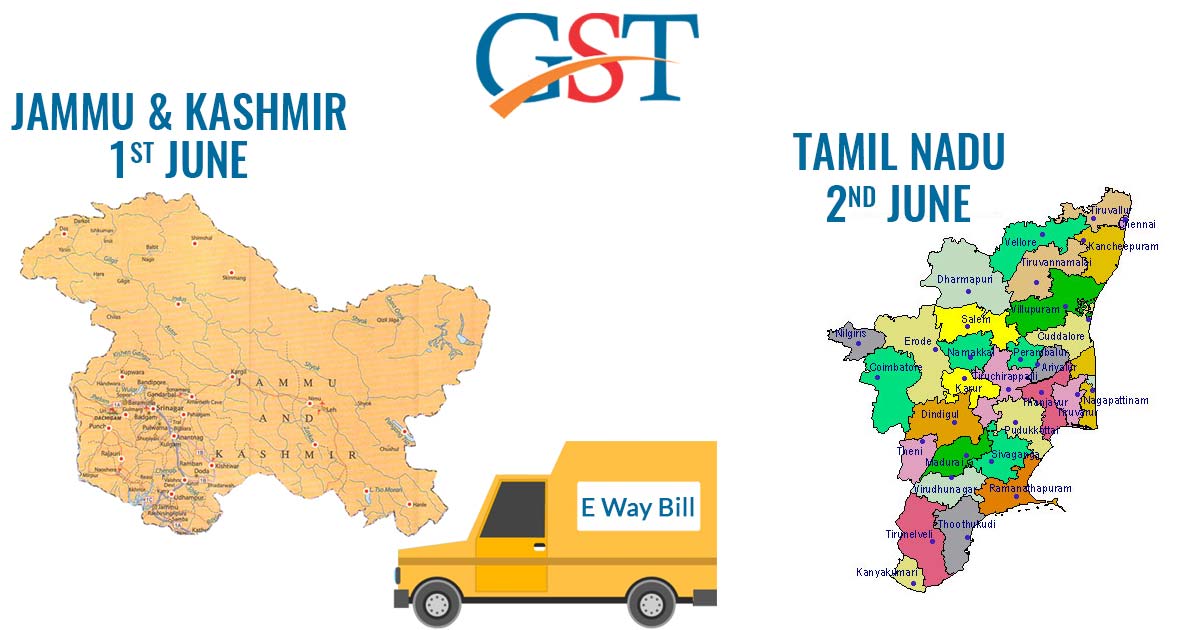

GST E Way Bill is all set to roll out in almost all the states, and now its the turn of Jammu Kashmir & Tamil Nadu. Both the states will have GST intrastate e waybill from 1st & 2nd June 2018 respectively.

The notification was announced regarding the implementation of the intrastate E Way Bill in the Jammu Kashmir on 1st June 2018 while in the Tamil Nadu, the intrastate E Way Bill is scheduled to be implemented on 2nd June 2018

GST E Way Bill is a mandatory bill which is to be electronically generated through the E Way Bill portal and must be carried along with the good valuing more than INR 50,000.

Apart from Jammu & Kashmir, Mizoram will also implement the intrastate E Way Bill from 1st June 2018. Earlier, the GST E Way Bill was implemented from 1st April and was decided that the system will be rolled out in a phased manner.

The decision for rolling out GST E Way Bill in a phased manner was to avoid any technical glitches due to overloading of the servers. According to the reports, there were lakhs of E Way Bills generated on the GST e way bill portal in the trial phase.

Due to the overloading and crashing of servers, the GSTN portal had to revamp the servers and infrastructure and also decided to roll out the E Way Bill system in a decisive and phased sequences.

Read Also: E Way Bill Portal: Comparison Govt Portal vs Gen GST Software