The Finance Act, 2025, has incorporated numerous amendments along with introductions. One such example is the introduction of the new tax regime. Though it seems chaotic, in essence, it is one of the revolutions in the area of tax. The Finance Minister has announced the new tax slab rates for the:

- Individuals

- Hindu Undivided Families

- Co-operative societies

Who Can Choose the New Income Tax Regime As Per Section 115BAC?

- With effect from financial year 2025-26, 115BAC is the default regime if HUF, as well as the individuals having business income and assessee willing to opt for the old tax regime, then Form 10-IEA has to be filed.

- All taxpayers are required to file Form 10-IEA, which is required to file the return within the ITR 3 or 4 pertaining to the business income that is opted under the new scheme.

- Note: Form 10 IEA is not required to be filed in the ITR 1 or 2, and if the option is mentioned in the ITR, they can select the latest tax scheme.

For the Finance Ministry, it was necessary to insert 2 new sections for the objective of bringing a new tax regime into execution. These 2 sections are as follows:

Section 115 BAC: This is a new tax rate for the income of

- Individuals

- Hindu Undivided Families

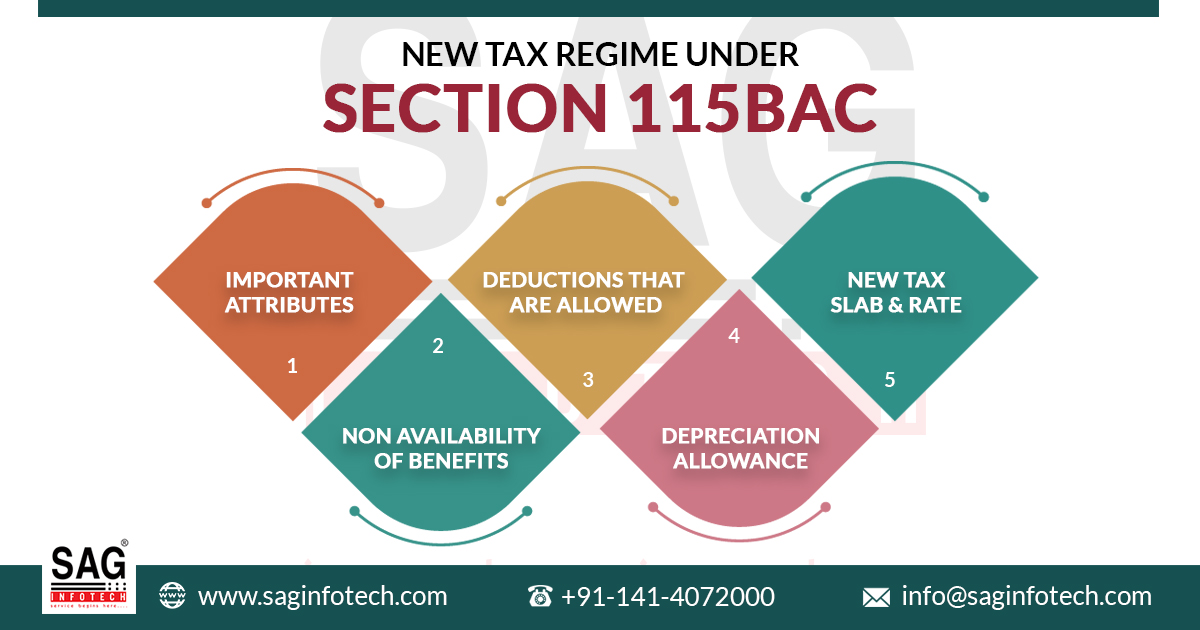

Important Attributes of the New Tax Regime Under Section 115BAC

- The aforesaid new tax regime is applicable from the Financial Year 2025-2026.

- The new income tax regime is the default; you may or may not opt for the old tax regime. In case of not opting for an old tax regime, the new (Default) tax regime shall be applicable.

- The rates of cess and surcharge in a new income tax regime are the very same as those prevalent in the existing/Old tax regime

- Even Senior Citizens and Senior Super Citizens can opt in for a new tax regime.

- In the new tax regimes, the rebate under section 87A is available to the resident individuals having a total income of equal to or less than Rs 12 lakhs per annum. But in the old tax regime rebate is available to the resident individuals having a total income equal to or less than 5.

New Tax Slab (Wef From FY 2025-26)

| Total Income | Rate of Tax |

|---|---|

| Up to Rs 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs. 12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs 24,00,000 | 30% |

Non-Availability of Benefits

However, if the taxpayer opts in for the new tax regime, then the following deductions and other benefits shall not be accessible to him:

- House Rent Allowance

- Leave Travel Allowance

- Children’s Education Allowance

- Deduction from the family pension scheme

- Other Special Allowances [Section10(14)]

- Interest on the housing loan of the vacant property or self-occupied property

- Deduction from Family Personal Income

- Chapter VI-A deductions

- Deduction or Exemption for any other allowance or other perquisite, and so on

Deductions That are Allowed

Though many deductions are not allowed under the new income tax regime; however, there are certain exceptions to it.

