A Simple Overview of a Trial Balance

The trial balance is a report that shows the balances of a company’s general ledger accounts at a specific point in time. A trial balance contains accounts for all major accounting items, liabilities, revenues, expenses, assets, gains, and losses. As a result of the transactions recorded in the general ledger at a particular point in time, it is primarily used to identify the balance of credits and debits.

What Contains Inside a Trial Balance?

Trial balances include totals for all general ledger accounts. A description of the account, the account number, and the final credit or debit balance should be included for each account. Furthermore, it should contain the end date of the accounting time for which the report is completed. The primary distinction between the trial balance and the general ledger is that the trial balance only displays the account totals, not each individual transaction, while the general ledger shows all transactions by account.

Finally, a trial balance must show any adjusting inputs that were made. The amounts prior to the adjustment, the adjusting entry, and the balances following the adjustment should all be displayed in this instance.

Objective to Prepare a Trial Balance

To find any numerical errors that may have occurred in the double-entry accounting system, a trial balance is generated.

Why Choose Gen Bal Software to Merge Two Different Trial Balances?

In addition to preparing balance sheets, Gen Bal software generates profit & loss statements automatically. In addition to preparing audit forms and calculating depreciation, this balance sheet software also assists in preparing audit reports. Form 3CB and 3CA can also be filed, annual returns can be generated, and specimen fund flow can be managed.

The data can be also imported from Busy Accounting and TallyPrime. A notable feature of Gen Bal ledger accounting software is the support for all types of audit reports, the ratio formula, and the ability to merge trial balances.

Some Benefits of the Gen Bal Software:

- Calculates deferred tax and ratios.

- Quantitative details can be added to a trading account

- Analysis of cash flow and fund flow

- Trial balances and profit & loss statements should be merged

- Prepares the depreciation chart

- It can import the TDS-related attributes directly to your audit report.

Step-by-Step Guide to Merge Two Trial Balances via Gen Bal Software

Step 1:- First Install the Gen Balance Sheet Software on your PC and laptop.

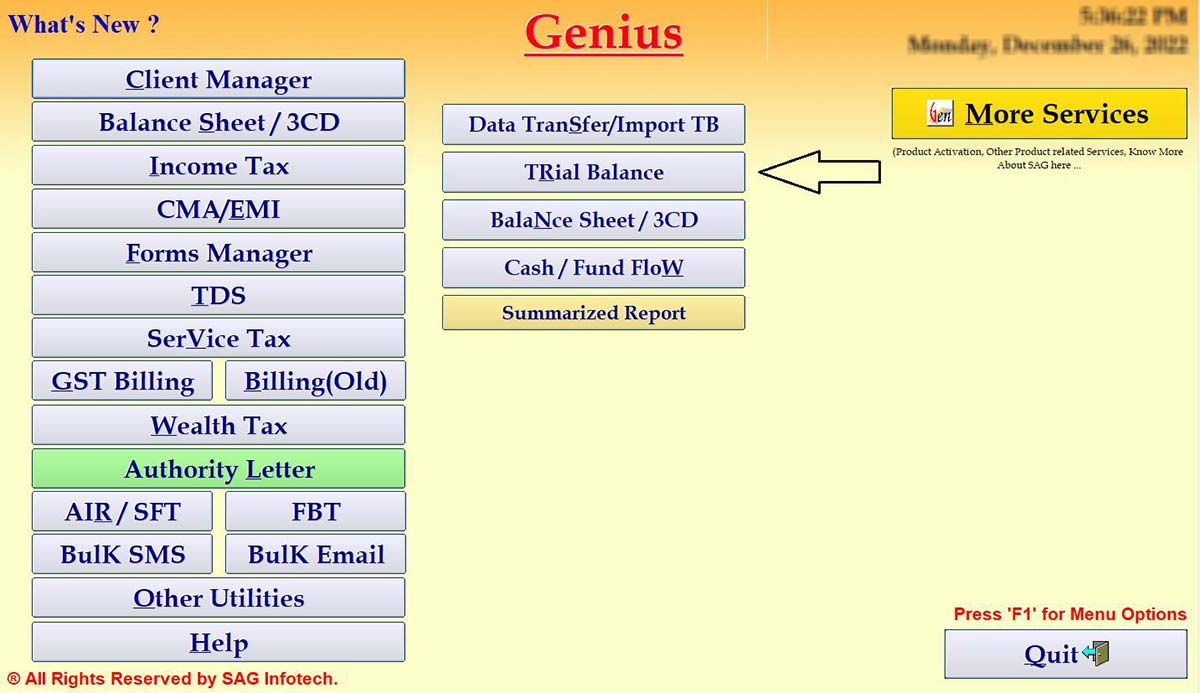

Step 2:- After that Open the Software Go to Balance Sheet/3CD and click on the tab Trial Balance.

