This article will explain the process of filing a request to condonation under section 119(2)(b) through online and offline methods. As we are aware, every taxpayer is required to submit their Income Tax Return within the stipulated timeframe, either by 31st July or 31st October, as per the provisions outlined in sections 139(1) and 139(4) of the Income Tax Act, 1961.

However, circumstances may arise where a taxpayer, due to genuine hardship or reasons beyond their control, is unable to meet the specified deadline, consequently facing substantial interest and penalties. In such scenarios, taxpayers have two available options. They can either submit the ITR-U form or initiate a request for the condonation of the delay in filing their Income Tax Return through the e-filing portal.

Fill Form for ITR & TDS Compliance Software

The ITR-U form, while a choice, comes with a significant drawback, as taxpayers may incur a hefty penalty of 25% or 50% of additional tax, under section 139(8A). This particular drawback, however, has been addressed by the Condonation Request process governed by section 119(2)(b). If the Assessing Officer approves the condonation request, the taxpayer is exempted from paying any interest or penalty.

Hence, the condonation of delay in filing the Income Tax Return stands as a special relief provided by the Income Tax Department under section 119(2)(b).

Basic Method to E-file the Condonation Request for Filing ITR Post-time Limitation

Here we have discussed the simple steps of online and offline filing requests for the condonation of an income tax return (ITR) beyond the deadline:

Online Method

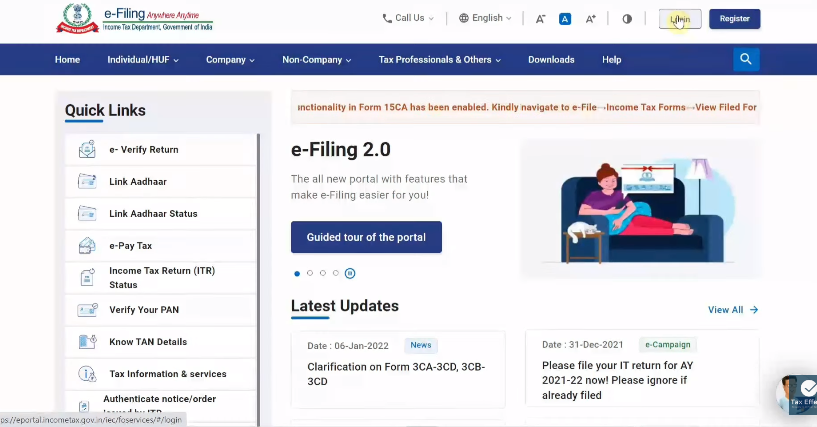

Step 1: Go to the e-filing website https://www.incometax.gov.in/iec/foportal/

Step 2: Then, log in by using your ID and password

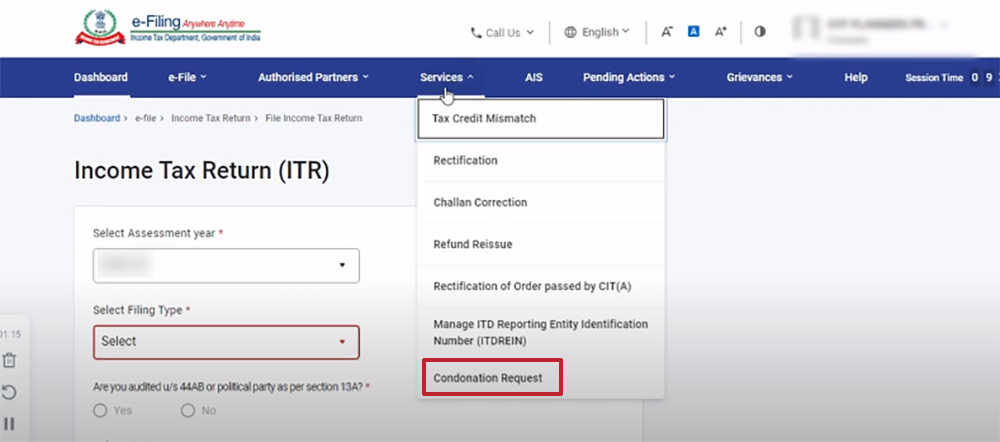

Step 3: Then, go to the dashboard, click on Service, and go to ‘Condonation Request’

