The latest feature has been updated on the GST portal in which the assessee can avail of the ITC despite it is not shown in GSTR-2A or 2B which is a bigger advantage to assessees.

To support the importers of goods along with the recipients of the supplies via SEZ search bill of entry that does not auto-populate in GSTR-2A. On the GST portal, a self-services functionality is open which is practiced to starch the same records in the GST system and bring these missing records through ICEGATE.

Download a Free Trial of ITC Software

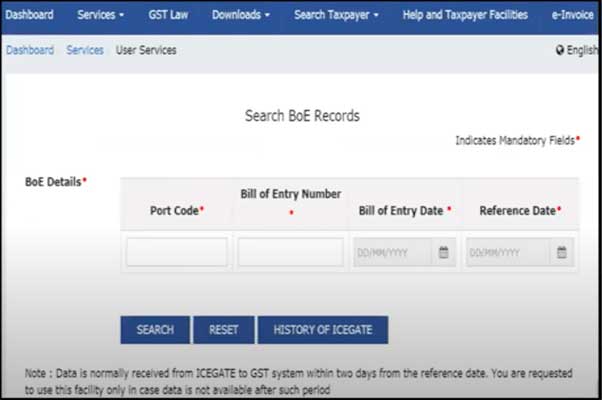

It uses 2 days post to the reference date for the BE information to get an update on the GST portal from ICEGATE. The system must be practiced if the information is not present post to the period. Note: The reference date might be out of the charge date, Duty payment date, or the revised date.

For records of type IMPG import of goods, information of period for Form GSTR-2A system-generated statement of inward supplies, reference date, bill of Entry Details like Port Code, BoE Number, BoE Date & Taxable Value; including the amount of Tax will be shown.

Towards the kind of records IMPGSEZ (Import of Goods from SEZ), details of Period for Form GSTR-2A; Reference Date; GSTIN of Supplier; Trade Name of Supplier; Bill of Entry Details like Port Code, BoE Number, BoE Date & Taxable Value, and the amount of tax will be shown.

The assessee is said to authenticate true information either from BE credentials or practising the portal of ICEGATE.

If there is any issue then you must generate the ticket from the GST support or GST self-service portal through engaging several information consisting of the full information about BE records, GSTIN, BE Number, BE Date, Port Code, Reference Number, and Screenshot of ICEGATE portal including BE record. While practising the “Search BoE” functionality on GST Portal they may face any kind of issues.

Easy Procedure of ITC Claiming

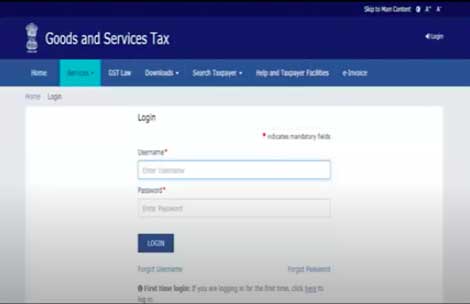

Step 1: The assessee should log in to the GST portal

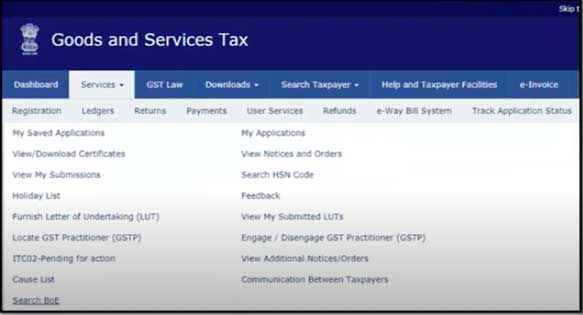

Step 2: Tap on the service tax and opt for Search BoE that is the latest functionality made inside the GST portal.

Step 3: On tapping the Search BoE you are required to insert all the information concerned to the Bill of entry port code, Bill of Entry Number, Bill of Entry Date, and Reference Date. Those individuals whose input tax credit has not been seen on GSTR-2A or 2B can enter the information of BoE.

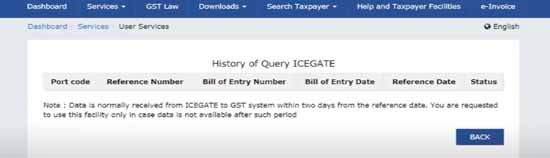

Step 4: The previous information of the fetched BoE taken through ICEGATE including the status of the issues is shown post 30 minutes from the time of hitting out the glitches. The same record will appear on search BoE, GSTR-2A and GSTR-2B if it is found on ICEGATE.

