Finally, the GST council has mandated the implementation of E-Way Bill from 1st April 2018 for Interstate logistics of goods in all the states.

The intrastate eway bill is now re-scheduled to be implemented from 3rd June 2018 across the country from the earlier date of 1st June 2018 due to some reasons unspecified but the GST council with central government has notified that the said date i.e. 3rd June is the deadline for all the states to implement intrastate GST eway bill anyhow.

What is GST E Way Bill?

GST E Way Bill is an electronic bill which will be required for the movement of goods in case the value of the goods is over 50,000 rupees. The bill can be generated from the GSTN portal and every registered taxpayer must require this e-way bill along with the goods transferred. And learn its implementation features, basics and method of generating GST E Way Bill through government’s official e-way bill portal https://ewaybillgst.gov.in/.

Latest Update

- From July 1st, GSTN will roll out interoperable services for the GST E-Way Bill (2.0) portal. View more

- This is an important update about the ENR 03 Form reporting by the unregistered persons and dealers registered on the GST E-Way Bill Portal. read more

- The Goods and Services Tax Network (GSTN) has issued an advisory that explains the requirement of the GST E-way bill under Chapter 71. Read More

- For the state of Kerala, the GSTN has issued a new advisory related to the introduction of the e-way bill system for goods classified under Chapter 71. View more

- “Advisory to Taxpayers on Extension of E-Way Bills Expired on 31st December, 2024” Read More

- For taxpayers having a turnover above 20 crores, Multi-Factor Authentication (MFA) will be mandatory from 1st January 2025. View more

- The advisory was issued to inform that the FOIS with Indian Railways has been integrated with the EWB system. Read PDF

- GSTN has published a new advisory for the entry of RR No./Parcel Way Bill (PWB) numbers following the integration of the E-Way Bill (EWB) with the Parcel Management System (PMS). View More | Click for Sample

- The new advisory related to the GST E-way Portal 2 portal will be released on 1st June 2024. Read more

- The e-way bill app for Android and iOS users has been enhanced to generate bills. Read PDF

- E-Waybill services have been successfully integrated with four new IRP portals, according to a new GSTN advisory. View more

- In March 2024, taxpayers whose accounts have been enabled for e-invoices will no longer receive E-Way Bills without e-invoice/IRN details. Read more

- Attention all taxpayers and transporters! There’s an important advisory about verifying the Transporter ID (TRANSIN) in the e-waybill system. Be sure to check the ID carefully to avoid any issues with the transportation of your goods. This is crucial for the smooth and hassle-free transportation of your goods. Read PDF

- 50th GST Council has recommended the inclusion of rule 138F in the CGST Rules, 2017 as well as in the SGST Rules, 2017 of the States which want to require the generation of e-way bills for intra-state movement of gold and precious stones under Chapter 71. Read PR

- Every taxpayer with AATO over 100 crore will be required to provide two-factor authentication starting 15/07/2023. read more

- The Calcutta high court has printed the order in the case of the Assistant Commissioner Vs Ashok Kumar Sureka. The order said that If the first GST e-way bill is correct, the vehicle cannot be held up due to the expiration of the second GST e-way bill. Read Order

- The Calcutta high court has issued the judgement for the petition Ashok Kumar Sureka related to the tax and penalty under section 129 CGST Act. The judgement said that no penalty for GST e-way bill expiry if no intent to evade tax. Read Order

- “New E-way Bill functionality Oct-Dec 2020 has displayed for online filing and blocking of (EWB) generation facility.” Read Pdf

- “Blocking of E-Way Bill (EWB) generation facility for taxpayers with AATO over Rs 5 Cr., after 15th October 2020”. Read more

New Features in E-Way Bill System for Transporters & Taxpayers

For the registered transporters, common enrolled assessees, the e-way bill system would be provisioned.

De-registration Process for Transporters

Transporters who enrolled in the e-Waybill Portal utilizing Enrolment (based on PAN) and no more wish to remain in the e-Waybill System can now de-enroll in the GST e-Waybill System. They will no longer be able to access the e-Waybill interface after they have been de-enrolled. As a result, any registered transporter who wishes to de-register from the EWB system may utilize the same utility.

The Id of the transporter could not be used in the e-way bills when it gets de-registered. Indeed for the de-registered transporter Id, the Part-B information could not get updated.

Cancellation of Common Enrollment

Some assessees would have performed the common enrollment but not wishes to carry forward with the common enroll Id irrespective of the reason. For the EWBs, the part-B information could get updated which is assigned with the common enrolment Id prior to the cancellation.

There is a one-month time limitation that is been furnished post-cancellation of the common enrollment. Nextly the login shall get restricted and there will be no more activity that can take place in the system of e-way bill.

The user could able to log in again with the use of the credentials of his/her GSTIN and generate the e-way bills once the common enrollment Id would get canceled.

Authentication with Two Factors

For having login access to the e-way bill 2-factor Authentication (2FA) is enabled and is made optional. But 2FA will be kept obligatory, after two weeks. It is advisable to create sub-users right away for users running the e-waybill system from several locations and using a single login.

List of all States Where Intrastate E Way Bill is Applicable:

| Andhra Pradesh | Arunachal Pradesh | Assam |

| Bihar | Chhattisgarh | Gujarat |

| Goa | Haryana | Himachal Pradesh |

| Jharkhand | Jammu & Kashmir | Karnataka |

| Kerala | Manipur | Mizoram |

| Madhya Pradesh | Maharashtra | Meghalaya |

| Nagaland | Odisha | Punjab |

| Puducherry | Rajasthan | Sikkim |

| Telangana | Tripura | Tamil Nadu |

| Uttar Pradesh | Uttarakhand | West Bengal |

List of Union Territories Where Intrastate E Way Bill is Applicable:

- Andaman & Nicobar

- Chandigarh

- Dadar & Nagar Haveli

- Daman & Diu

- Lakshadweep

What Documents Required to Generate E Way Bill Online?