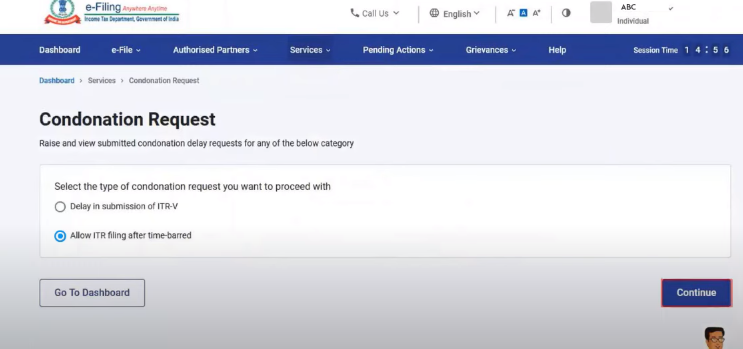

Step 4: When the condonation Request page appears, choose the ‘Allow ITR filing after time-barred option’

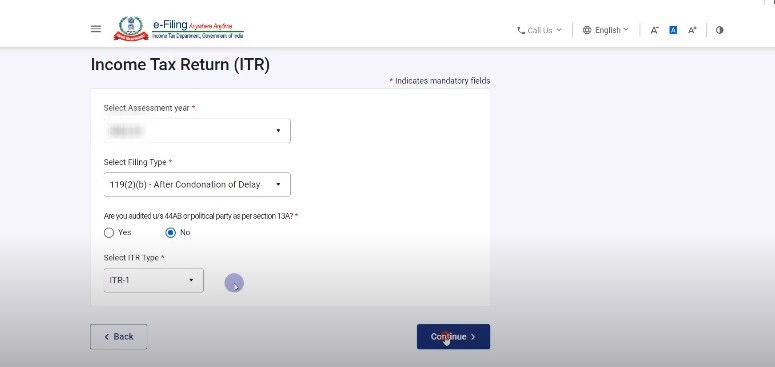

Step 5: Create ‘Condonation Request’. Upon reaching the ‘Enter Details & Upload ITR page’, enter the following details.

Step 6: Select the ‘Request Category, Assessment Year, ITR, Claim Value, Filing Type, Reason for Delay & ITR Type’ from the provided choices.

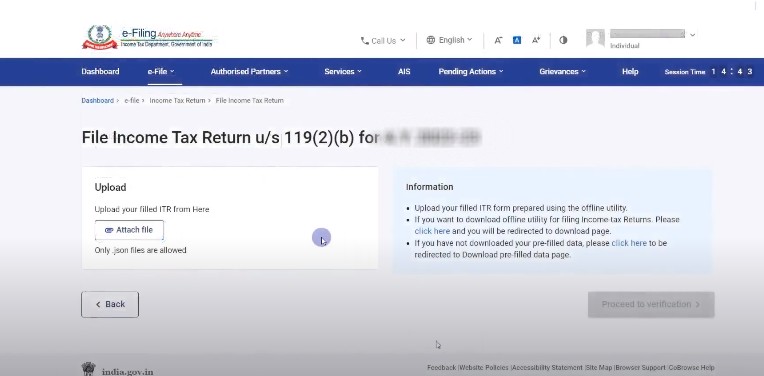

Step 7: Proceed to the ‘Upload ITR’ option and submit the Income Tax Return (in PDF/XLS format) corresponding to the condonation of delay request you are filing.

