A new form for filing updated IT returns has been announced by the Income Tax Department. In this form, taxpayers should provide the reason for filing and the portion of income to be allowed for taxation purposes. ITR-U is a new form that taxpayers can use to file updated income tax returns for the Assessment Year 2021–22 and onwards.

ITR-U form can be filed within four years from the end of the appropriate assessment year. Taxpayers will have to provide proper reasons for revising the income return, not already filed, not reporting the income correctly, choosing the wrong heads of income or reducing carried forward loss. read more

Latest Update

- The Income Tax Department has notified the 19th Amendment Rules related to the updated ITR-U form for filing returns under section 139(8A). Read PDF

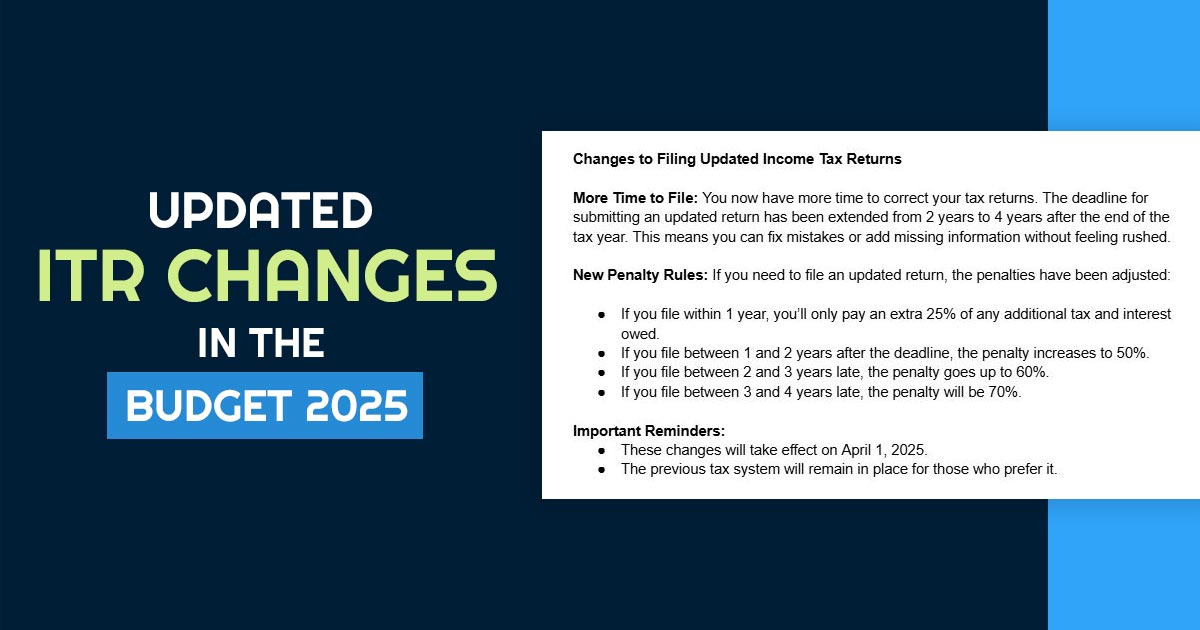

- Updated ITR Changes in the Budget 2025: The Union Budget 2025 has obtained some significant changes to the updated income tax return (ITR). Let’s take a look at these changes.

- The 2.0 portal has shared a comprehensive guide on filing Updated Returns under Section 139(8A) of the Income Tax Act, 1961. Read more here.

Need Demo of Best ITR E-filing Software

The reasons include a shortfall in unabsorbed depreciation or decrease in tax credit under section 115JB/115JC of incorrect rate of tax or other reasons the taxpayer delivered.

Budget 2025 has made arrangements so that taxpayers can revise their Income tax return filing within four years, subject to payment of taxes. This move is aimed at helping taxpayers rectify any discrepancies or omissions. However, there is a limitation as well, a taxpayer can file only one updated return per assessment year.

