version to Enhance UX and Navigation

CBIC has issued an improved version of the portal that will be launched on May 3, 2024, to enhance user experience and provide easy navigation.

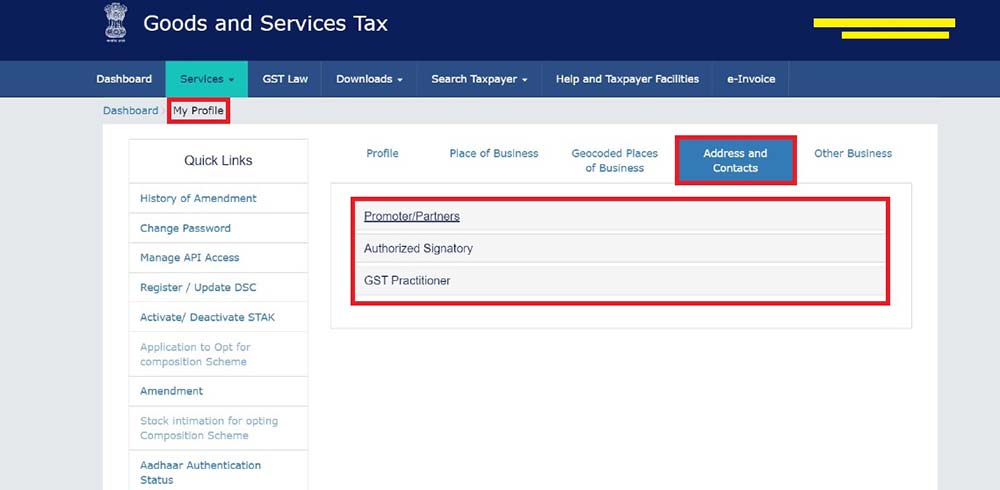

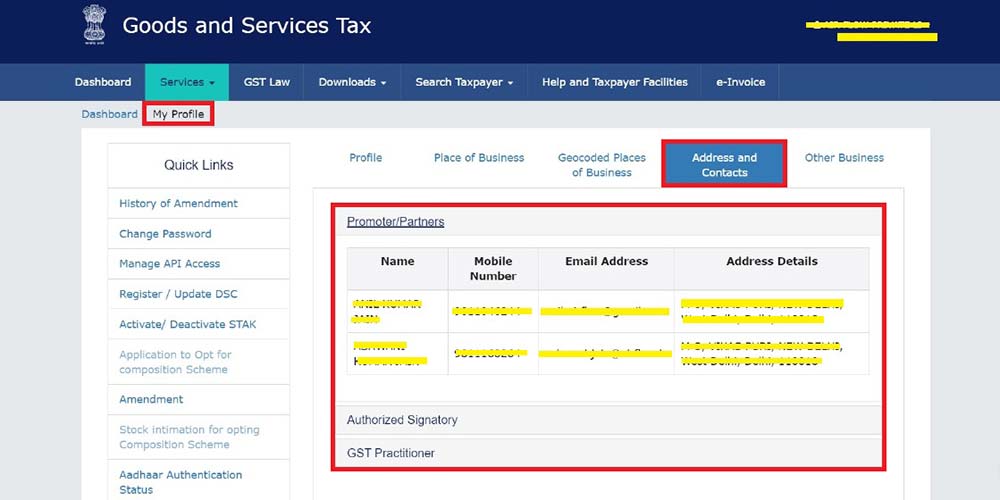

Address and Contacts Feature Under ‘My Profile’

As part of the GST Portal update, the GSTN has introduced a new feature known as “Address and Contacts” under the “My Profile” section. All promoters and authorized signatories’ names are listed in this new tab to provide users with comprehensive information. This centralized screen enables users to easily access mobile numbers, email addresses, and even physical addresses.

GSTN New E-Invoice Verifier App for Easy Verification

E-Invoice Verifier app, a cutting-edge solution designed to streamline and simplify the process of verifying e-invoices. This user-friendly app, developed by the Goods and Services Tax Network (GSTN), offers efficient and accurate verification of e-invoices and related details. With its key features like QR code verification, a user-friendly interface, comprehensive coverage across all Integrated Reporting and Payment System (IRP) portals, and a non-login-based system, the E-Invoice Verifier app ensures a seamless experience for users.