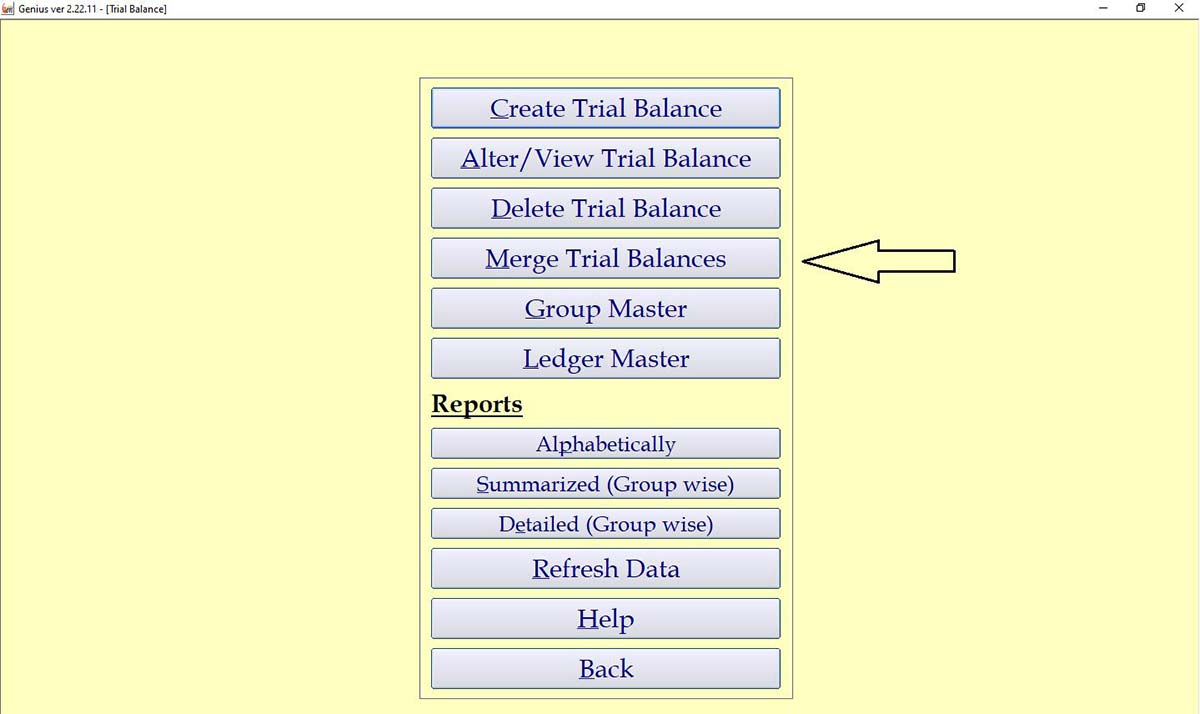

Step 3:- Now Click on the Merge Trial Balances Tab.