- Deduction under section 80 JJAA, i.e. additional i.e. additional employee cost is available

- Deduction under section 80CCD(2), i.e. employer’s contribution to pension account, is allowed

- Conveyance Allowance for the performance of the office duties is allowed.

- Daily allowance to employees is allowed

- Any allowance that is made for the cost of the Tour/Travel/Transfer

- Transport Allowance for Differently Abled Employees is allowed

Section 80LA

In case a person owns a unit in the International Financial Services Centre that is referred to in sub-section (1A) of section 80 LA, who has exercised the option, the conditions listed in section 115 BAC shall have to be modified to the extent that deduction as per section 115 BAC shall be available to the aforesaid unit.

Depreciation Allowance

In case of Depreciation allowance that is made with respect to a block of assets that has not been given full effects to before the assessment year that is going to begin from April 1, 2021, then the corresponding adjustment shall have to be made to a written down value of such block of assets as on April 1, 2020, in a prescribed manner; however, if the option of the new tax regime has been implemented for a previous year that is relevant to assessment year beginning from April1, 2021.

Frequency of choosing between the options of tax regimes

For Salaried Person

An Individual who has a salaried income but no business income has the option to make a choice between the old tax regime and the new tax regime every year

Business Income

However, the above-mentioned option that is available to salaried persons is not available to Individuals having business income. If the businessman has once opted for an old tax regime and subsequently selects the default new tax regime, then the old regime cannot be selected at life time.

Application for the withdrawal/exercise of the option

Individuals or Hindu Undivided Families have to file Form 10-IEA to opt in or take a step to opt out of the new tax regime.

Due Date of Filing Form 10IEA

- For Business Income before the due date of filing the Income Tax Return

- If the assessee does not have business income, then Form 10IEA is not applicable

Frequency of Filing the Form 10-IEA

- A person earning a Salary Income shall not be required to file the above-mentioned Form 10-IEA for every year during which he wants to select the new tax regime.

- A person earning business income has to file Form 10IEA only when a person opts for the old regime. If a person continues the new regime (default regime), then Form 10IEA is not required to be filed.

Non-filing of the Form 10-IEA

In case of non-filing of the Form 10-IEA by the aforesaid due date, then the taxpayers are deemed to be in the new regime (default regime). If taxpayers are willing to opt old regime, then Form 10-IEA needs to be filed.

Switching from the Previous Chosen Option

As per the circular issued by CBDT dated April 13, 2020, once the chosen tax regime has been communicated to the employer, thereafter, employees cannot change the tax regime during that financial year. Nevertheless, at the time of filing the Income Tax Return, an individual shall have an option to switch to another tax regime, irrespective of the fact of what has been communicated to the employer.

Contents of Form

- Name of the Individual/Hindu Undivided Family

- Confirmation regarding profit or gains from the business or profession

- Address

- Permanent Account Number

- Date of Birth/Date of Incorporation

- Confirmation

- Date of Birth/Incorporation

- Details of previous Form 10-IEA filed (in case applicable)

- Declaration

I’ve file ITR-3 for AY 2021-22 and AY 2022-23 opting new tax regime. I’ve filed Form 10-IE for AY 2021-22. I’ve file ITR-3 for AY 2023-24 under new tax regime mentioning “Continu to opt in” and mentioned details of Form10-IE filed for AY 2021-22. I’ve filed my return of income within time prescribed u/s.139(1). Is it correct. or should I have to file Form10-IE again for AY 2023-24 for continue to opt in?

You do not need to file Form 10-IE again for AY 2023-24. Your filing for AY 2023-24 is correct.

I filed 10IE for A.Y. 2022-23 and filed return under 115BAC. This year I wish to continue new regime, but the ITR is not filed before the due date i.e. 31.10.2023 (Audit case) Can I file ITR under new regime now.

Please check the validation rule and section 115BAC of income tax act 1961. Assessee can not opt section section 115BAC under the new tax regime after due date of filling of return of income.

I’m filling ITR-3 of a partner in a firm having Salary as well as interest from the firm and wants to file return in the new Tax regime u/s 115 BAC. While filing form 10-IE, the nature of business is to be filled. What should i write under the column Nature of Business as in the Drop Box Partners’ Salary and interest not mentioned therein.

My query is what business category should I select under the column “Nature of Business”?

IF ITR-3 is applicable and If taxpayer have income from firm only and having no other business /profession income then you can select business code 00001 “share of income from firm only”. For more help you can contact to practicing CA.

Can 115BAC BE OPTED FOR 139(8A) return for ass year 21-22 Assesee has not filed before ITR

After due date of filling return not get benefit for chose new tax regime. so in case 139(8A) you are not able to opt 115BAC.