The sections explain step-by-step procedures for generating GST E Way Bill on the EWB portal. There are some mandatory requirements before generating an e-way bill (including all the methods)

- Registration on the EWB portal

- The Invoice/ Bill/ Challan related to the consignment of goods must be in hand.

- If transport is by road – Transporter ID or the Vehicle number.

- If transport is by rail, air, or ship – Transport document number and date on the document.

Basic Points to be Remember About GST E way Bill

- How to Generate GST E way Bill in Your State?

- GST E Way Bill Registration Guide

- How to Update Vehicle Number Online on EWB Portal?

- Supply in E way Bill

- E way Bill Validity Period

- GST E Way Bill Preparation Guide

- Method of Generating E way Bill

- Process of E way Bill Circulation

- E way Bill Acceptance

- E way Bill Cancellation

- Items Exempted From GST E way Bill

There are various rules and regulations issued by the CBEC for the handling of the e-way bill. Those rules and be gst-e-way-bill-rules.

How to Generate GST E Way Bill Easily Online or SMS?

Recently introduced GST E Way Bill has been implemented from 1st February 2018 across the nation. The government has mandated to utilize e-Way Bill for transportation of supplies of value more than 50,000 in all the states. While the GST E Way Bill generation process can be done at e-Way Bill (EWB) portal with single and consolidated options, there are some more features like a change in the number of vehicles which has been already generated on GST E Way Bill portal and cancellation of generated E Way Bills.

Here, we describe how to generate an e-Way bill in the state of Andhra Pradesh, Arunachal Pradesh, Assam, Bihar, Chhattisgarh, Goa, Gujarat, Haryana, Himachal Pradesh, Jammu and Kashmir, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Punjab, Rajasthan, Sikkim, Tamil Nadu, Telangana, Tripura, Uttar Pradesh, Uttarakhand & West Bengal.

Two Simple Methods to Generate via EWB-01:

How to Generate E Way Bill Online: Full Guide

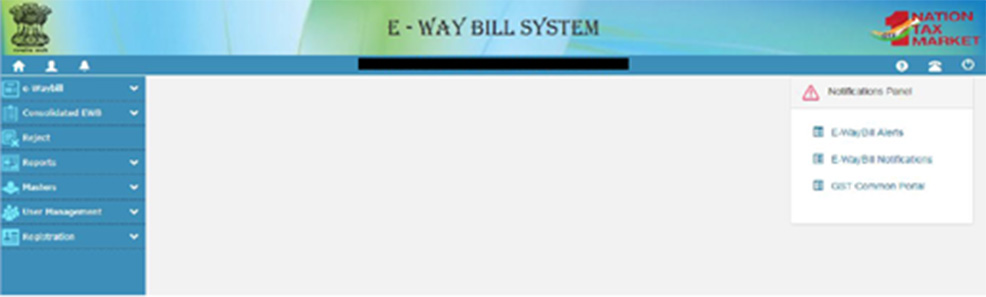

Step 1: Log in at e-way bill system website: www.ewaybillgst.gov.in

- Enter the Username, password and Captcha code, Click on ‘Login’

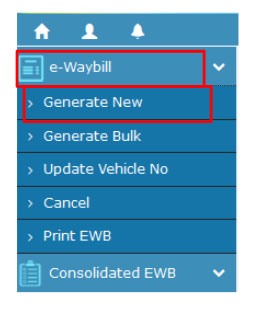

Step 2: Click on ‘Generate new’ under ‘E-waybill’ drop-down option mentioned on the left side of the dashboard.

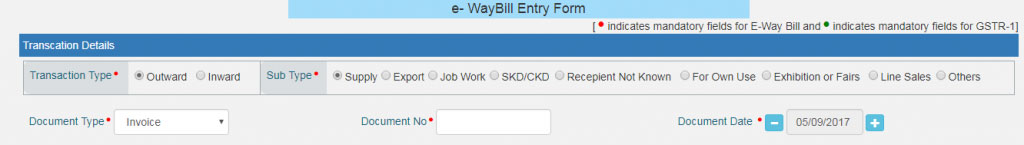

Step 3: Fill the respective entries that appear on the screen:

1) Transaction Type:

- Select ‘Outward’ if you are a supplier of consignment

- Select ‘Inward’ if you are a recipient of consignment.te GST Bills in Excel

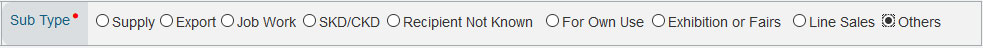

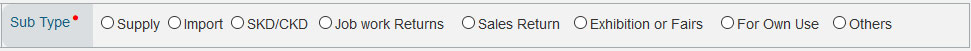

2) Sub-type: Select the relevant sub-type applicable:

If the transaction type selected is Outward, the following subtypes appear:

If the transaction type selected is Inward, the following subtypes appear:

Note: SKD/CKD- Semi knocked down condition/ Complete knocked down condition

3) Document type: In case other options are not listed then select either Invoice / Bill/ challan/ credit note/ Bill of entry

4) Document No.: Enter the document/invoice number

5) Document Date: Select the date of the Invoice or challan or Document.

Note: Please be aware, the system does not allow to enter future date

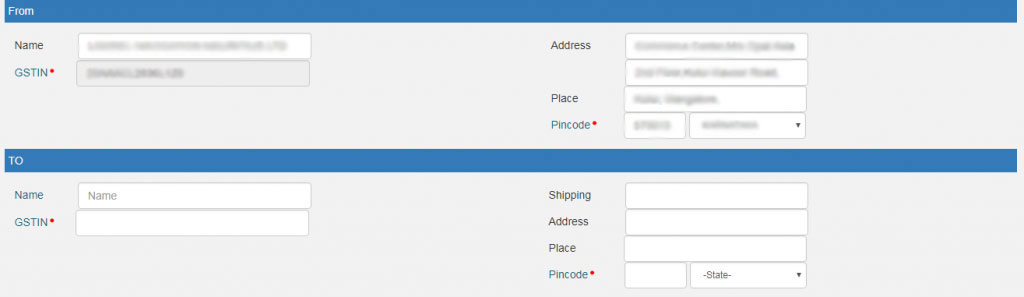

6) From/ To Depending on particular nature, in case you are a supplier or a recipient, enter the To / From section details.