At present, if the IT department finds that some income has been omitted by the assessee, it goes through a lengthy process of adjudication, and the new proposal will re-establish trust in the taxpayer.

Budget 2022-23 Speech By Finance Minister

Earlier, Finance Minister Nirmala Sitharaman in her 2022-23 Budget speech said, “To provide an opportunity to rectify such errors, I am proposing a new provision allowing taxpayers to file updated returns on payment of additional tax. This updated return can be filed within two years from the end of the relevant assessment year,”.

An extra 25 per cent will need to be paid on tax and interest due if the updated ITR gets filed within a year (12 months), the rate will reach 50 per cent if the updated ITR gets filed after 12 months but before 24 months from the conclusion of the appropriate assessment year.

However, if a prosecution proceeding has been started by allocating notice concerning a particular Assessment Year, taxpayers will be unable to avail of the return benefits of the updated ITR in that specific year. Additionally, if the taxpayer furnishes an updated return but payment of the additional taxes has not been made, then the return would be rendered invalid.

What is an Income Tax Updated Return (ITR-U)

Updated return is a type of return on income u/s 139(8A) of the Income Tax Act 1961 to be filed using Form ITR-U. It allows taxpayers to:

- File Return of Income Not Filed Earlier

- Make Corrections in Disclosure in Income Tax Return

- Fix or Change the Head of Income

- Reduce the Carry Forward Loss

- Reduce Unabsorbed Depreciation

- Reduce Income Tax Credit and More

Who Should File ITR-U (Income Tax Updated Return) Form?

Any taxpayer can file an updated return, whether he has submitted their original/revised/delayed return of income or not.

When did the Provisions Become Effective?

1st April 2022

Deadline for Filing an Income Tax Updated Return

The updated return can be furnished within 48 months from the end of the specific assessment year. For example, for the assessment year 2021-22, an updated return can be filed by 31 March 2026.

Note: The deadline for filing an updated ITR for FY 2021-22 (AY 2022-23) is 31st March 2027.

When You Can Not Submit an Updated Return?

In the following circumstances, an updated return cannot be furnished if:

- The updated return is a return of the loss

- The updated return reduces the income tax liability from the return filed earlier

- The updated return result increases the refund

- The search has been started under section 132

- Books of accounts or any other document are called for under section 132A.

- A survey is done under section 133A

- Any proceeding of assessment, revaluation, recalculation, or revision is pending or completed in that year.

- The AO has information against such person under the Prevention of Money Laundering Act or Black Money (Undisclosed Foreign Income and Assets) and Tax Act or Benami Property Transactions Act or Smugglers and Foreign Exchange Manipulation Act and the same have been reported to the assessee.

- Other Notified Person

How to Calculate Income Tax Updated Return via a Simple Process?

Section 140B of the Income Tax Act 1961 provides the procedure to calculate income tax on an updated return.

Payable Tax + Interest + Payable fees for non-filing of Income Tax (if any) + Payable amount as Additional Tax (For taking benefit of Section 139(8A))= Total Income Tax Liability.

Total Income Tax Liability (from above) – TDS/TCS/Advance Tax/Tax Relief etc = Net Tax Liability u/s 140B.

Short Brief of Additional Tax Liability

To avail the benefit of section 139(8A), the assessee is required to pay additional tax computed as under:

- 25% of tax, HEC, SC, and interest as calculated above, if an updated return is to be filed within 12 months from the end of the assessment year.

- 50% of tax, HEC, SC, and interest as calculated above if an updated return is to be filed after 12 but before 24 months.

How to Generate a JSON File If the Path & Excel Utility Are Not Found

Via the Income tax portal, people could file an updated tax return with the help of Form 139(8A). But the same could merely take place in the offline mode in which the JSON file is required to get generated through the use of the return preparation tool.

To prepare and generate the same JSON file, the IT department furnishes an Excel-based utility, however, the same shall need a .NET framework for running its macros.