I HAVE A HUF PAN , WHEN I FILE 10IE HIS SHOW (SUBMITION FAILED RESPONS FROM SERVER :

PLEASE FIX THE FOLOWING ISSUE AND TRY TO SUBMIT AGAIN(INVAILID INPUT)

PLEASE RESOLVE MY ISSUE

Please see the details of the issue being faced by me while trying to file ITR for Financial Year 2022-23 as given below:

1.Financial Year 2020-21:

I had Professional Income.

I opted for filing the Income Tax Return in New Regime under Section 115BAC.

Form 10-IE was filed before filing the Income Tax Return for the Financial Year 2020-21. ITR3 was filed.

2.Financial Year 2021-22:

I had no Professional Income.

I filed the Income Tax Return under the Old Tax Regime.

The Income Tax Software did not prompt me to file Form 10-IE while filing the Income Tax Return for the Financial Year 2021-22 under the old tax regime as there was no Professional Income. ITR2 was filed.

3.Financial Year 2022-23:

I have Professional Income again.

I want to continue with the Old Tax Regime. I am trying to file ITR3 Form.

The Income Tax Software is asking for the Acknowledgement Number of Form 10-IE for the Income Tax Return filed under the Old Tax Regime for the Financial Year 2021-22 but it was not required to be filed and therefore not filed as I had no Professional Income.

Kindly clarify how to proceed on the Income Tax Software’s request for Acknowledgement Number of Form 10-IE for Financial Year 2021-22 while trying to file Income Tax Return for Financial Year 2022-23.

Kindly inform me of a solution to the above mentioned issue being faced by me as I am unable to proceed with filing my Income Tax Return for Financial Year 2022-23.

Further, I would request you to inform me how to deal with such situations if in future also when there is professional income in one Financial Year and no professional income in another Financial Year, as assessees having professional income are allowed the option of changing from new tax regime to old tax regime only once but other assessees are allowed to change the option in every Financial Year. Please note that I do not have a continuous source of income ( I am not a partner in any firm) and therefore I may not have professional income every year.

Thanks

Hello Sir, I have submitted return using ITR2 under new tax regime with only salary income. But IT has rejected it saying I must have filed form 10-IE. Is it true that 21AG is applicable? I was under the impression that since I do not have any business income and filed under ITR2, I need not have applied separately for new tax regime. Please, can you advise next steps?

In case of ITR-1 & ITR-2, there is no need to file form 10-IE Separately.

Sir, i’m working as a consultant in government sector. even though im not a salaried employee, getting salary as business receipt. now i need to file ITR 4, 44AD. While filing Form 10IE, what detail should i fill in verification section such as Registered address and Individual details as im not having any registered company with me. kindly guide me for filing form 10ie

In the Registered Address you can fill the Residential Address details as in Form 10IE details of Business is required.

i was filed a income tax returnunder business category for AY 2022-23 with new tax regime on dt 31st december 2022 and also form10IE on same date. Order u/s 143(1) passed in old tax regime as form 10IE filed after 31st July 2022. Now can iclaim deduction u/c VI-A in u/s 154 or filed u/s 139(8A)?

Return u/s 139(8A) can only be filed if you have taxable income and the tax is payable on the same. If you have TDS refundable then an Updated Return can not be filed.

You can opt for the new regime only before the date of filing of return u/s 139(1) which was 31st July 2022. As you filed the form on 31st December department is not allowing you to opt for New Tax Regime. Hence you can claim an exemption in 154 i.e. Rectification.

Sir, I have filed my return for AY 2021-22 under new regime – 115 BAC – by submitting a declaration in form No.10IE opting for new regime of taxation. For the Assessment year 2022-23 , I wrongly assumed that I have to submit form 10IE again and as such I have filed the form again for the AY 2022-23. But while filing the form No:10IE for the second time, I have inadvertently selected “YES” tab for the question ” are you opting out of the new regime “. After submitting the form IE declaration I realised the above mistake. Actually I still wish to continue in the New regime u/s.115BAC for AY 2022-23. Please let me know , how to correct the declaraion filed for AY 2022-23 to file my return under New regime

Form 10-IE is not required to file again and again every year. If you have again File form 10-IE then it will be considered as opt out of the form. You have to contact to Income Tax Portal for the correction of this Form.

An assessee opted for 115 bac by completing the form 10IE on 28.09.2022. But while filing the income tax return he feels opt-in is not beneficial. Now he wants to file his return without opting for 115bac. Is it a valid return? Filing of IT return is yet to do.

Please guide.

The assessee has to again file Form 10-IE to opt out of the scheme. If you file your return without opting out of the same then the Return will be considered as an opt-in for 115BAC Scheme.

Can one file revised return for filing return already filed opting under old scheme to be filed under new scheme to get tax benefits.

FORM 10IE (OPTING FOR NEW REGIME) IS MANDATORY FOR SALARIED CLASS? IF SO, FORM 10IE IS NOT VALIDATING WITHOUT FEEDING ” NATURE OF BUSINESS”. HOW CAN WE FEED NATURE OF BUSINESS IN SALARIED CASES. PLS GUIDE

Exhaustive deliberations on 115BAC and 10(I-E).