Note – In case if supplier/client is unregistered, then you must mention ‘URP’ in the field GSTIN, indicating that the supplier/client is an ‘Unregistered Person’

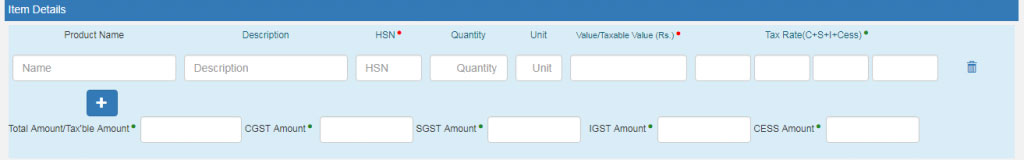

7) Item Details: Add particular details of the consignment (HSN code-wise) in the mentioned section:

- Product name

- Description

- HSN Code

- Quantity,

- Unit,

- Value/Taxable value

- Tax rates of CGST and SGST or IGST (in %)

- Tax rate of Cess, if any charged (in %)

Note: On the implementation of e-way bills, Based on the details entered here, corresponding entries can also be auto-populated in the respective GST Return while filing on the GST portal.

8) Transporter details: The mode of transport(Road/rail/ship/air) and the approximate distance covered (in KM) are required to be mandatorily mentioned in the part.

Apart from the above, Either of the details can be mentioned:

- Transporter name, transporter ID, transporter Doc. No. & Date.

OR

Vehicle number in which consignment is being transported.

- Format: AB12AB1234 or AB12A1234 or AB121234 or ABC1234 or AB123A1234

Note: First of all update the ‘My masters’ section which is available on login dashboard for the products, clients/customers, suppliers, and transporters which are regularly in the GST E Way Bill generation and then proceed.

Step 4: After which click on ‘Submit’. The system validates all the data entered and shows an error if any.

Otherwise, the request is processed and the e-way bill in Form EWB-01 form with a particular unique 12 digit number being generated.

The final e-way bill generated looks like this:

Select conveyance along with GST E Way bill for the transportation of goods in a particular selected mode and then print and carry it with the consignment.

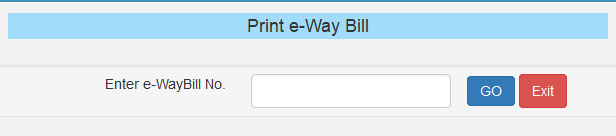

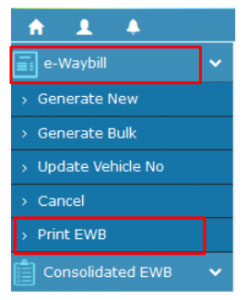

Print GST E Way Bill at any time accordingly:

Step-1: Click on the ‘Print EWB’ sub-option under ‘e-Waybill’ option

Step-2: Then further enter the applicable e-way bill 12 digit number and click on ‘Go’ button

Step 3: Now one can click on ‘detailed print’ or ‘print’ button:

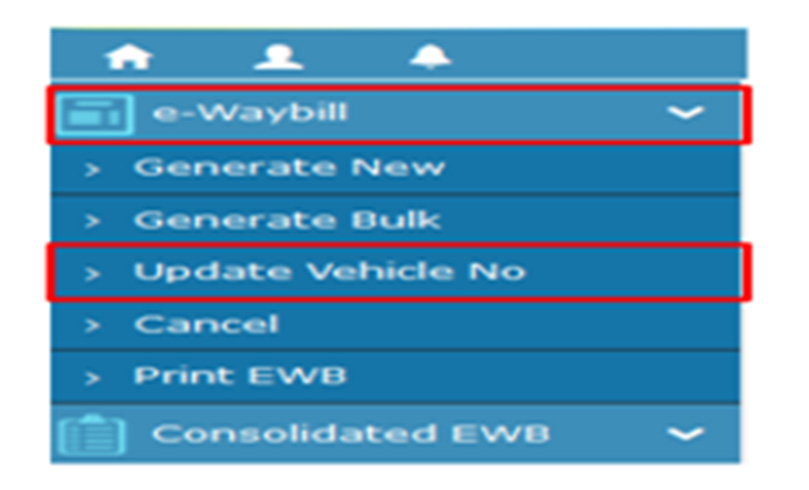

How to Update Vehicle Number Online in E Way Bill on EWB Portal?

As the taxpayers have understood how to generate e-way bills, both separately or in a bulk method, now it is to be acknowledged that the e-way bill is not valid in case it doesn’t have a vehicle number on it for the movement of goods. If in case a supplier or recipients are performing the transportation of consignment via their own personal vehicle or non-transporter vehicle, the taxpayer will have to fill in the vehicle number but in case if the supplier of the goods are availing the services of a transporter, they are obliged to mention the Transporter ID of the transporter. After which the transporter will be required to sign in to the e-way bill portal and further update the vehicle number in GST E-Way Bill from his side.

While there might be some situations in which the vehicle can be changed or replaced. A reason can be anything like a transporter handling multiple vehicles to get through the delivery assigns the different vehicles to the same consignment for the transportation of the vehicle in a different area. A different practical reason might be a vehicle breakdown, where, the transporter would require the need to get hold of another vehicle to further continue the transport of goods. In both cases, it is not likely that one can update the GST E-Way Bill with the right vehicle no., so that anytime if the e-way bill getting checked by any tax official, the vehicle no. must be matching with the vehicle carrying the goods. This is why the change provision has been kept under the GST E Way Bill updation to assist the vehicle number change.