At the time of generation of the JSON file through an Excel-based utility, a common issue that occurs is that a pop-up message prompts mentioning that “JSON is saved in the path”; the JSON file might not be present. When the ‘NET Framework 3.5’ is disabled, then the problem shall arise.

To solve the problem of not being able to generate the JSON file, 2 steps need to be chosen-

1. Enabling the ‘NET Framework 3.5’:

- Proceed to Control Panel ⏩ Programs and Features ⏩ Turn Windows Features on or off, or search for “Windows features on or off” in the start menu.

- Find “.NET Framework 3.5 (includes .NET 2.0 and 3.0)” and expand the feature by tapping on the plus symbol.

- Enable both categories and tap OK.

- When displayed, select “Let Windows Update files for you” and wait for the procedure to finish.

2. Downloading the .NET Framework 3.5 Service Pack 1 (Full Package):

- On Google Search for “dotnetfx35.exe”, navigate to the Microsoft website to download the file.

- After it gets downloaded, double-tap the setup file to install it.

- Reopen the Excel utility and attempt to generate the JSON file again.

Steps to File ITR-U (Income Tax Updated Return) Form

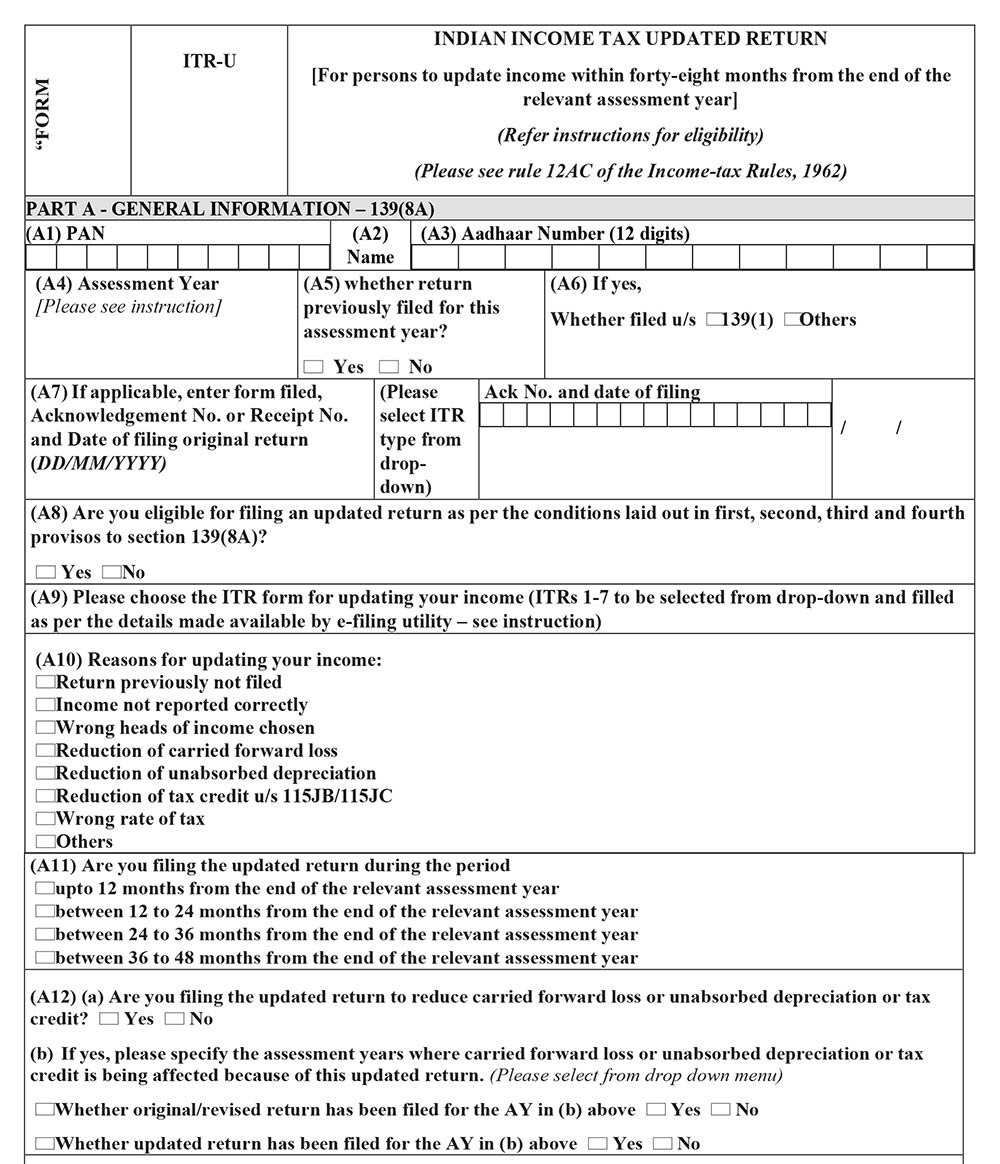

Part A: General Information-139(8A)

- PAN

- Aadhaar Number

- Assessment Year

- Whether return previously filed for this assessment year? (Yes/No)

- If yes, Whether filed u/s 139(1) or Others

- If applicable, enter the form filed, Acknowledgement no, or Receipt No. and Date of filing the original return (DD/MM/YYYY)

- Are you eligible to file an updated return as per the conditions laid out in the first, second and third provisos to section 139(8A)? (Yes/No)

- Please choose the ITR form for updating your income (ITRs 1-7 to be selected from the drop-down and filled as per the details made available by the e-filing utility – see instructions)

- Reasons for updating your income:

- Return previously not filed

- Income not reported correctly

- Wrong heads of income chosen

- Reduction of carried forward loss

- Reduction of unabsorbed depreciation

- Reduction of tax credit u/s 115JB/115JC

- Wrong rate of tax

- Others

- Are you filing the updated return during the period

- Upto 12 months from the end of the relevant assessment year

- Between 12 to 24 months from the end of the relevant assessment year

- Between 24 to 36 months from the end of the relevant assessment year

- Between 36 to 48 months from the end of the relevant assessment year

- (A12) (a) Are you filing the updated return to reduce carried forward loss or unabsorbed depreciation, or tax credit? Yes/No

- (A12) (b) If yes, please specify the assessment years were carried forward the loss or unabsorbed depreciation or tax credit is being affected because of this updated return