GSTN Reference Number (RFN) Verification Feature for Offline Notices

Soon, taxpayers will be able to verify system-produced documents including notifications and orders on the GST website using an automatically created Reference Number (RFN). Additionally, a new feature has been added that enables State GST tax officers to create an RFN for correspondence sent to taxpayers in the offline format, which the taxpayer can then validate.

This function will work both before and following logging in. The RFN of an offline communication sent by the State GST authority can be checked by taxpayers by going to Services > User Services > check RFN and entering the RFN. The CBIC Document Identification Number (DIN) feature may be used on documents issued by Central GST authorities.

Amnesty Scheme on Late Fees for GST Return Forms

As per the announcement of the government to provide effect to the amnesty scheme the late fee liable to be paid for the late filing of distinct returns would have capped as shown in the table-

| Module/form | Capping on the late fee payable per tax period (Rs.) | Filing of an amnesty petition between April 1st and June 30th, 2023 | Applicable Tax Period |

| Quarterly Form CMP 08 (GSTR- 4) | INR 500 | – | FY 2017-18 and 2018-19 |

| Annual GST Return Form 4 | INR 500 | – | FY 2019-20 to 2021-22 |

| Form GSTR- 10 (Final | INR 1000 | – | FY 2017-18 to 2021-22 |

| GSTR-9 Annual Return Form | INR 20,000 | – | FY 2017-18 to 2021-22 |

STAK Now Authenticates Form GST CMP-08

The current authentication modes for filing on the portal are DSC and EVC, a new mode of authentication for filing Form GST CMP-08 through the use of the Single Use Time-Based Authentication Key (STAK) would get executed on the portal. The assessees would be obligated to install the “GST Secure OTP” app on their Android devices. It gives the exposure to the assessees other than the companies and LLP to generate the token on their mobile and use that during filing the Form GST CMP – 08 on the GST web portal.

The non-filers are entitled to an amnesty U/S 62, which is called a withdrawal of the ASMT 13 order upon filing the GST return within a scheme.

If a return in Form GSTR-3B would get filed post-lapse of 30 days from the date of order creating demand u/s 62, this demand would not automatically be nullified.

Relief would have been furnished by the government to these assessees i.e those who would not have furnished their returns in form GSTR 3B within 30 days from the creation date of demand given that they file form GSTR 3B and ruin their pending tax liabilities by 30th June 2023 despite the period of 30 days has passed. The demand made against non-filers would be nullified and there is no requirement for preferring appeal in these cases.

Extension of Time to Apply for Revocation of Suo Moto Cancellation of GSTIN

As the government has announced the claim of the amnesty scheme, between 1st April 2023 and 30th June 2023, has been allowed for assessees on the portal. Between 1st July 2017 and 31st December 2022, the assessees cancelled Suo Moto are enabled to furnish the application for the cancellation revocation of the registration be the fact whether they would have furnished the revocation application or not.

New Feature for Incorporates Bank Account Validation

The GSTN is pleased to inform you that the GST System now incorporates a bank account validation feature. This new feature was included to ensure the accuracy of the bank account information for taxpayers. By going to the Bank Account Status page in the FO portal’s Dashboard My Profile section, you may determine whether your bank account has been validated. As soon as the process of validating your stated bank account is finished, you will get information about the status of your bank account on your registered email and phone number. View more

New Option to Utilize Cash Ledger Amount

The Goods and Services Tax Network (GSTN) has made it possible for another GSTIN to utilise money from one GSTIN’s cash ledger (a business with the same PAN) through a transfer using the GST PMT-09 form, which is now available on the GST website. Regulation 87(14) of the Central Goods and Services Tax Rules, 2017 (the “CGST Rules”) is a pertinent provision.

Any tax, interest, penalty, or other amounts that are available in the electronic cash ledger under the Act may be transferred by a registered person on the common portal to the electronic cash ledger for central tax or integrated tax of a distinguishable individual as stipulated in subsections (4) or, as applicable, subsection (5) of section 25.

But, if the registered person has any outstanding liabilities in his electronic liability record, no such transfer shall be allowed.