Let us understand how to update the vehicle number in the E-Way Bill in case one has to do the changes on an urgent basis:

- Before starting the updation of vehicle no., a taxpayer must be ready with the e-way bill and the number for which one wants to update the vehicle no. along with the new vehicle no. for entry

- Now log on to ewaybill.nic.in

- Enter the User Name and Password, after which the Captcha Code, and then click “Login”, as depicted:

- After the successful authentication of credentials, there will be the main menu on display of the GST E Way Bill portal as shown below:

- Now at the left-hand side of the main menu of the GST E Way Bill Online Portal, click on the option i.e. “E-way Bill”

- Now click the sub-option “Update Vehicle No.”

- After which one will see the following screen:

- Now one can opt to see its GST E Way Bills by following 3 options,

- “Show E-way Bill”:

- E-Way Bill No.

- Generated Date

- Generator GSTIN

- Upon the options one has selected, it will be asked to enter the e-way bill no. / generated date/generator GSTIN, after which it will get the GST E Way Bill of one’s choice, in which the concerned person want to update the vehicle no.

- Once the taxpayer has selected the e-way bill of its choice, for which he wants to update the vehicle no., will be redirected to the particular form given below:

- Now update the details in the vehicle no. EWB updation form, based on the e-way bill transporter have selected, the following fields will be auto-populated:

- From GSTIN & Place Information

- To GSTIN & Place Information

- The following fields will need to be filled in by you:

- Mode of Transport (Road, Rail, Air OR Ship)

- Enter Vehicle No. (If the mode of transportation is rail, air or ship, you need to enter the transporter document no., instead of the vehicle no.)

- Enter From Place

- Select From State (Select from the drop-down menu)

- Select Reason (Select from the drop-down menu, the appropriate reason, which could be transhipment or vehicle breaking down)

- Remarks

After all the details get filled on the form, the server will validate the given information and once the information gets validated the server further update your request to changes the GST e way bill vehicle number on the particular e way bill.

How to Generate, Delete & Modify E Way Bill Through SMS?

While some taxpayers and users who wish to generate single GST e way bill or the taxpayers who are not able to access the website can use the facility of SMS for generating GST e waybill.

EWB SMS facility helps in cases of emergencies as well even in the bigger transportations as well.

Here topic covers the step-by-step process of :

- How to register for SMS facility?

- How to use the SMS facility for creating/cancelling e-way bills?

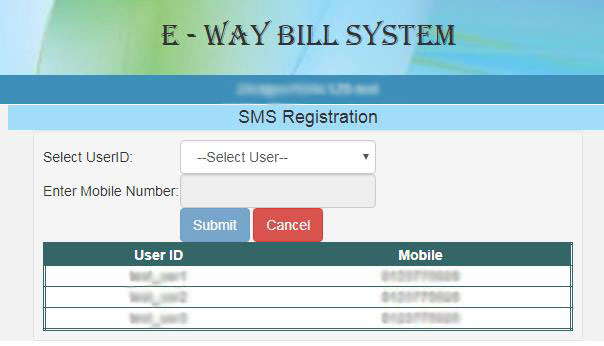

How to register for SMS facility?

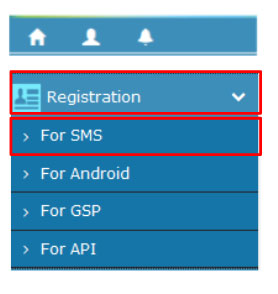

Login (http://ewaybill.nic.in) to E-way bill portal, Click on ‘Registration’ flashing on the left-hand side of the dashboard and select ‘For SMS’ from the drop-down.

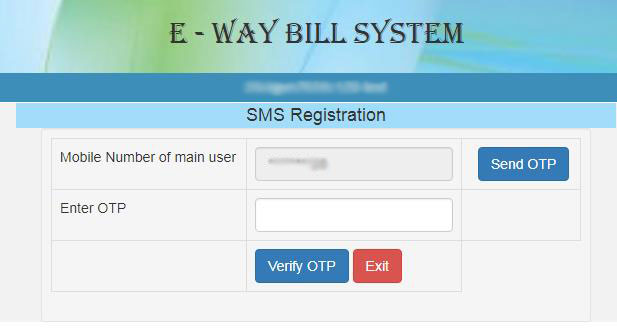

The mobile number registered for the GSTIN gets displayed partially. Click on ‘Send OTP’. Enter the OTP generated and click on ‘Verify OTP’.

Mobile numbers which are registered with the website are eligible for the registration with the facility of SMS.

A total of two mobile numbers are eligible for the registration under one GSTIN.

In case if multiple user IDs presented against a single mobile number, the following screen appears:

One has to select desired user ID/username and click ‘submit’ button in case mobile number is for the usage in more than one User IDs created.

How to use the SMS facility for Creating/Cancelling E-way Bills?

There are certain SMS codes defined for the facility of GST eway bill generation/cancellation.

Suppliers and transporters have to to ensure that the correct information has been inserted to avert any errors.

For understanding, EWBG/EWBT for E-way Bill Generate Request for suppliers and transporters respectively; EWBC for E-Way Bill Cancel Request; EWBV for E-Way Bill vehicle update Request are the prescribed codes.

Overview:

Type the message( code_input info) and send the SMS to the mobile number of the State from which user(taxpayer or transporter) is registered.Eg: 9876xxxxxx in Karnataka

Insert the relevant code for the desired action eg: Generation or cancellation and /or type the input against each code by giving single space and wait until validation to take place. Verify and proceed.

Now check how to use this SMS facility for different actions as follows:

1. For Suppliers- Generate e-way bills

The format of SMS request is as follows:

EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

Now send this particular SMS to the registered mobile number of the State from which taxpayer is operating. Eg: 9731979899 in Karnataka

Illustration:

Mr B of Raichur, Karnataka make an delivery of goods worth Rs. 1,00,000 bearing HSN code-7215, against an invoice he created- No. 1005 dated 27/01/2018 to a unit of Mr C at Bangalore, Karnataka through vehicle number KA 12 AB 2456 covering a distance of 73 km.