- Whether original/revised return has been filed for the AY in (b) above Yes No

- Whether updated return has been filed for the AY in (b) above Yes No

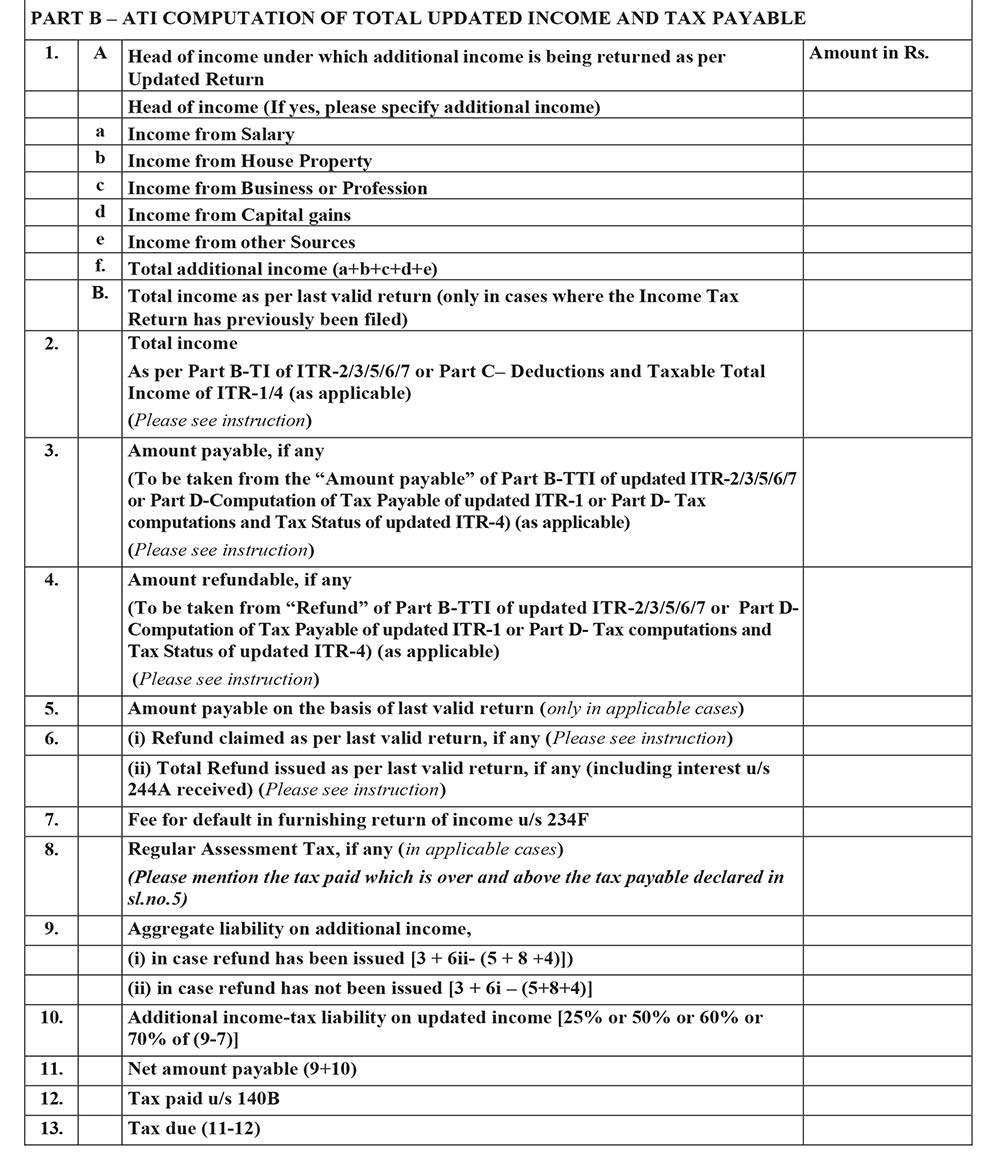

Part B: ATI Computation Of Total Updated Income And Tax Payable

- 1 (A) Head of income under which additional income is being returned as per the Updated Return

- 1 (B) Total income as per last valid return (only in cases where the Income Tax Return has previously been filed)

- As per Part B-TI of ITR-2/3/5/6/7 or Part C– Deductions and Taxable Total Income of ITR-1/4 (as applicable)

- Amount payable, if any (To be taken from the “Amount payable” of Part B-TTI of updated ITR-2/3/5/6/7 or Part D-Computation of Tax Payable of updated ITR-1 or Part D-Tax computations and Tax Status of updated ITR-4) (as applicable)

- Amount refundable, if any (To be taken from “Refund” of Part B-TTI of updated ITR-2/3/5/6/7 or Part DComputation of Tax Payable of updated ITR-1 or Part D- Tax computations and Tax Status of updated ITR-4) (as applicable)

- The amount payable based on the last valid return (only in applicable cases)

- 6. (i) Refund claimed as per the last valid return, if any (Please see instructions)

- 6. (ii) Total Refund issued as per last valid return, if any (including interest u/s 244A received

- Fee for default in furnishing return of income u/s 234F

- Regular Assessment Tax, if any

- Aggregate liability on additional income

- (i) in case refund has been issued [3 + 6ii- (5 + 8 +4)])