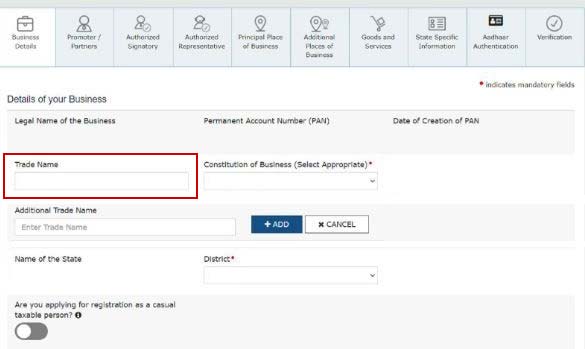

Additional Trade Name New Feature Under Same GSTIN

The GSTN has enabled the upgraded functionality in the official portal to add the additional trade name beneath the identical Goods and services tax identification number (GSTIN). Through this, the same becomes simpler to execute multiple businesses beneath the same legal name with a distinct trade name.

Every GST return form poses a distinct column of both trade name and legal name that is required to be filed. A single trade name is permitted for one enrollment till now, the assessee would not use two distinct trade names for the single enrollment. An assessee would choose more than one enrollment in one state with the same PAN when he expects to hold two distinct businesses with the two distinct trade names in an identical state.

User Interface for Auto-Filling in GST REG-01 Form

The Registration application user interface (UI) has been made efficient with the latest feature by the GSTN. The user interface concerning the address fields in the Registration Application GST REG-01 has been modified for a better process. Multiple features and changes like map tile incorporation with the address pinhead and the automatic filing of the address input field are also incorporated. The auto-filling of address fields has been one on the macro level address with the PIN codes.

Also, the users can also auto-fill the address with the suggestion-based data and the address field has been made into segregation for a better Latitude/ Longitude of the address type of auto-population.

Withdrawal Application for GST Registration Cancellation

The GSTN has enabled the withdrawal application feature for the GST registration cancellation as it has been offered to those who might have made GST registration by mistake and now need to withdraw the application. The taxpayer needs to visit the common portal and then after he should go to the services Services → User Services → View My Submissions. Click on the “Withdraw” button just aside the application for cancellation of registration and then he must confirm.

GSTIN New Feature for Search Tax Payer Details

In the recent update to the GST portal, the government has introduced the best feature to date to ease the difficulties of the taxpayers as well as the professionals i.e. the search of taxpayers by the details or name or the ID no. The recent GST portal now features the search tab on the GST portal with the ability to bring the required search of the taxpayer and its details with help of the GSTN.

GSTN New Feature for Stopping to File GSTR 1

The notification no. 35/2021 in the central tax mentioned the clause (a) of the sub-rule (6) of Rule 59 of CGST Rules, 2017 amendments, in which the preceding two months’ words are being substituted by 1st January 2022. The utility will be barring taxpayers from filing GSTR 1 if the filing is not done for GSTR 3B for the recent month. The utility will be soon live on the GSTN portal making it mandatory for the taxpayers to file the GSTR 1 and 3B.

New Feature to Check Last 5 GST Returns

Upon the GST portal the Goods and Service Tax Networks (GSTN) has given a latest feature in which the assessee can now see their returns for the last five return periods. This return calendar will assist evey enrolled business and professionals to check the past five return periods which assist in avoiding any interest or late fees.

GST Portal: New Features Added in GST Search Taxpayer Tab

The Goods and Service Tax Network (GSTN) has incorporated additional features at the GST Portal. The changes have been made in the “GST Search Taxpayer tab”. The two pieces of information added in the GST Search Taxpayer tab at GST Portal are Profile and Place of Business (PoB). The PoB shows the Mobile Number and Email of the Principal Signatory.

The aforesaid tab comprises features of the constitution of business, administrative office, gross total income, annual aggregate turnover, the status of e-KYC verification, and the status of Aadhaar Authentication.

Selection of Core Business Activity Feature Live on GST Portal

The Goods and Service Tax Network (GSTN) has approved the unique characteristic to select Core Business Activity enabled on GST Portal. Today if you open the GST portal you will watch the new pop-up in which you will have to examine the main business as either a trader or service provider etc.

Only post choosing any one of the choices stated above, you will be entitled to login into the GST account or furnish the GST return, and so on. It is to be noted that you can opt for only one major business activity. For the event where all the activities are applied to you, please choose the main business activity. Others will engage the work Contract and Other Miscellaneous Items.