Step 5: Whenever the GST self-service portal fails to display the BOE, the taxpayer can raise a ticket on the GST help desk or GST self-service portal. The taxpayer must include the following details in the ticket such as GSTIN, BoE date, BoE number, Reference date and Port code. A screenshot of the BoE record on ICEGATE. Any other problem or error faced by the taxpayers with the search BoE functionality of the GST portal.

What is reference number and date to be filled in the form to fetch the details ?

I am facing problem of IGST on import not reflecting on GST portal. I have raised ticket on two ocassions. There is no satisfactory addressal of the greviance . When called the executive says we have escalated the matter to the concerned team and they will reply to you. Only email is the mode of correspondence for problem addressal by the concerned team . They asked me to upload screen shot from ICEGATE for transmission of data. I have even done that. But the reply is ” you have not uploaded required data”. Please upload the data within the stipulated time else the ticket will be closed. Even after uploading data in the required format my matter was not resolved and till today it remains as it is. The ticket was closed unresolved.

“Please consult GST practitioner for the same”

Exactly the same problem is being faced by me. More issues are there with BOE through ECCS.

How to get it resolved?

“Please raise complaint on GST portal for the same”

One BE is not reflecting in 2A & 2B, while I used “Search BOE” option in Portal, then it is reflecting in 2A only, but not in 2B. can we claim it accordingly. T/U.

“Please consult GST practitioner for the concerned issue”

Sir,

BOE details processed in History of Icegate but not coming to GSTR2A

i raised a ticket in grievance redressal portal almost 3 months back, but the status is showing ” Escalated to technical team”

how many days take to resolve my issue?

This problem is resolved by the portal itself, so it is better to get in touch with the concerned grievance redressal portal for a solution

Dear sir,

same problem , unable to avail the Import of goods not reflected in GSTR2B.

please resolve the same at the earliest

Dear sir, you need to contact your Supplier for the same or you can the same GSTR 2b whether is it coming in ITC not available column

Our IGST import bill is not reflected in the GSTR portal, even after searching in BOE check & Grievance. But we are availing the input credit from Jan to till I have availed import credit based on our Import Bill.

I am facing the same problem. Import of goods not reflected in GSTR2B only reflected in GSTR2A. Is your issue resolved, if yes then please tell me how?

Import of goods not reflected in GSTR2B only reflected in GSTR2A. Is your issue resolved, if yes then please tell me how?

For import from Nepal, it takes around 6 months for ICEGATE updation. How to take ITC in absence of icegate updation?

GSTR 1 was filed by the supplier by the 10th May 2022 for the month of April 2022 of the subsequent month which is reflected in GSTR 2A, but the same is not reflected in GSTR 2B instead GSTR 2B only reflect March 2022 invoices filed during April 2022 after 12.04.2022. In this case how to take the input.

Please read the advisory issued by the GST portal in this regard https://www.gst.gov.in/newsandupdates/read/542

i updated all the bill of entry details in the portal, some message done ,some are reflected no data available , then i check after 30minuts in 2A, but it is not updated in the portal, what shall i do?

Sir, you have to wait until data reflected in GSTR 2A/2B

Suman whether your problem resolved? if yes please tell me how?

As per new rules of gst from 31st December 2021, that we can only claim input as per shown in gstr 2B, but if some invoices are not showing in gstr2B for the same month but that invoice uploaded by supplier after due date and that invoice shown in gstr2A in next month, so in that case how can we claim the input of that invoice, even that input not showing in gstr2B of next month.

You can claim the same in GSTR 3B next month, if only if it is visible in your GSTR 2B Otherwise you need to contact the supplier for the same

i updated all the bill of entry details through the portal, message also came you can check after 30minuts in 2A, but it is not updated in the portal, what might be the reason?

What is the next step i have to take to reflect in the 2A

“Please contact to GST portal helpdesk for the same”

Sir, The Import Duty paid including GST through our forwarder which is not reflecting in GSTR 2B. Can i able to avail the ITC on Duty paid based on BOE. Please advise.

“Please contact to GST practitioner for the same”

I am facing the same problem. Import of goods not reflected in GSTR2B only reflected in GSTR2A. Is your issue resolved, if yes then please tell me how?