- (ii) in case refund has not been issued [3 + 6i – (5+8+4)]

- Additional income tax liability on updated income [25% or 50% of (9-7)]

- Net amount payable (9+10)

- Tax paid u/s 140B

- Tax due (11-12)

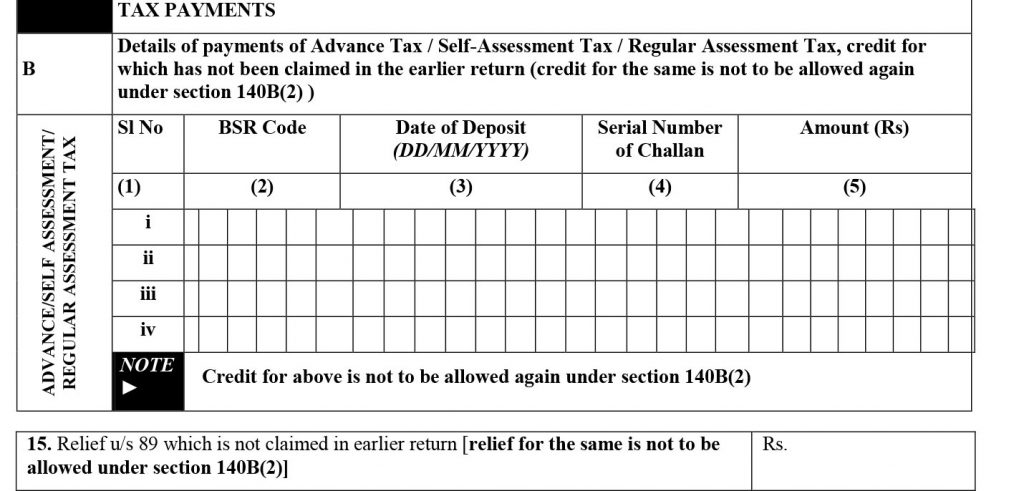

Tax Payments (Only as per Updated Return)

- Details of payments of tax on updated return u/s 140B

- Details of payments of Advance Tax / Self-Assessment Tax / Regular Assessment Tax, credit for which has not been claimed in the earlier return (credit for the same is not to be allowed again under section 140B(2) )

- Note: Credit for the above is not to be allowed again under section 140B(2)

- Relief u/s 89, which is not claimed in earlier return [relief for the same is not to be allowed under section 140B(2)]

Verification

I, son/ daughter, solemnly declare that to the best of my knowledge and

belief that the information given in the return is correct and complete, and follows the provisions of the Income Tax Act of 1961. I further declare that I am making this return in my capacity as _(drop-down to be provided in e-filing utility), and I am also competent to make this return and verify it. I am holding a permanent account number. (Please see instructions.)

Date: Signature:

Expert Overview on Income Tax Update Return

- Shailesh Kumar Nangia & Co LLP Partner reviewed this form and said, “The form has been kept very precise so that the assessee can fill in the relevant information easily. Further, it can be seen that only the amount of income to be allowed to be taxed is to be specified under the prescribed income heads. Unlike regular ITR forms, no break-up of income or any detailed information is required to be submitted, and the exact reason for filing an updated return is to be submitted in the form itself”.

- Sandeep Sehgal, Tax and consulting firm AKM Global Partner-Tax, said that Taxpayers desirous of filing it for the financial year 2019-20 will have to pay an additional 50 per cent of such tax and interest along with the tax and interest due. For those wishing to file for FY 2020-21, the additional amount would be 25 per cent of the tax and interest payable.

For those looking to file for FY2020-21, the additional amount will be 25 per cent of the tax and interest payable.

- Sehgal added, “Filing of an updated return is not allowed if it has the effect of showing a loss or reducing the total tax liability already determined or increasing the refund. The form requires appropriate disclosure in this regard,”.

