If taxpayers and CA professionals face a problem generating UDIN on the official portal. We have published the easy steps to generate the UDIN Number or Unique Document Identification Number in Tax Audit via Gen Balance Sheet Software. We have also included the registration process, UDIN format, etc.

All Details About UDIN

Each document and certificate that has been attested by a registered CA is given a unique UDIN Number or Unique Document Identification Number. As of February 1, 2019, all certificates and documents issued by Chartered Accountants in Practice must include UDIN.

A UDIN is a unique number generated for every certificate and another similar record that has been certified by a Chartered Accountant who has registered themselves on the UDIN official portal.

UDIN Registration Process on the Portal

In order to generate the UDIN for every document that needs to be attested, full-time practising Chartered Accountants (CAs with COP) must first register themselves on the UDIN portal.

Simple to Understand the UDIN Format

In the following format, the UDIN has 18 digits and is generated by the system, for example, 22314875RKTSAN1639

- A YY code refers to the last two digits of the current year (i.e 22)

- ICAI’s membership number is the next 6 digits, which is AAAAAA (i.e. 314875)

- The next 10 digits are generated at random, i.e (RKTSAN1639)

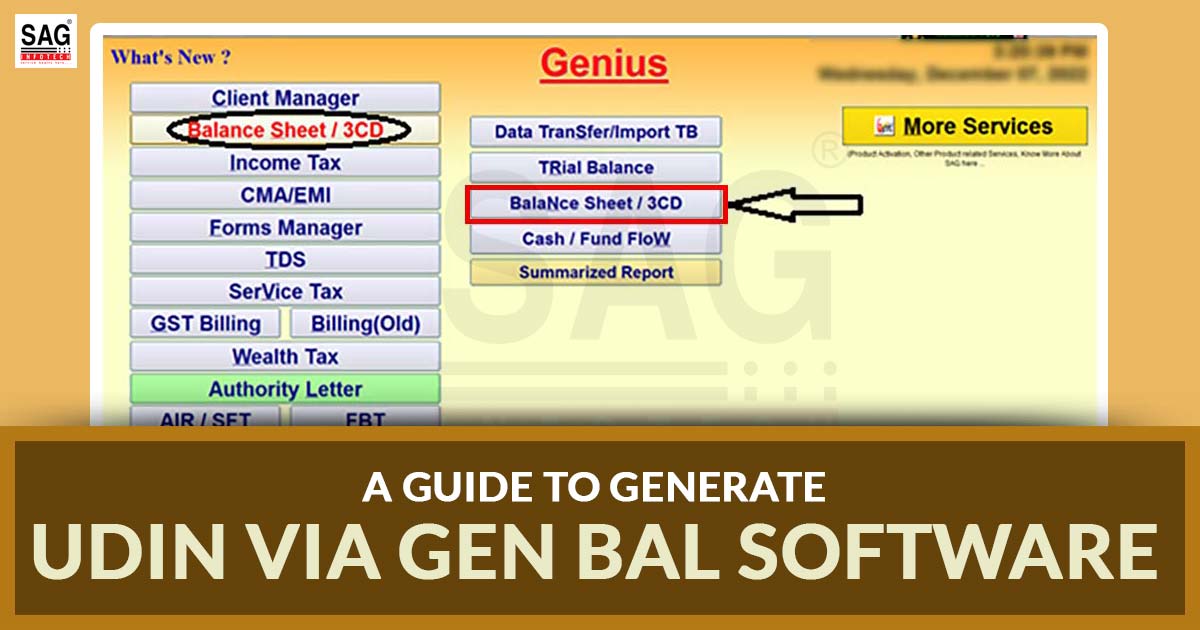

Procedure to Generate UDIN Via Gen Balance Sheet Software

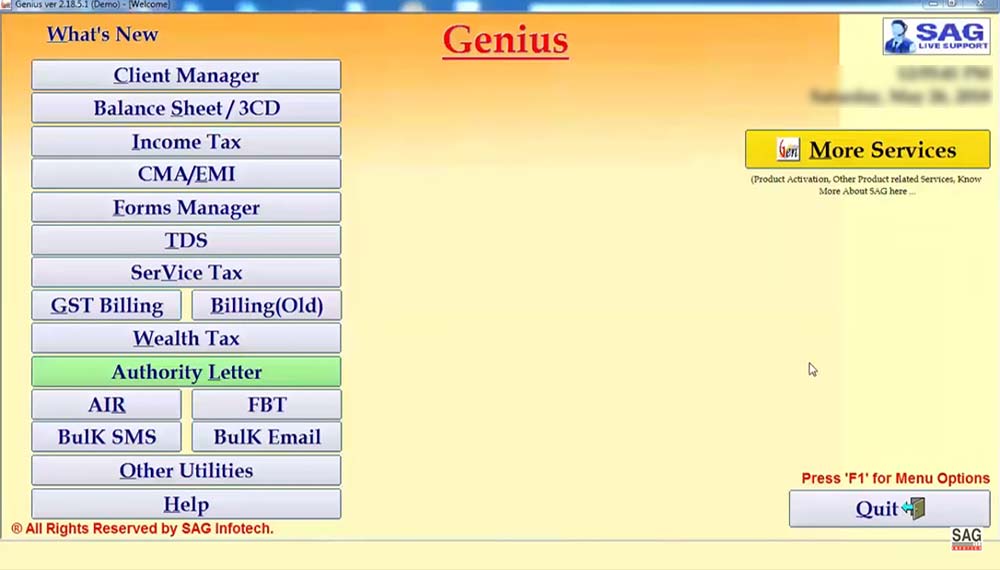

Step 1: First, install Genius tax software on your desktop and laptop.

