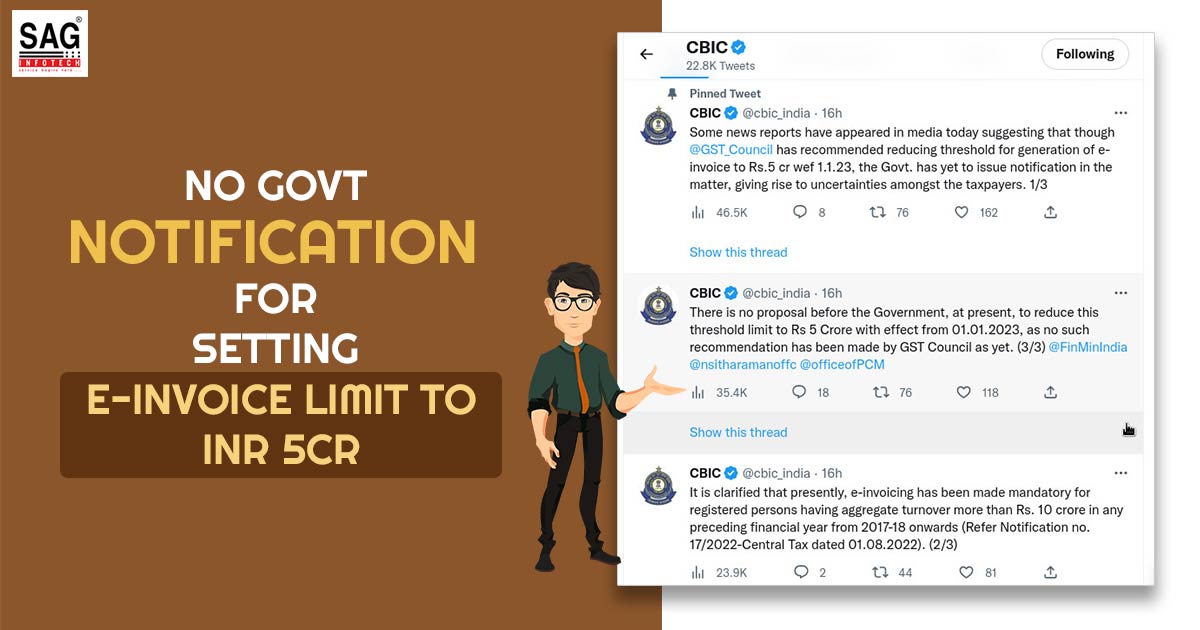

The CBIC stated on Monday that there was no suggestion before the government to decrease the threshold for the required creation of e-invoices beginning January 01st 2023. Businesses having revenue of Rs 10 crore or more are already required to create electronic invoices for all B2B transactions.

At this time, there is no suggestion well before Government to decrease this specified threshold to Rs 5 crore with force from 01.01.2023, as no such suggestion has been made by the GST Council as per the Central Board of Indirect Taxes and Customs (CBIC) stated.

According to media sources, the GST Council has proposed lowering the barrier for the creation of e-invoices to Rs 5 crore with beginning on 1, 2023, but the government has yet to release a notification on the topic.

E-invoicing for business-to-business (B2B) interactions was made required under GST law for enterprises having a turnover of more than Rs 500 crore from October 1, 2020, and was later extended to those with a revenue of more than Rs 100 crore on January 1, 2021.

Read Also: GST Council: Constitution, Functions and Decision-making

Companies having a turnover of more than Rs 50 crore began generating B2B e-invoices on April 1, 2021, and the barrier was reduced to Rs 20 crore on April 1, 2022. The limit was reduced to Rs 10 crore on October 1, 2022.