The second wave of Corona-19 has ruined and devastated the life of crores of people on our planet. To date, nearly 185,390,254 people have slipped in this death trap; however, the major proportion of people have survived and the others have lost their lives. Still, there are hundreds of people who are still struggling for survival.

Coming to India, Government Machinery in India is welfare-oriented. Consequently, the Government of India has taken a multitude of steps for providing relief measures to the people of the country. In line with the abovementioned relief measures, the Central Board of Direct Taxes (CBDT) has provided tax deduction to the people whose life has been impacted by Corona. The CBDT has recently made a provision to provide tax deduction while filing Income Tax Return

Tax Relief Provided for Covid Treatment by way of Ex-gratia Payment

The Government of India has on Friday taken 2 steps

- The government provided tax relief to those people who received assistance from their employers or other people for the treatment of Covid-19

- The government granted concessions for ex-gratia payment that is received by the family members of those who have died due to this deadly virus

In case the family members of an employee received ex-gratia payment from an employer, then it shall be tax-free whereas in the case of others pay up to Rs 10 lakh shall be tax-free.

CBDT on Financial Support to Covid-affected Families

CBDT commented that there is a category of taxpayers who have lost their lives in the wake of Covid-19. Consequently, their employers and well-wishers have lent a helping hand to the family of those taxpayers who died by providing their families the financial assistance

For providing relief to family members of those taxpayers who have died, an income-tax exemption for the ex-gratia payment that has been received by the family members from the employer for the purpose of Covid-19 during the year 2019-20 and the subsequent years shall also be provided, CBDT added.

“In order to provide relief to the family members of such taxpayer, it has been decided to provide an income-tax exemption to ex-gratia payment received by family members of a person from the employer of such person or from another person on the death of the person on account of Covid-19 during FY 2019-20 and subsequent years. The exemption shall be allowed without any limit for the amount received from the employer and the exemption shall be limited to ₹10 lakh in aggregate for the amount received from any other persons, it added.”

Health Insurance for COVID-19 Pandemic

A tax exemption of up to Rs 25,000 could be claimed as per Section 80 D for the premium paid for a health insurance policy. The Health Insurance policies that have been bought to provide a cover to any Covid-19 related health expenses have also been covered under this deduction.

Elicit whether the amount incurred towards corona govid 19 if reimbursed by insurance company can be treated as revenue

In India, the COVID-19 treatment cost is reimbursed by an insurance company, it should generally be treated as a reduction in the medical expenses. It should not be considered taxable income, as it is merely reimbursement for expenses already incurred.

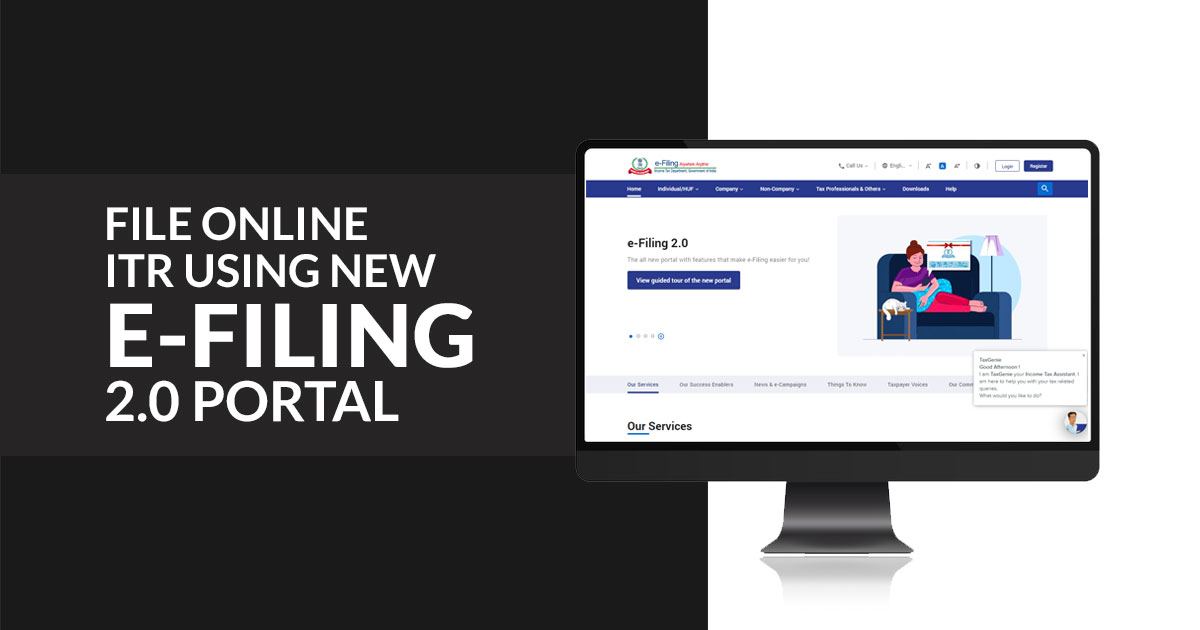

Sir, how to claim tax relief for the assistance received from employer. Under which section of IT rules I can claim refund?

whether any option available in ITR filing for claiming the COVID-19 reimbursement, if available where it is available in the software?