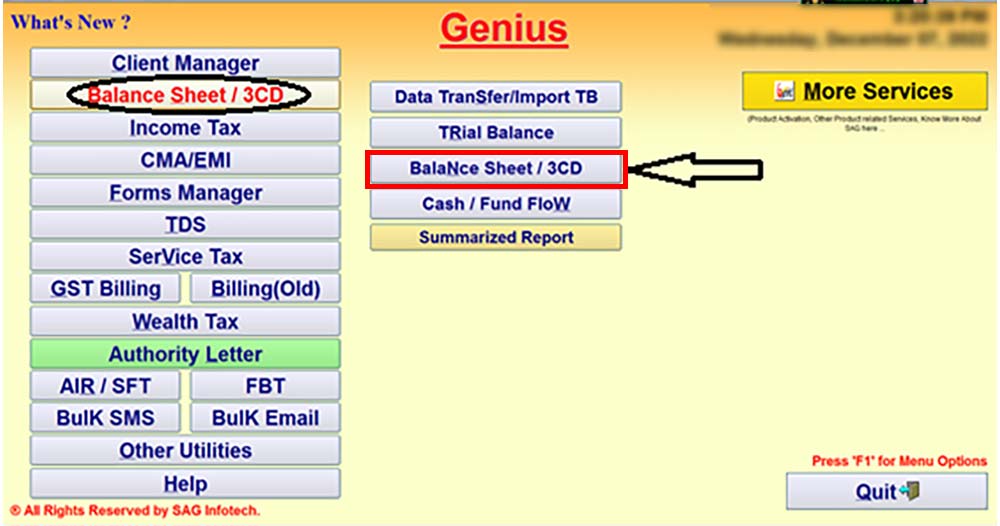

Step 2: After installing the software, move the cursor to the ‘Balance Sheet/3CD’ option.

Step 3: Select the ‘Balance Sheet/3CD’ option from the list.