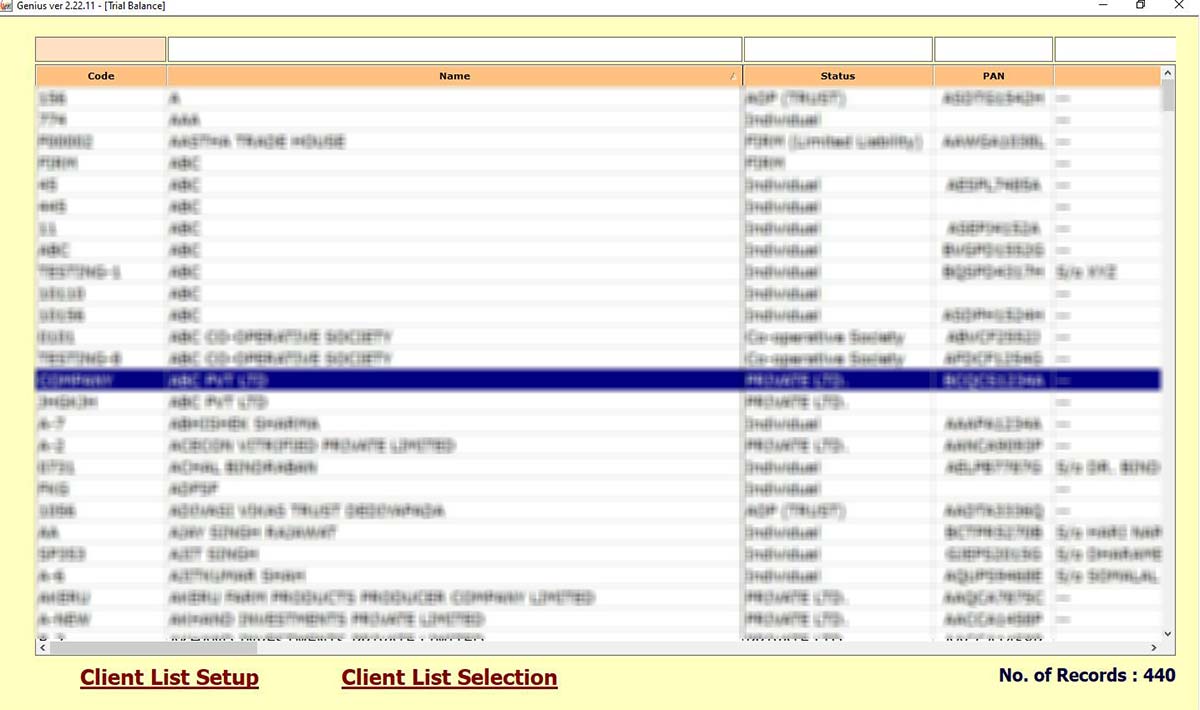

Step 4:- Select the Company in which you want to Merge the Trial Balances.

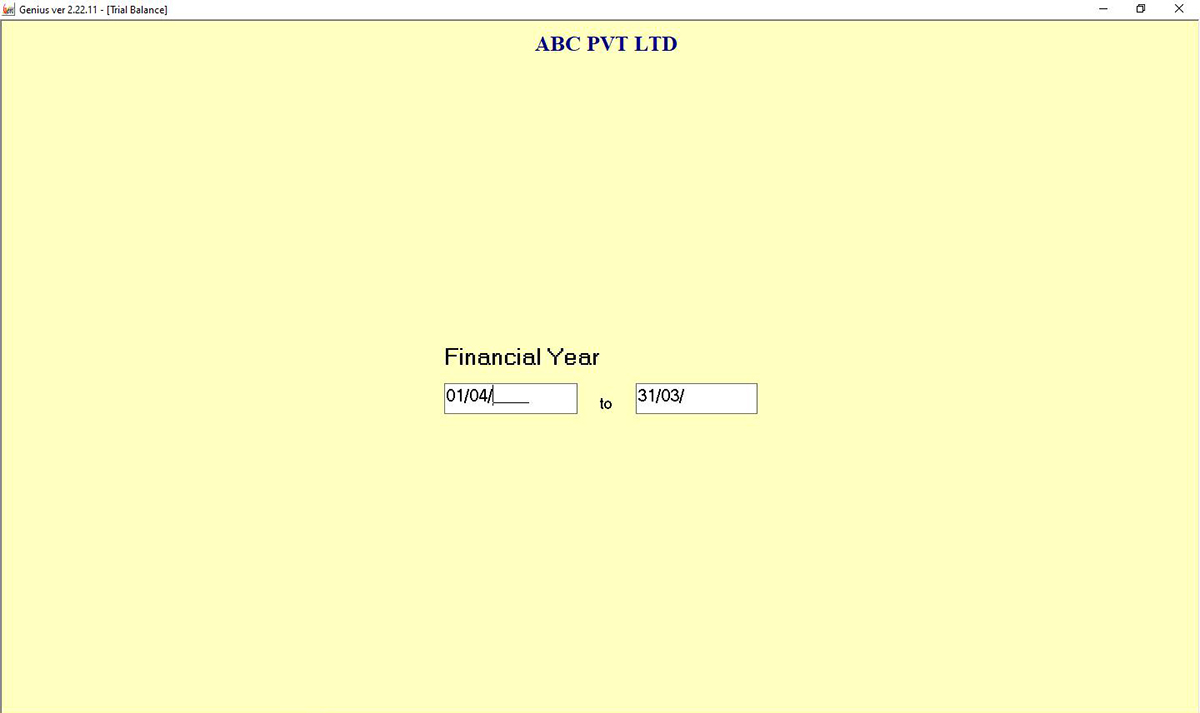

Step 5:- After that mention the year in which you want to Merge the Trial Balances.