The draft SMS to be typed in by Mr B will be :

“EWBG OSUP 29AABPX0892K1ZK 560021 1005 27/01/2018 100000.00 7215 73 KA12AB2456”

This SMS needs to be sent to “9731979899” mobile number

A message will follow as a reply instantly in case if no errors present:

“E-way bill generated successfully. E-Way Bill No:181000000287 and date is 27/01/2018 “

2. For Transporters- Generate e-way bills

The format of SMS request is as follows:

EWBT TranType SuppGSTIN RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

Send this SMS to the registered mobile number of the State from which you are operating. Eg: 97319 79899 in Karnataka

Illustration:

Sans Transports of Bangalore, Karnataka a GTA delivering goods worth Rs. 1,50,000 bearing HSN code-7215, on behalf of Mr B of Bangalore, Karnataka, against the invoice – No. 456 dated 20/01/2018 to a unit of Mr C at Kolar, Karnataka through vehicle number KA 02 AB 7542 covering a distance of 73 km.

The draft SMS to be typed in by the operator at Sans Transports will be:

“EWBT OSUP 29AABPX0892K1ZK 29AAEPM1443K1ZP 560021 456 20/01/2018 150000.00 7215 73 KA02AB7542”

This SMS needs to be sent to “9731979899” mobile number

A message as follows is received as reply instantly if no errors:

“E-way bill generated successfully. E-Way Bill No:171000006745 and date is 20/01/2018

3. Updation of Vehicle Number

The format of SMS request is as follows:

EWBV EWB_NO Vehicle ReasCode

Forward this SMS to the registered mobile number of the State from which you are operating. Eg: 97319 79899 in Karnataka

Illustration:

Sans Transports of Bangalore, Karnataka a GTA delivering goods worth Rs. 1,50,000 bearing HSN code-7215, on behalf of Mr. B of Bangalore, Karnataka, against the invoice – No. 456 dated 20/01/2018 to a unit of Mr. C at Kolar, Karnataka through vehicle number KA 02 AB 7542 covering a distance of 73 km has generated the e-way bill no. 171000006745 dated 20/01/2018

Assume that the vehicle breaks down amidst journey on 20/01/2018 afternoon and Sans Transports arranges alternate vehicle bearing registration number KA 43 AB 2267 for the delivery of the consignment to the destination.

The draft SMS to be typed in by the operator at Sans Transporters will be:

“EWBV 171000006745 KA43AB2267 BRK”

This SMS needs to be sent to “9731979899” mobile number

A message as follows is received as reply instantly if no errors:

“Vehicle details updated successfully and date is 20/01/2018”

Note: The e-Way bill cannot be updated with the vehicle details If in case the validity of the e-Way bill expires eg. one day in case distance covered is less than 100 km.

4. For cancellation e-way bill

The format of SMS request is as follows:

EWBC EWB_NO

Forward this SMS to the registered mobile number of the State from which you are operating. Eg: 97319 79899 in Karnataka

Illustration:

Mr B of Bangalore, Karnataka insist to cancel the e-Way bill generated by him bearing number 160056750192.

The draft SMS to be typed in by Mr. B will be:

“EWBC 160056750192”

This SMS needs to be sent to “9731979899” mobile number( officially registered for Karnataka users)

A message as follows is received as reply instantly if no errors:

“e-way bill is cancelled successfully”

Following errors are forwarded to the user as reply messages automatically.

For example: “This e-Way Bill is not generated by your GSTIN” and so on. Then make the necessary correction in the SMS and resend.

Please Note:

- Only the generator can cancel the GST E Way Bill

- Only 24 hours available to cancel the generated GST E Way Bill

- No cancellation granted for the verified GST E Way Bills

What is a ‘Supply’ in Case of E way bill under GST?

A supply may be –

- Supplied for a consideration (means payment) in the course of business

- Supplies made for a consideration (payment) which may not be in the course of business

- Supplies without consideration ( without payment)

Central Board of Excise and Customs (CBEC) has proposed a GST e way bill in the event of transiting goods above INR 50,000 under the GST regime. This will ask for online registration of the goods consignment and this will give the tax authorities a right to inspect the element anytime if suspected of a tax evasion. The board has issued a draft rule over the Electronic way (e-way) billing which will be requiring registered entities to upload in a prescribed format on the GSTN officials website the details of the concerned goods or commodities which they wish to move in or out of the state.

In this, the GSTN will create e-Way bills which are valid for a period of 1-15 days on the condition of distance travelling in which one day considered as 100 km and 20 days for more than 1000 km in transit. The draft rules stated that “Upon generation of the e-way bill on the common portal, a unique e-way bill number (EBN) shall be made available to the supplier, the recipient and the transporter on the common portal.”

GST E Way Bill Validity Period According to the Distance

| Sr. no. | Distance | Validity Period |

|---|---|---|

| 1 | Less than 200 km | 1 Day |

| 2 | 200 km or more but less than 300 km | 3 Days |

| 3. | 300 km or more but less than 500 km | 5 Days |

| 4. | 500 km or more but less than 1000 km | 10 Days |

| 5. | 1000 km or more | 20 Days |

A notification is been given by the CBIC for the alterations in e-way bill validity to 1 Day for Every 200 km under Central Goods and Services Tax Rules (Fourteenth Amendment), 2020 CBIC is given the notification No. 94/2020-Central Tax, on December 22, 2020, which makes a change in Rule 138 of the Central Goods and Services Tax Rules, 2017.

Below are the mentioned ways in which, a new amendment will be imposed from January 1, 2021:

- As per the amendment, the e-way bill will be valid which has been applied to one day for every 200 km of travel with respect to 100 km as it was before. This is applied only for the case other than over-dimensional cargo or multimodal shipment where the transportation through the ship is engaged.