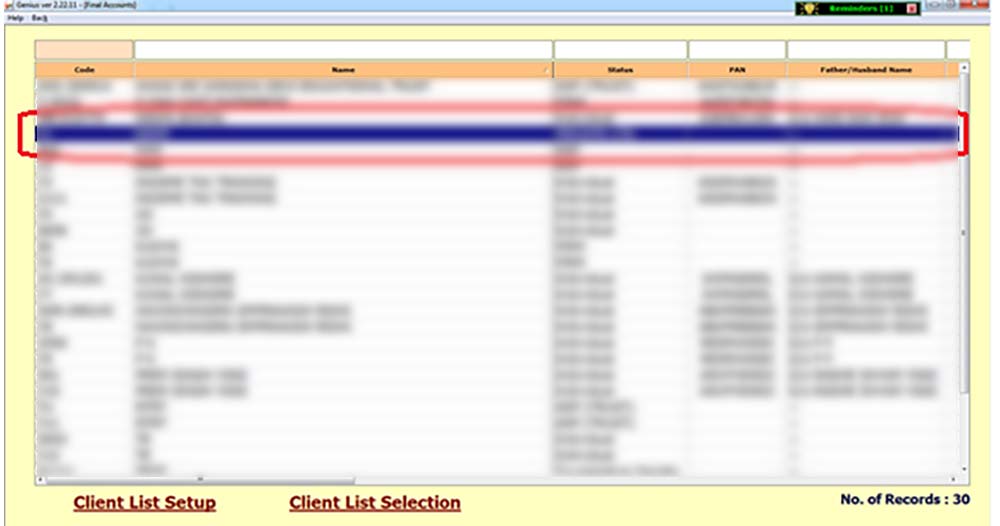

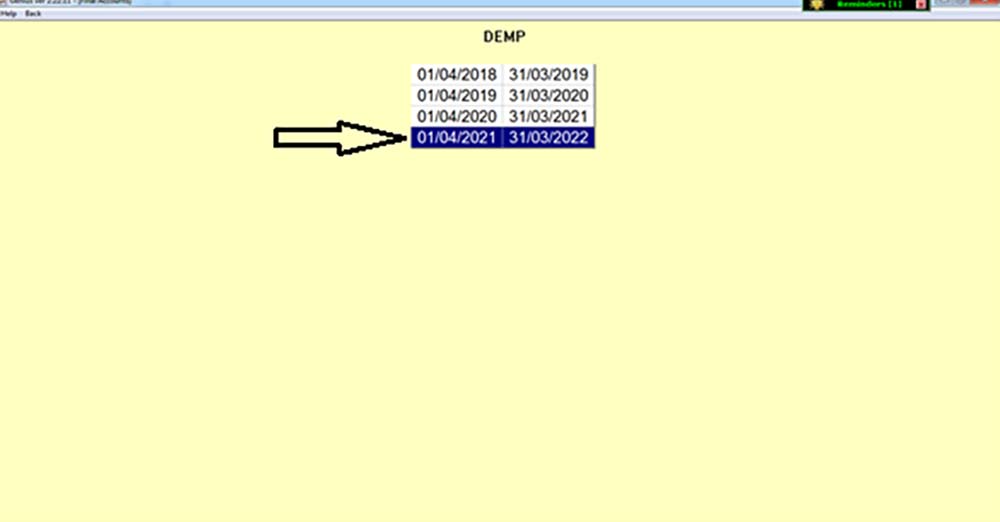

Step 4: Move on next step, then select the ‘Client and Year’ for which you want to generate the UDIN.

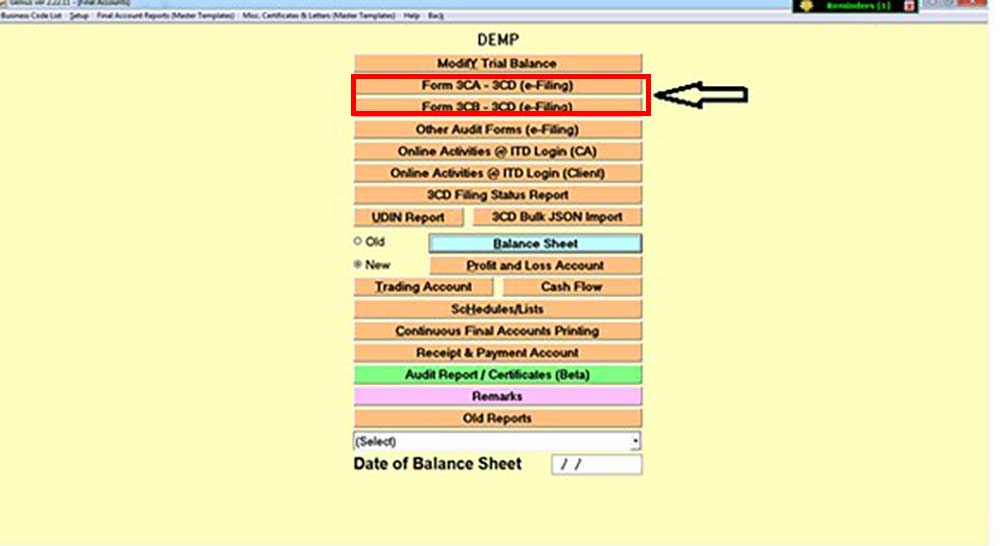

Step 5: Move the cursor next to select the ‘Form 3CA-3CD or 3CB-3CD’ form list for which you want to generate UDIN.

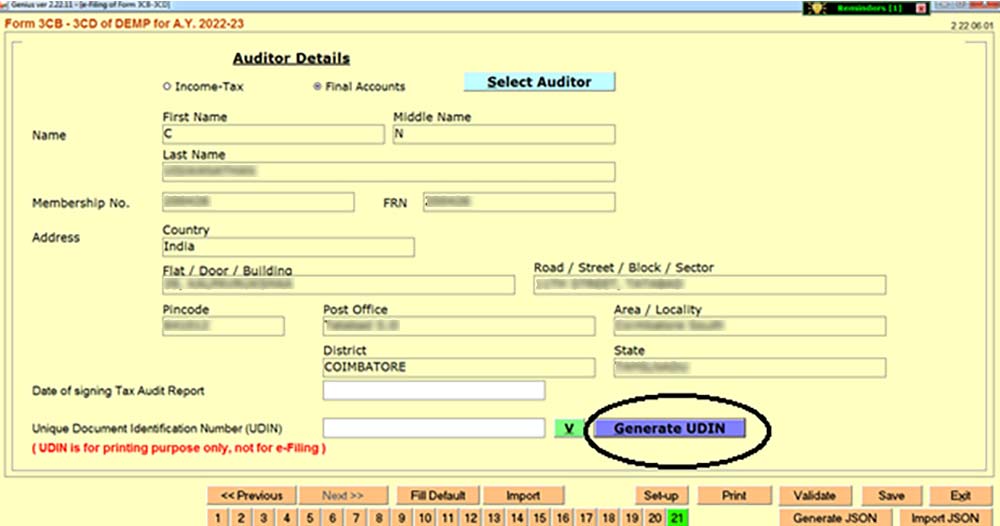

Step 6: After selecting the ‘Form 3CA-3CD or 3CB-3CD‘, click on ‘Generate UDIN’

Step 7: You will be directed to the portal screen after that, and you will need to fill in the Captcha image, and then UDIN will be generated.