- So to acknowledge the destination of the Manufacturer / Trader / Service Provider, you can click on the “Information Button”

- Moreover, if you need to amend it in the future then you can do it by navigating MY PROFILE>CORE BUSINESS ACTIVITY STATUS

Enabled Feature for Filing LUT on GST Portal

(LUT) Letter of undertaking for the financial year 2021-2022 can now be furnished in the GSTN portal as the new functionality has been activated for all the taxpayers and this has done for the facilitation of taxpayers.

GSTN New Module Wise Functionalities for Oct-Dec 2020

The latest functionalities which are introduced in the GST portal are like coming in stream for all the parities concerned with the GST scheme. The additional features which are introduced in the Registration, Returns, Advance Ruling, Payment, Refund, other Miscellaneous topics of same kind. Also the scheme has been elaborated on multiple webinars and to make aware of such functionalities to everyone.

| S.No | During the period | Click Link Below |

|---|---|---|

| 1 | October-December, 2020 | Check PDF |

New Communication Facility for Taxpayers on the GST Portal

The GST Portal now features a new facility of ‘Communication Between Taxpayers’. This facility has been provided to send notifications, concerning missing documents or any deficiencies in documents or any other issue, by recipient taxpayers to their supplier and vice-versa.

The facility is open for all registered persons, excluding people registered as TDS, TCS, or NRTP. After log in to the portal a registered person can use this facility to send a notification, view notification, send a reply, and view replies.

Main features of Communication Between Taxpayers:

- Registered taxpayers can send notifications (Check procedure below).

- Registered taxpayers can view notifications by navigating to Services > User Services > Communication Between Taxpayers > and select the Compose option.

- Registered taxpayers can view notification sent or reply sent by checking Outbox (Notification & Reply Sent) option.

The process to Send a Notification:

- After Log in to the portal Navigating to – Services,> User Services

- Then select Communication Between Taxpayers > and select the Compose option

- Choose the Supplier option to send a notification to a Supplier, otherwise, go with Recipient

- From the Document, Details section choose the Action Required by Supplier/ Recipient from the drop-down list and fillup all the required details

- The facility provides the facility to attach Up to fifty documents in a notification

- The Sender also has the option to add Remarks of up to 200 characters in the remark box

This facility packs some other features such as

- The receiving party will get notifications about all the notifications received on their registered email and mobile number.

- The receiving party will also get a notification on GST Portal logging into the GST portal.

- Up to 100 notifications can be sent to a single GSTIN for a particular tax period.

- The recipient can send details of missing documents (not uploaded by their supplier in their Form GSTR-1) using this facility and send a notification to their supplier.

- Suppliers can add such documents directly to their Form GSTR-1, if not previously reported

- The document upload and download facilities will be available soon. Read more

GSTN Adds Two New Features Under GSTR-3B

The Goods & Service Tax Network (GSTN) has lately added two new features to the portal with the aim to make it more user-friendly. Now, the taxpayers can get GSTR-3B monthly statements auto-populated on the portal.

Another facility that has been added to the website is “Communication between Taxpayers”. To access this feature, log-in to your GSTN account and find the option under services > user services. This feature aims to enable seamless, peer-to-peer communication between the users, increasing user experience, security, and scalability.

GST Refund Application Status Track on GST & PFMS Portal

The government of India has offered a utility for the tracking of Refund Application Status from the GST portal. The given utility is said to provide the comprehensive details on the ‘Refund Application Status’ of the GST portal. However, the PFMS will validate the account detail first in the two stages through the RFD-01, and in RFD-05. Still, there is no extensive details are provided by the government on the GST portal.

Comparison Between Liability Declared and Input Tax Credit Claimed

As a result of the new functionality released by the GST portal, the tax filers get assisted and find it’s easy in comparing their GSTR-3B tax liabilities with the GSTR-1 which have been filed. Just like this, the users of this portal could also compare their input tax credit claimed in GSTR-3B with the credits available in GSTR-2A. Along with this Comparison could also be made by them in their ITC claimed in the form GSTR-3B with the credits available in GSTR-2A

We would now be discussing the four different tabs under which the comparison of data could be carried out:-

- Liability other than export/reverse charge

- Liability due to reverse charge

- Liability due to export and SEZ supplies

- ITC credit claimed and due

The above-mentioned functionality would be proved to be very effective and would largely help in the reconciling of the GST returns filed and also in the preparation of the Annual returns. Data is readily available for both Financial years, viz, 2017-18 and 2018-19.