Step 8: Press on ‘Upload documents to upload the supporting documents

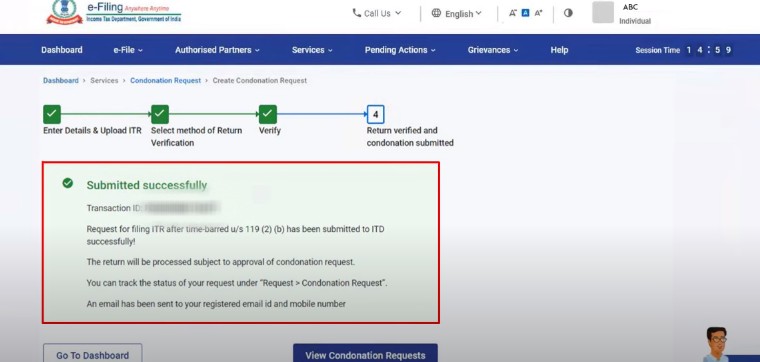

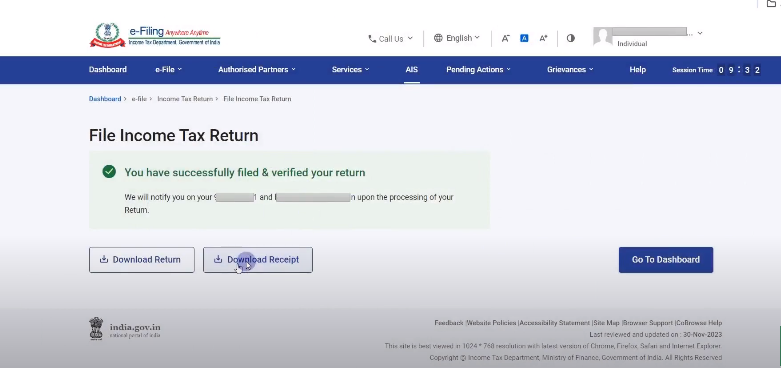

Step 9: After submitting the request, proceed to the e-verify page and choose an appropriate option. Upon completion, you will receive a successful e-verification message along with a Transaction ID.

Offline Method

As of today, the online submission option for condonation requests is not yet operational. Hence, it is necessary to manually submit an application, including a reasonable cause and its supporting documents, to the Principal CIT in your jurisdiction.

Upon approval, the PCIT will grant condonation and provide a letter with a unique number, which must be incorporated into the ITR. Please be aware that in such cases, only offline utility support is available, and online filing is not an option.

Procedure to E-File a Condonation Request After Verification of Late ITR

The process to file the condonation request for the late verification of the ITR is stated as-

Step 1: Proceed to the income tax e-filing website

Step 2: Log-in by using your user ID and password.

Step 3: Now go to Dashboard, ‘select ‘Services’, and then tap on ‘Condonation request’.

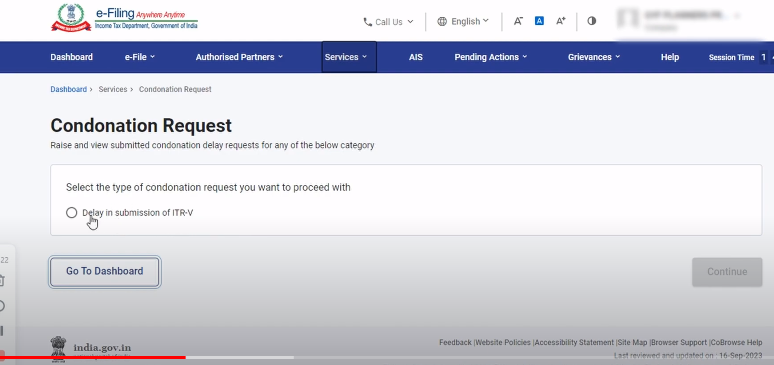

Step 4: After coming to the Condonation Request page, choose the Delay in the submission of ITR-V option.

Step 5: As the ‘Delay in submission of ITR-V’ page loads, press, ‘Create Condonation Request’

Step 6: When the ‘Select ITR’ page appears choose the particulars record for which you would want to raise a condonation request.

Step 7: Enter a reason for your delay on the ‘Provide reason for delay’ page.

Step 8: Press ‘Submit ‘and you will receive a successful message and a transaction ID.

Closure

Condonation of Delay Requests under section 119(2)(b) can be submitted not only for tardy filing and verification of the ITR but also for purposes such as claiming a refund or carrying forward and offsetting losses.

Nevertheless, the assessing officer will only accept such requests when there is a genuine hardship faced by the taxpayer. This section extends special relief to taxpayers, as upon acceptance by the assessing officer, there is no obligation to pay interest or penalties in the case of delayed ITR filing, or a refund is granted when claiming a refund.

After my retirement from Bank service on 30.11.2011, I could detect through RTI Act that the Bank has debited 57 days instead of 14 days as EXTRA-ORDINARY LEAVES and recovered my Hard-earned salary of 71 days on 22.10.96.

I am corresponding with the Bank since 2013-14 and the then Chairman confirmed over phone that he will settle my issues soon after attending Board Meeting. Later I was sick and undergone OPEN HEART SURGERY in DECEMBER 2015,

my youger brother expired in 2017 .Then I could contact the Bank but they were raising many doubts forwhich I have responded. Finally in January 2024 the Bank twisted the matter stating that the Leave matter was already settled prior to 1995.But its purely false since 24 days of leave debited DOUBLE TIME for the SAME VERY SAME DATES as per RTI CONFIRMATIONS.

Now I want to file writ in Supreme Court seeking refund of my 57 days salary due from 22.10.96.

Please confirm whether condonation is available

Please suggest me at the earliest. With regards