- The e-way bill once generated was valid for 1 day for up to 200 km of travel for every 200 km and after that one more day will be permitted. For the event of over-dimensional cargo or multimodal shipment where at least one leg is engaged to the transport of ship then 1-day validity of e-way bill is relevant for 20 km of travel. Exceeding that, one extra day will be compensated for every 20 km or more.

Small businesses, who deliver goods within an area of 50 KM in the same state, have been given a relief by removing the need to provide the transport vehicle details. This limit was 10 KM earlier.

The incharge of conveyance will be mandated to keep the invoice or bill of supply or delivery challan, and a copy of the e-way bill or the e way bill number in physical or Radio Frequency Identification Device (RFID) format with him and must be attached to the conveyance. The tax commissioner or the authorized officer can demand the e-way bill or the number associated to verify the details upon all the inter-state and intra-state movement of goods and commodities.

Some Features of GST E Way Bill

- In order to generate e-Way bill easily, the user is able to make masters of suppliers, products, and customers

- Multiple forms of e-Way bill generation for convenience in use

- Notifications and alert messages will be forwarded to registered e-mail and mobile number of the users

- A unified e-Way bill will be generated to vehicle taking various consignments

- Now it is easy to regulate e-Way bills generated from users account or on behalf

- The user can further make sub-users and roles on concerning e-way bill portal for creating the e-way bill

- Vehicle number can be added by the recipient or supplier of goods generating EWB or who is the transporter

- QR code will be mentioned on an e-way bill in order to make easy accessibility of information

Benefits of E Way Bill Portal

- Users can prepare master data of their customers, suppliers and products in order to facilitate the generation of the eway bill.

- Users can vigilante the e-way bill generated in their account

- There are multiple ways of easy generation of e-way bill

- User can make sub-user and roles on portal for easy generation of e-way bill

- Users will get alerts on their registered mail/mobile number

- Vehicle number will be recorded by either transport company or supplier of goods who is generating the eway bill

- QR code will be present on every eway bill so that it is easy to see the summary

- A detailed eway bill can be generated for those who are carrying multiple consignments

Methods of Generating GST E Way Bill

| Who | Time | Annexure Part | Form |

|---|---|---|---|

| Registered person in GST | Ahead of Goods Movement | Complete Part A | Form GST INS-1 |

| Registered person is consignee or consignor | Ahead of Goods Movement | Complete Part B | Form GST INS-1 |

| Registered person is consignor or consignee and goods are transferred over to the transporter of goods | Ahead of Goods Movement | Complete Part A & B | Form GST INS-1 |

| Transporter of Goods | Ahead of Goods Movement | Complete Form GST INS-1 if consignor does not | – |

| Recipient is registered to the unregistered person | Recipient Undertakes compliance assuming as supplier | – | – |

The verification of physical conveyance can be taken out in the specific information of stealing of taxes as mandated by the rules. The guidelines further mentioned, “Where a vehicle has been intercepted and detained for a period exceeding 30 minutes, the transporter may upload the said information in (prescribed form) on the common (GSTN) portal.”

Nangia & Co-Director (Indirect Taxation) Rajat Mohan also thinks that the e-way bill may give some respite to the transporters as in the given time he can upload the data on the GSTN portal. Rajat Mohan also added that “A country like India where per capital GDP is still comparable to countries like Nigeria and the Philippines, Ease of Doing Business Index 2017 still says we are at a 130th position in the world. With such background, is it economically viable and beneficial to implement GST in the highly automated environment? Does infrastructure at Indian tier-II and tier-III cities ready to implement GST?”

Sources Through which E Way Bill can be Generated?

- Web-based generation through laptop and desktops with the help of browsers

- Android app from smartphone

- Through SMS via registered mobile number

- API ( Application program interface) by connecting consumers IT process with eway bill process

- Eway bill toll through bulk generation

- By third party service providers

Quick Process of How E way Bill Circulates

- Dharma Traders delivers all the goods to Verma Traders through the transporting company Quick transporters

- In this handling of goods, Dharma traders have furnished all the related details of the stock in the Part – A while remaining details of transporters in the Part – B form of GST INS 01

- So according to the details which are furnished by the Dharma traders in Part A of form GST INS 01, the Quick transporters will be generating the e-way bill from GSTN portal, which is to be carried with the logistics vehicle

- Just after the generation of the e-way bill, there will a unique e-way bill number also noted (EBN) sent to all the three parties involved, Dharma traders, Verma traders and the Quick transporters for the security purpose

- Apart from this, all the designated details of the e-way bill will be sent to the Verma traders for the validation for their acceptance and further proceedings

Acceptance of GST E way Bill

The generated e-way bill gets acceptance in the following cases:

- The consignment of available e-way bill is accepted by the recipient who is registered on common portal

- If in case the recipient doesn’t respond to the available E-way bill details within 72 hours, then it is considered that the e-way bill is accepted by the recipient.

- The E-way bill does not need consent in the following case and considered to be accepted:

- If the goods transportation comes under Annexure of Rule 138(14)

- When the mode of transfer is non-motorised conveyance

- If the goods are transported to inland container port or a freight station for customs clearance from the airport, air cargo complex, and the port

- if the movement of Goods is to the concerned areas of the states covered under clause(d) of sub-rule (14) of rule 138 of GST

Cancellation of E Way Bill

In the case, when E-way bill not transported to the mentioned place or not transported according to the details in the generated E-way bill within 24-hours of issuance, the bill is cancelled automatically by the common portal.

The cancellation can be done automatically through a common portal or by the order of commissioner through a Facilitation Center. By logging in the common portal using the ID and password of that particular Facilitation Center, the cancellation can be done. But if the bill is verified in transit as per the rule under 138B, the cancellation is not possible.

