A clarification has been furnished by the Finance Ministry in between the dissemination of deceptive details on social media platforms concerning the new income tax regime.

The same shows that there are no additional revisions that are effective from 1st April 2024. Taxpayers are enabled to opt for either the old or new tax regime established on their preferences and financial situations with the option to opt out of the new regime till return filing for the AY 2024-25. Qualified individuals without income from business could alternate between the old and new regimes for each financial year.

the Finance Ministry on the social media platform mentioned that it is witnessed that deceptive details associated with the new income tax regime are being spread on certain social media platforms. It is consequently clarified that:

- No new change is there which is coming in from 01.04.2024.

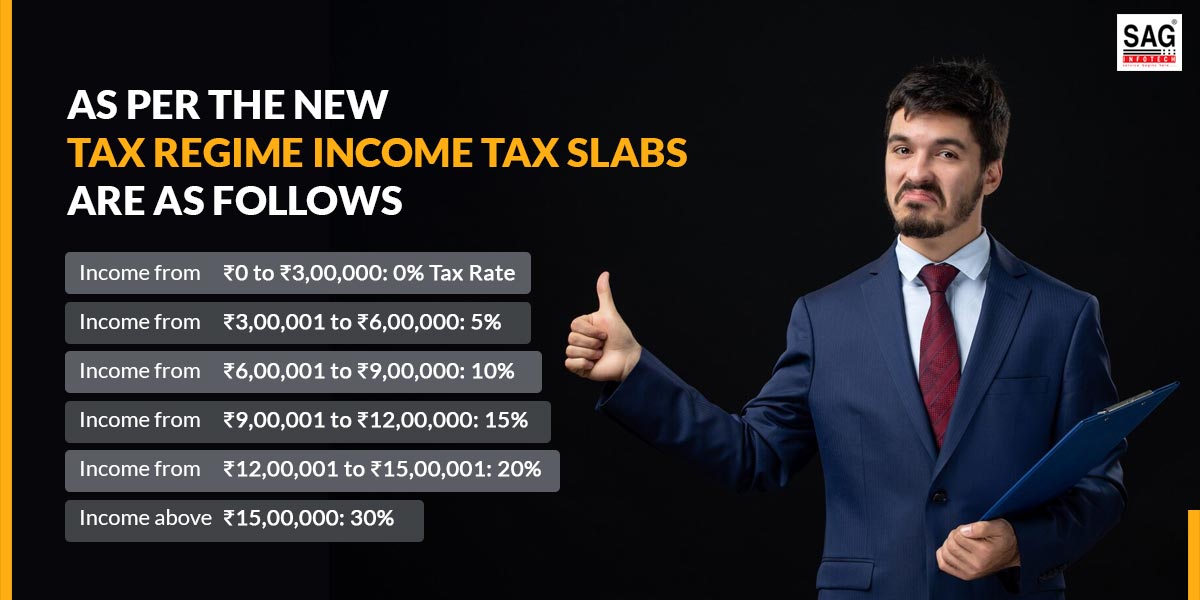

- Under section 115BAC(1A) the new tax regime was introduced in the Finance Act 2023, as compared to the existing old regime (without exemptions) (SEE TABLE BELOW)

- For persons other than companies and firms the new tax regime is applicable, is applicable as a default regime from the FY 2023-24 and the Assessment Year corresponding to this is AY 2024-25.

- The tax rates under the new tax regime are quite lower, but the benefit of different exemptions and deductions (other than the standard deduction of Rs. 50,000 from salary and Rs. 15,000 from family pension) is not available, as in the old regime.

- The new tax regime is the default tax regime, but, taxpayers are able to opt for either the old tax regime or the new tax regime that they think is valuable to them.

- The option to choose from the new tax regime is available till the return filing for the AY 2024-25. Eligible individuals without any business income shall have the chance to opt for the regime for each financial year. Therefore, they can choose a new tax regime in one financial year and an old tax regime in another year and vice versa.

Tax Slabs From the Old Regime

- Under the old tax regime income up to ₹2.5 is exempt from taxation.

- Under the old tax regime Income between ₹2.5 to ₹5 lakh is taxed at the rate of 5 per cent.

- Personal income from ₹5 lakh to ₹10 lakh is taxed at a rate of 20 per cent in the old regime

- Personal income above ₹10 lakh is taxed at a rate of 30 per cent under the old regime.