- Kumar also said that the form is expected to be updated regularly with every passing year to make it wider for analysis and processing by the IT Department.

- Kumar added, “While returns can be verified only through Digital Signature Certificate (DSC) in tax audit cases and return can be filed by a political party, electronic verification code (EVC) can be an option in non-tax audit cases. The verification option is not specified by posting the acknowledgement in Bangalore,”.

Dear Sir,

Updated file return which not file in 139(1) so filing in 139(8A) so plz send format of Computation Format of ITRU4 plz ASAP

Click : https://blog.saginfotech.com/wp-content/uploads/2024/04/form-ITR-U.doc

itr u return challan paid under section with head clearify

Dear Sir

God evening.

1)My net income from pension, and bank interest after all deductions and exemptions for the AY 21-22. is 4,94, 080. I also got a refund of 4,900. Now I want to file an updated ITR showing an additional income of 1,662. What is my eligibility?(Filed U/S 139(1)

2)My net income for the AY 22-23 after all deductions &exemptions is 5,81,130 for which paid a tax of 27,275 . Now I have an additional income of 3,224 to show.What will be my tax liability(Filed U/S 139(1)

Regards

B S SARMA

I AM NOT FILED MY RETURN FOR A.Y.2021-22 & 2022-23 WHETHER I CAN FILE U FORM U/S139(8A) SOME TDS ALSO AVAILABLE IN 26AS AND MY INCOME IS BELOW RS.500000 AFTER CONSIDERING DEDUCTIONS KINDLY ADVISE

I CAN NOT FILE AN UPDATED RETURN F Y 21-22 WITH A TOTAL INCOME OF 340000 ALONG WITH 1000 LATE FEES

I HAVE NOT FILED INCOME TAX RETURN. MY TAXABLE SALARY IS BELOW RS. 250000.00 CAN I FILE ITR U FOR ASSESSMENT YEAR 2020 – 21 AND 2021 – 22

You can ITR-U only when the Taxable Salary is more than Rs 2,50,000.

My tax liability u/s 140B comes to Rs. 28,029/- and against the same, I have paid Rs. 30,000/- (after making rounding off) u/s 140B. Now, the system is not allowing the same, and the error is showing Para 13 should not be negative, in other words, the amount entered at Para 12 of Part B can not be more than Para 11 of Part B.

Please guide how to file updated return.

Updated Return is not allowed in case of Refund. As you have paid the amount more than the amount due then Net Tax Liability is coming as a refund. So, you have to Increase your tax liability to Rs 30000 in order to file an updated Return.

When can we expect ITR U filing through Genius

under which challan tax to be paid u/s 140B

whether Refund received in original return for AY 2021-22 have to be surrendered while submitting updated return for the FY 2021-22

Dear Sir,

We have not filed original return due to covid -19.Can i claim refund in updated return & what are other solutions available to us . kindly provide solutions.

Thanking you

Expected date of enabling ITR-U in e-filing portal?

Sir if we have paid the tax u/s 140A, but have not filed the ITR, Can it be filled in ITR – U now? What happens to the Tax amount paid u/s 140A– if it is filed in ITR-U now.

And What about the Interest 234A, 234B and 234C calculation regarding ITR-U.

If TAN number is wrongly mentioned in ITR can it be rectified through ITR-U. In such case what amount of fees is payable?

Is it a physical form or we can file it through Income Tax Portal or Genius Software ?

Now department just notified ITR-U Form for Updated Return but has not enabled E-Filling so as soon as the department will enable E-Filling you can file through Genius

New form for ITR-U filing for fiscal year 20-21 is not available online on the portal .please update me when it will be available

Sir, I the income is increased in ITR U but there is no tax effect, means my total income as per original ITR was 273,700/- was less than original income i.e. 420380/-. Can I file ITR U?

“Now department just notified ITR-U Form for Updated Return but not enabled E-Filling”

when can we expect this in IT portal