When the taxpayer’s company has used the company’s services outside India and payment has been made outside India, the taxpayer company shall not be obligated to deduct tax at source u/s 195, New Delhi ITAT ruled.

Under Section 195 of the Income Tax Act, TDS should be deducted at the time of credit or payment on specific payments made to non-residents, and it applies to interest, royalty, fees for technical services, and other sums levied to tax in India.

The Bench of B.R.R. Kumar (Accountant Member) and Sudhir Kumar (Judicial Member) noted that “except in two circumstances, firstly, where the fees paid in respect of services utilized in a business carried on by the assessee outside India or secondly fee is paid to earn any income from any source outside India, in all other cases the assessee is liable to deduct tax on the amount of technical fee paid to non-residents”.

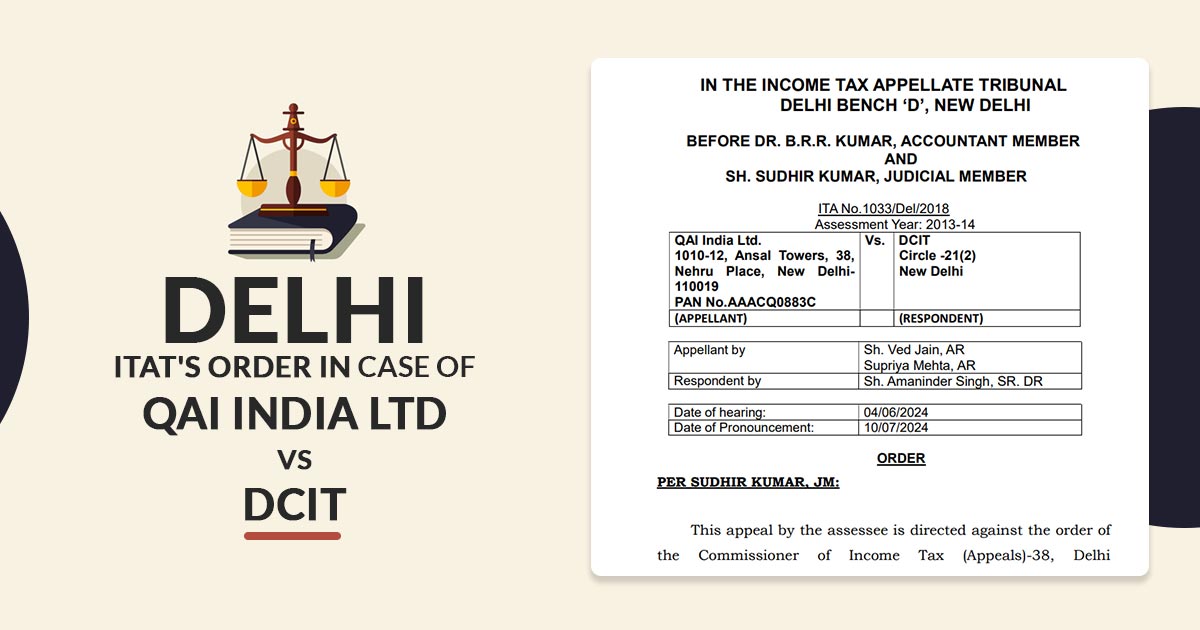

The Case of QAI India Ltd vs DCIT

The taxpayer company is in the software development business and has paid Everest Global Inc. without deducting tax at source u/s 195. It was noted by the AO that the taxable event and, therefore, the occasion for TDS, emerged when the taxpayer had made payment of royalty of Rs.54,65,508 to Everest Global Inc., and therefore made disallowance under section 40(a)(i).

Notices from the Tribunal

The Bench from a perusal of the order of CIT(A), discovered that Everest Global Inc. does not have any permanent establishment in India and the service was furnished from outside India to the taxpayer.

It was remarked by the bench that under the agreement entered between the taxpayer and Everest Global Inc., the services of Everest Global Inc. were used to carry out the project work and the income source was located outside of India and the payment has been made outside of India.

The technical services fee was paid via the taxpayer to make or earn income via any source outside India and hence stated section 9(1)(vii)(b) gets attracted, the Bench mentioned.

It was indeed mentioned by the Bench that the income made via these non-residents could not be considered to accrue or emerge in India and the fees for the technical services were not levied to tax.

ITAT remarked that a work order was issued outside India to make an income via a source outside India, concluded that the paid amount is covered in exception furnished u/s 9(1)(vii)(b), and the taxpayer was not needed to deduct tax at source.

ITAT deleted the addition that the AO made and permitted the petition of the taxpayer.

| Case Title | QAI India Ltd. Vs. DCIT |

| Citation | ITA No.1033/Del/2018 |

| Date | 10.07.2024 |

| Appellant by | Sh. Ved Jain, AR Supriya Mehta, AR |

| Respondent by | Sh. Amaninder Singh, SR. DR |

| New Delhi ITAT | Read Order |