Items Exempted from Listing Under GST E Way Bill

The central government has recently announced a list of particulars which are totally exempted from the e-way bill provision under the GST. These items are considered as common use items and are exempted from the necessity of having an electronic permit for the transportation under the GST scheme.

According to the goods and services tax, it is mandatory to have a permit i.e. E-way bill for transportation of consignment with Value more than 50000 in order to check tax evasion practices. But in a recent GST Council meeting on August 5, it was announced a list of 153 products which are totally exempted to be requiring any sort of e-way bill while transportation.

The list which is exempted from the e waybill includes some of the items like:

- LPG

- Kerosene

- Jewellery

- Currency

- Live Bovine Animals

- Fruits and Vegetables

- Fresh milk

- Honey

- Seeds

- Cereals

- Flour

- Betel Leaves

- Raw Silk

- Khadi

- Earthen Pot

- Clay Lamps

- Pooja Samagri

- Hearing Aid

- Human Hair

- Frozen Semen

- Condoms

- Contraceptives

No E Way Bill Needed for Transports Made Using Personal Vehicle

In a meeting held on 11 March, the GST Council has made some important decisions about the implementation of the e-way bill for transports. E-way bill is mainly applicable on transports being made from business to business (B2B. Common men buying goods with the value over Rs 50,000 and carrying the same in his private vehicle need not carry an e-way bill, however, traders carrying any goods worth more than Rs 50,000 using a loading truck or rickshaw will need to have an e-way bill.

E-way bill is not needed for goods transported by railways, however, the recipient of such goods will have to produce the e-way bill at the time of receiving. Also, the goods transported via public transports, such as bus, from one business to another will require carrying e-way bill. It has also been clarified by the GST Council that such transports are only liable for a single check during a trip. That means, if a vehicle has already been checked and passed by a tax officer, it won’t be checked again during that trip.

We require list of items on e waybill 02 applicable

Sir, I have generated JSON format file by the file name invoice.json. In bulk upload option while uploading is getting the error message that

“file name is not valid” what may be the issue, it is about file name or file format or website?

The file name is not valid. Change the file name as the extension. JSON shall not be there in the name.

Sir, How to generate Bulk E waybill in GST Portal?

Option for bulk e-way bill generation has been provided by dept. on the portal. You can use the excel utility provided by dept. on the portal and then can generate JSON file to generate the bulk e-way bill.

Hi, please keep me posted for the progress on implementation of E Way Bills state wise.

Sir, How to change our own address in e way bill of comtaxup

Suppose I am a registered person under GST and having business in Delhi. I deal in the supply of bakery machine to other states. so I have to generate Waybill under GST suppose I supply goods to an unregistered person with the value of more than 50000/-. then who has to take the responsibility of making Waybill & the buyer has to obtain GST No. in this case?

Sir, I am a Transporter, every time I have to ask my customer for waybill because they have a lot of doubts and their knowledge about GST is not clear. Request you to please share details of documents and waybill required at the time of transporting consignment or goods. Because some people provide waybill for their state but to enter their consignment to other states also waybill is required. So can you make a chart state wise were waybill is required and documents required to transport? Is way bill required for both the state at the time of interstate transportation.

Waiting for your positive reply in this regard

Thanks, & Regards

Pritish

The documents required for transportation of goods are:-

1. Invoice or bill of supply or delivery challan as the case may be.

2. Copy of e-way bill as provided by the consignor to the transporter or e-way bill number in physical or Radio Frequency Identification Device (RFID) format.

Yes, waybill is required for both interstate and intrastate supply & movement of goods of the state of supplier i.e. E-way is required of state from where supplier supplying goods.

States, where e-way bill is required as of now till centre notifies and implement its e-way bill rules:-

1. Andhra Pradesh

2. West Bengal

3. Kerala

4. Bihar

5. Odisha

6. karnatka

7. U.P.

HAPPY WITH THE DETAILS PROVIDED.

Hi, I must say this is a very helpful article and much appreciate your prompt reply to all users on their queries. I have one question that e way bill not opening up in PDF format after submission of E waybill.

Need your help, thanks in advance !!

Hello Sir,

The latest update after 22nd Council Meet Says that the Eway Bill has been deferred to April 2018. Please let me know if the States still have to generate and carry the way bills along with the consignments? And what does “GST Council decides to roll-out e-way billing from April.” mean?

Appreciate your kind reply!

Generation of E-way bill has been suspended until 31st March 2018. Till then all the old provisions for waybill prevails.

Dear Sir, Import item purchase from The Netherlands. How will generate e-way bill for import material? As I considered Taxable Value + GST (Tax Amt) = Gross Value., if it is ok.

Santhosh

The e-way bill generation utility has been postponed.

We have registered for Waybill password about a week back, but not received as of now. Please help us whom to contact. I am from Telangana state.

Hi, Sir, I am buying goods from the same city (Local Purchase distance less than 300 meters) while generating E-Way bill it asks for Transport name and vehicle number but its a hand delivery there is no use of Vehicle or transport now how do I generate the e-way bill? Please guide.

E-way bill is not required in case if the goods are transported by non-motorized means.

Please confirm the implementation date of e-way bill post GST.

16th January 2018

In web submission unit quantity code is error how can solve this problem?

Contact department for assistance.

Dear Sir,

When we create e waybill with registered Delhi vehicle no DL1LN1662 that time we see on our screen the vehicle no. is invalid how we shout out this problem please guide us and shout out my query.

There are specific formats accepted by e-way bill sites. So you have to enter vehicle no. in the correct format.

How does E-way bill work? if there are transactions above INR 50K or whatever limit between 2 unregistered dealers

Thanks

IF I PURCHASE SOME ITEM SHOULD I CREATE E WAY BILL

How to generate E-Way bill to branch office

i am buying goods from Maharastra to Karnataka. I am actually unable to generate e way bill as server here is down. Can the supplier from Maharastra generate e-waybill and send to Karnataka .

E-way bill can only be generated by the liable person. For any technical issue, please contact to department.

