Brief About Fund Flow Statement

Fund flow refers to the overall flow of funds within a business, which encompasses the operational capital of that business. In a fund flow statement, the changing net working capital of a company is shown for a specified period. It can be used to assess a company’s financial standing and to aid in long-term financial planning. The fund flow statement can reveal irregular financial behaviour or expenses. A fund flow statement is valuable in determining investor sentiment even though it may not be as comprehensive as a cash flow statement.

A Summary of the Cash Flow Statement

A cash flow statement is an important tool for understanding how cash flows within a company. Funds are effectively tracked from the company’s accounts over a given period. The movement of cash could be related to operations, investments, or financing. This statement shows an analytical comparison between opening and closing cash balances during a given period. The liquidity statement is one of the four most important financial statements for investors, as it reveals any potential liquidity issues with the company.

Why Gen Bal is the Most Famous Software for Taxpayers in India?

One of the most well-liked balance sheet software for chartered accountants is Gen BAL. To quickly prepare balance sheets, the software makes it incredibly simple to automatically generate profit and loss statements. Direct trial balance import is possible from third-party accounting programmes like Tally and Busy. Moreover, users may easily submit 3CA/CB documents within the software for eventual uploading online. Also to model cash flow and fund flow statements. You may utilise Gen BAL to create audit forms, yearly returns, and depreciation calculations.

Our balance sheet software’s ability to import data straight from Tally, Busy, MS Excel, and other well-known accounting and tax features is one of its strongest USPs. Based on the user-provided Trial Balance, the software may automatically create balance sheets, profit-loss statistics, trading accounts, and lists. Updated Tax audit reports, the ability to change the item formats in the Accounts Notes, the ability to draw trading accounts in column format with quantitative details, the ability to prepare all types of audit reports, the ability to calculate Deferred Tax Liability, ratio formulas, the ability to merge trial balances, and more are additional noteworthy features of Gen Bal.

Step-by-Step Procedure to Prepare Cash/Fund Flow Statement via Genius Software

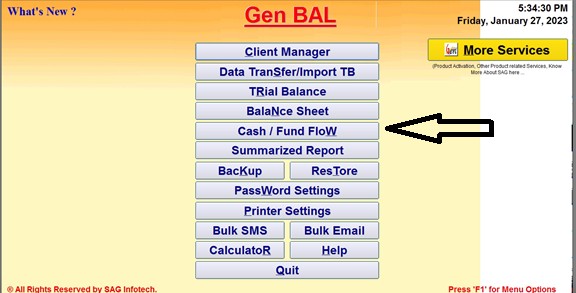

Step 1:- First Install Gen Balance Sheet Software on your laptop and PC.

Step 2: Next click on the ‘Balance Sheet/3CD’ Option and go to Cash/Fund Flow.

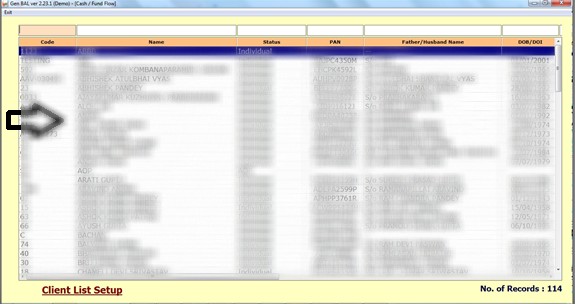

Step 3:- Now select the client for which you want to prepare Cash/Fund Flow.

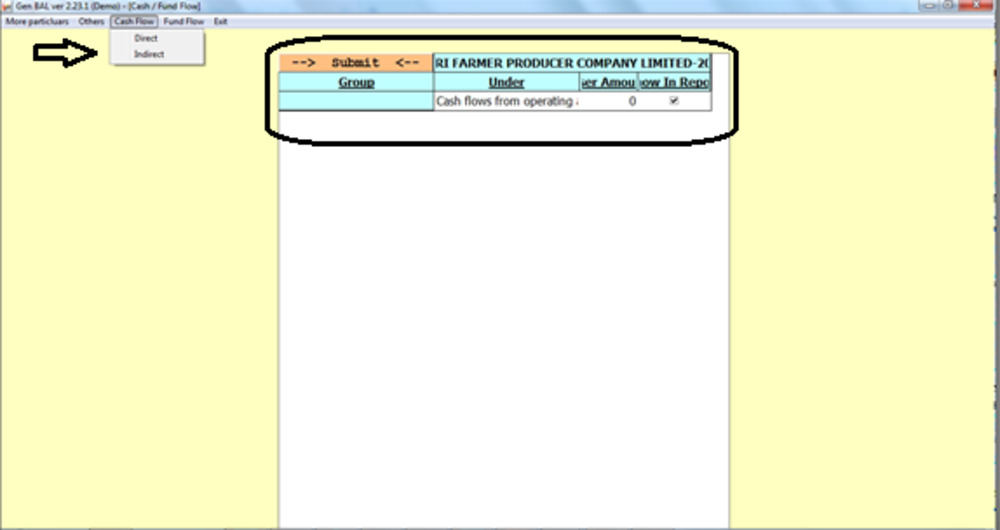

Step 4:- Choose the year for which you are preparing the cash flow statement.

Step 5:- If you have already filled the Balance and P&L in the Software then you can click on Cash Flow and Select the type of method i.e. Direct or Indirect and the Cash Flow will get prepared automatically. If you want to prepare Cash or Fund Flow manually can do the same by selecting the Head and entering the amount.