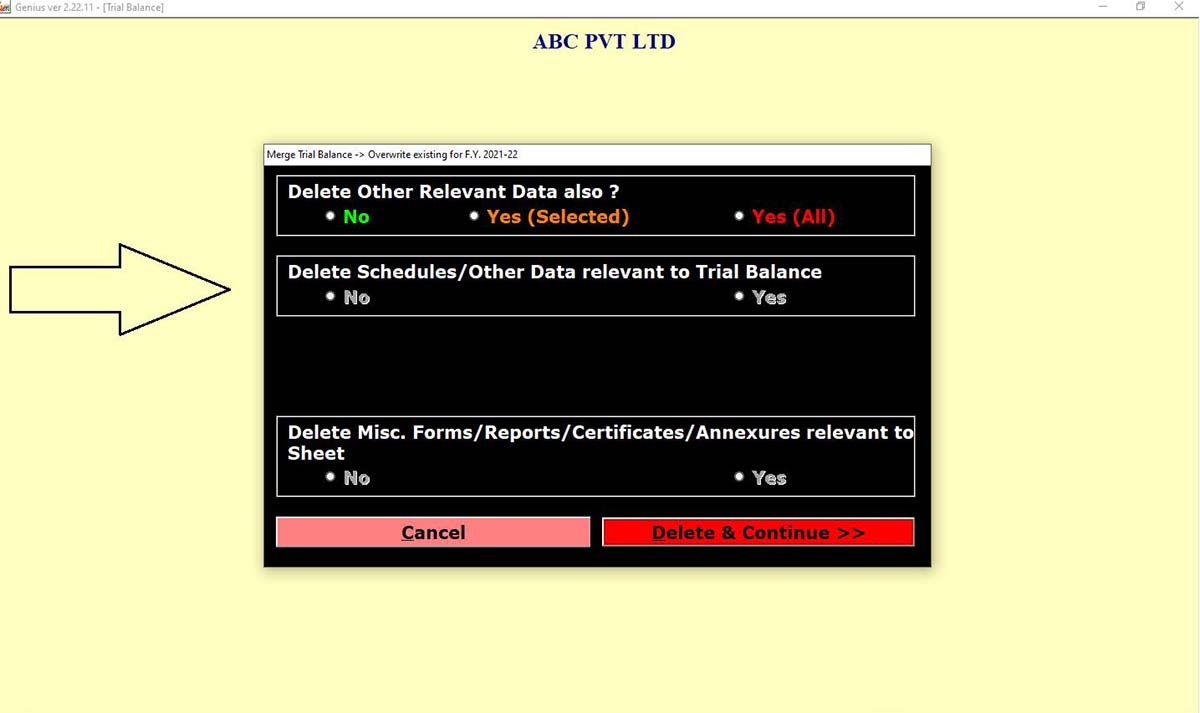

Step 6:- Now Select the Relevant Schedules for Merging the Trial Balances.