Dear Sir,

How to Generate E- Way Bill for Export Under Without Payment of GST and Payment of GST

HOW TO GENERATE GST E WAY BILL IN AP, PLEASE GIVE DEMO TO US

Sir, If a seller from Punjab sold his goods to a customer of U.P.( Billed To Party) But Goods Delivered In Gujarat (shipped to party) then who will provide waybill in that case.

If i purchase goods from inter state exceeding Rs. 50000 from more then 2 firm. Is e way bill required?

Yes, E-way bill is required for transporting goods exceeding the value of Rs. 50000 from a registered person.

If i Send the material from one place to another within state or interstate, but the material is not for sale. For Example we own cranes, which we give on hire, some parts of the crane like Counterweights are transported separately on trailers or truck from one place to another. which would then return to our own place after the work is completed. In this case also do i need to Generate the E way Bill?

yes, in case of interstate transfer, E-way bill is required.

kya cement me ewaybill ki jarurat h

if the value of goods exceed Rs. 50000 then ewaybill is required.

Can you please tell who issue this bill? buyer or seller?

We have been trying to make eway bill for material from Gujarat to UP. once intermediate Number is generated, then there is no other option to download eway bill on the portal. can some one help.

Sir, what i do if e way bill no. is lost???

Is there any other option???

Hi sir, please tell us when state will start process to issue the E Way bill in India?

Till now, no notification has been issued regarding this.

tell me the procedure of generating e-waybill. step wise required please

Please read the full procedure at http://www.cbec.gov.in/resources//htdocs-cbec/gst/ewaybill-rules.pdf

We are GST reg. vendor in Mumbai. we are in process of shutting down one of our retail / whole sale outlet temporarily for shifting to a new location within Mumbai only but after 5-6 months. The present outlet is on rent. at present we would like to send our present dismantled interior ( used ply, ACs, glass, furniture and fixtures ) to be sent to our spare bungalow near to Ahmedabad. Also, due to space crunch in other outlets, we would like to shift our present stock ( garments, dress materials ,imitation jewellery etc. ) temporarily t the same bungalow.

The case is clear and we are not hiding anything. What is a way that all these could be transported to the Gujarat site through a NP holder transporter without any difficulty. ( we might require to bring all back for our new outlet post few months or to have it used for our new outlet in Gujarat. Request reply on priority.

Hi,

We have 7 branches, 2 stock yard and 6 outlets (where we keep some stock only for display).We transfer stock from one place to another place. Is e way bill mandatory for us?

Please be kind enough to provide me accurate details

Regards

GST is also applicable in case of stock transfers. So if branches are in different states then E-way bill is required.

the HO will act as a consignor for branches so they need to fill all the form,i.e. part A, part B and consolidated.

ON THE BASIS OF STOCK TRANSFER WHAT IS THE SUB TYPE IN E WAY BILL FORM

now th e E- Way bills are available in GST PORTAL

sir,

can i know where e-way bill has to be entered. where in GST portal.

no, right now facility of e-way bill is not available on GST portal

it is compulsory to add gst in e way bill

WAY BILL GENERATE FACILITY WILL STARTS FROM MONDAY ie. 10/07/2017

How to generate e-way bill. Please send us the link

ANS: . Information to be furnished prior to commencement of movement of goods and generation of e-way bill

(1) Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees —

(i) in relation to a supply; or

(ii) for reasons other than supply; or

(iii) due to inward supply from an unregistered person, shall, before commencement of movement, furnish information relating to the said goods in Part A of FORM GST INS-01, electronically, on the common portal and

(a) where the goods are transported by the registered person as a consignor or the recipient of supply as the consignee, whether in his own conveyance or a hired one, the said person or the recipient may generate the e-way bill in FORM GST INS-1 electronically on the common portal after furnishing information in Part B of FORM GST INS-01; or

(b) where the e-way bill is not generated under clause (a) and the goods are handed over to a transporter, the registered person shall furnish the information relating to the transporter in Part B of FORM GST INS-01 on the common portal and the e-way bill shall be generated by the transporter on the said portal on the basis of the information furnished by the registered person in Part A of FORM GST INS- 01:

I have purchase goods from Coimbatore in the last week of june .The transport neeD way bill. The bill is generated in CST 2%. Can i generate way bill from gst format Please help

No, you have make it as per sales tax only.

how to generate e-way bill for granite exports, please send link for generating way bill.

Till yet government have not given the facility of E-way Bill. Government is working on it and will be provide soon.

is their any update on eway bill for UP state.

No updates

how to generate e-waybill for gst invoice please send link for generating waybill

How a small re-seller from purchase goods from other states stockist doing business less than 20 lac per month require GSTN no. or not. and how they will business. After GSTN.

Prakash

Will transporters charge GST on freight charges in their consignment note ?

If The Party In Not Register in G S T Then You May Charge G S T on Freight .But That Party Sends The Goods In Home State Only.

HI, I am Vishal, we are in express transportation business means co-loading the new GST will shut down our business because We deals with the courier and small cargo companies and according to GST law we have to generate multiple e-way bill for every small movement

Example:-

When courier is booked by a courier like trackon or dtdc or firstflight etc.

Their branch or booking counter generate a e waybill for shipment he booked for said courier and then he move it to branch near to him

Again that branch (where multiple booking counter consolidate their load ) again generate an E-WAY BILL to transfer it to their HUB

Again courier hub will generate a E-way bill for connection to

1) Airlines

2) Train

3) Road

4) Coloader

And then again one E-way bill for co-loader to airlines or train or road

Same process for destination till the end recipient. This is practically impossible

Vishal Goyal

Multimode logistics India Pvt Ltd.

Yes, we know the issues that may arise after the introduction of E-way bill but as an light thought, the E-way bill is just proposed right now and is not sure to be implemented. At the time of implementation, CBEC may ease some rules and regulations regarding the applicability of the bill. Thank you