E-way Bill Data Required to be Imported to File GSTR-1

In order to provide the taxpayers with the facility of seamless importing of data, the GST Portal got integrated to the E-way bill (EWB) portal. Now, the users are facilitated to get the B2B and B2C (large) invoices sections imported. They could also import the HSN-wise-summary of outward supplies section and both automatically. With the help of this update, the taxpayers could verify the data first and then could proceed and thus are exempted from unnecessary data-entry.

A Taxpayer’s GSTIN can be Entered while Filing a Refund Application

In effect of the inverted duty structure under GST, a registered taxpayer could file a refund application for accumulated ITC. This portal has made the entry of a taxpayer’s own GSTIN possible in the inward supply detail statement by filing it on the same GST portal. This is a new facility which was not available earlier.

Preferred Banks List Introduced for Payments

During the payment process, a list of 6 banks would emerge on the portal among which, one bank needs to be selected by just one click and after that, we can proceed with the payment. The user is exempted from filling the complete Bank details time and again for making payment.

Suppose you do not find your Bank’s name on the portal, what you just need to do is that you can add the Bank name in the list and the Banks’ name which is least preferable would itself get omitted thus, axiomatically maintaining the list of six.

The Credit of TDS/TCS Credit Can be Utilised

A new window has been introduced in the Portal which offers with an option to accept or reject the TDS/TCS credits available. So here the taxpayers could select the option and get the GST returns filed. Following this, the credits get relocated to the cash ledger and could be used for the GST payments. The window assists the taxpayers to recognize such credits and acts as per.

Quarterly-filers can File Refund Applications Monthly

The tax filers till now were supposed to file their returns on a quarterly basis but now due to an update, it would not be required to wait for the quarterly filing of refund applications. As per the update, the portal has enabled the monthly filing option of the same. However, the clause now is that to file the refund application the taxpayer is required to make sure that the GSTR-1 for the quarter has been filed. Well, the facility is also there for the Businesses especially SMEs, that they could mobilize their cash flows if they are not willing to wait till the quarter end.

Responding to Show-cause Notices for Compulsory Withdrawal

The Portal has now been updated to make it easy for the Composition taxpayers to respond/reply to show-cause notices that have been issued for compulsory withdrawal from the composition scheme. In the case where a show-cause notice has been issued and the proceedings have been initiated the option there is just to reply to the same on the Portal. This is a time saviour and simplifies responses for composition taxpayers.

Now File Online Appeals & Receive System-generated Acknowledgements

GST portal now offers an option where a taxpayer could file an appeal against an order passed by an appellate authority, or against an advanced ruling by an appellate authority. The taxpayer has the same choice in the case of rectification of a mistake in the order passed.

If an appellate authority fails to issue a final acknowledgement within the specified time, then a system generated final acknowledgement will be issued with the remark “subject to validation of certified copies”. This has made the process of filing appeals & tracking its status very easy & simple.

Get Compulsory Withdrawal Through SCN Online Via Reply by Composition Taxpayers

Following the updation, the composition taxpayer under GST now has the opportunity to Show Cause Notices (SCN) on the portal when the SCN is being issued for compulsory withdrawal from the composition scheme, also if the proceedings are originated against the composition taxpayer.

No Need of Bank Account Details at the Time of Registration

It is now not required to furnish the complete bank account details at the time of registration for Normal, OIDAR and NRTP taxpayers. The GST registration number should be obtained first and then the Bank details should be furnished at the time of the first login. This scheme would be most profitable for new businesses who are in the process of obtaining bank accounts. They have the benefit of saving time by simultaneously initiating GST registration.

ITC Claim and B2B Invoices Amendment of FY 2017-18 Re-opened Till March 2019

This is Good news for the Taxpayers who missed out to claim credits or has made errors while reporting for any invoice in the past. We have witnessed that the facility which was offered to get the GSTR-1 details amended for FY 17-18 got closed on filing the September 2018 return. The users are now benefited and could now amend B2B invoices of FY 2017-18 while filing returns for the months of January to March 2019.

Again, the omitted and unclaimed Input tax credit for FY 2017-18 up till September 2018 could now be claimed up to March 2019.

The new refinements have made the online GSTN portal convenient for taxpayers. Some new further updates are expected to take place by July 2020.