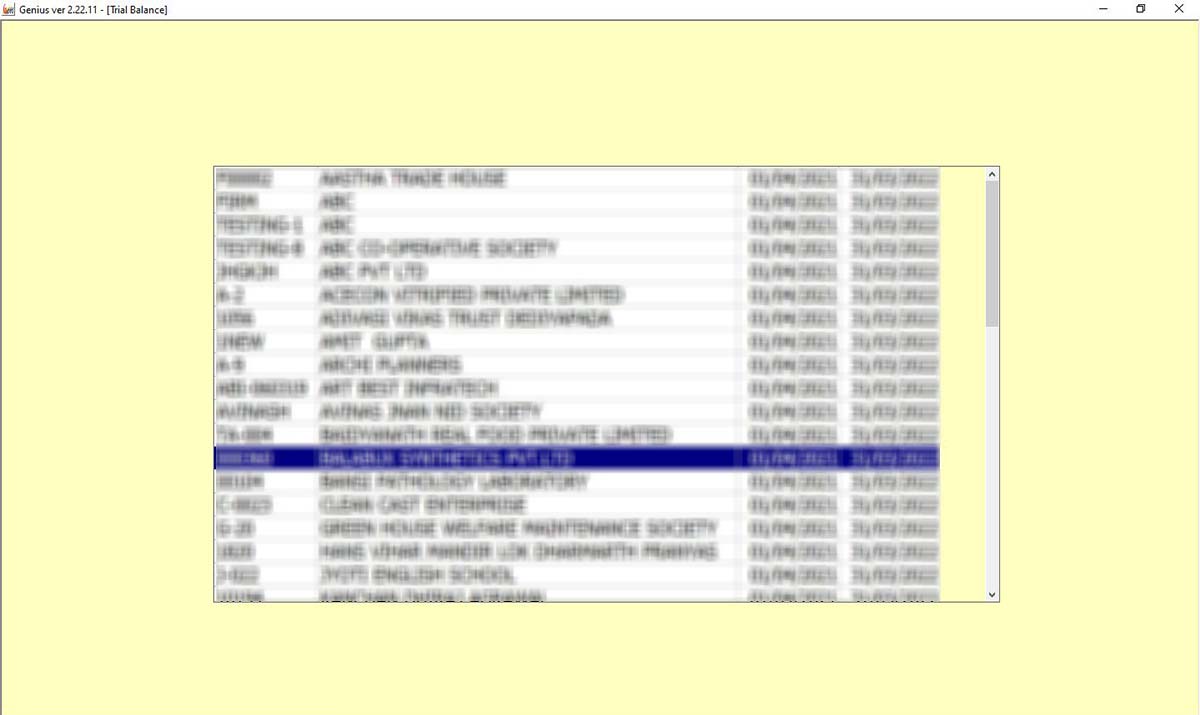

Step 7:- After Select the Company which you want to merge the Trial Balances.

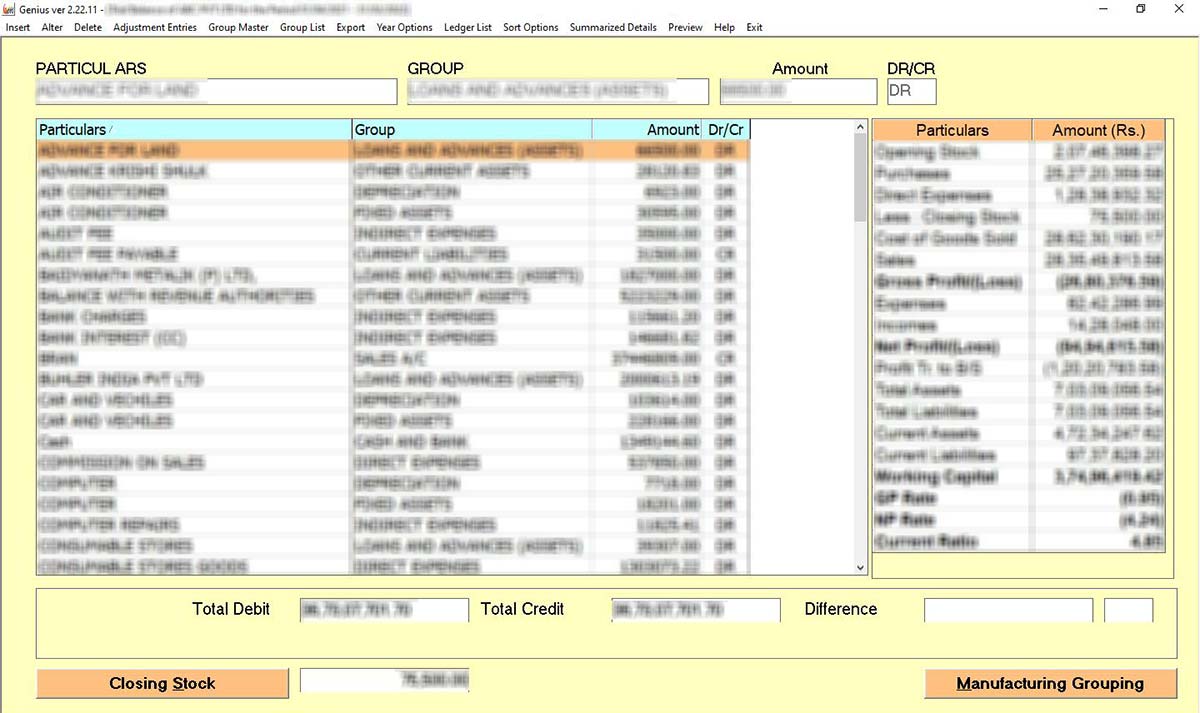

Step 8:- After that merged Trial Balances will get prepared.