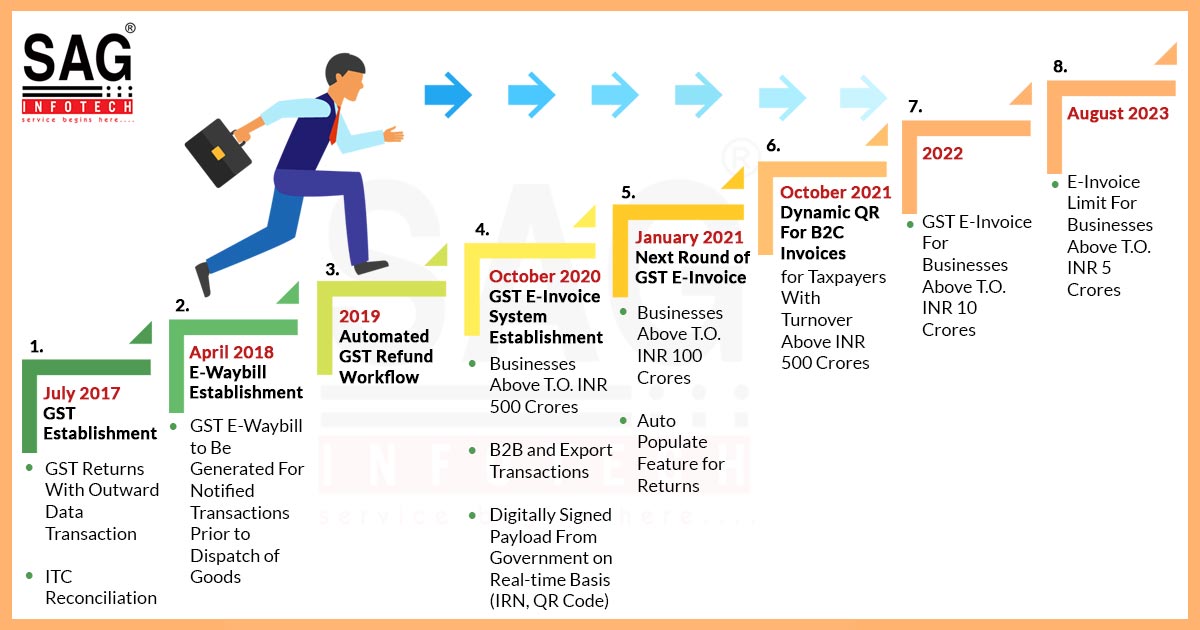

The Indian government has decided to make GST e-invoicing mandatory for firms whose turnover exceeds Rs 5 cr via central tax notification number 10/2023. The GST council has recommended the GST e-invoice limit and the new rule has already been effective voluntarily from August 2023 as per the notification no. 10/2023 – Central Tax.

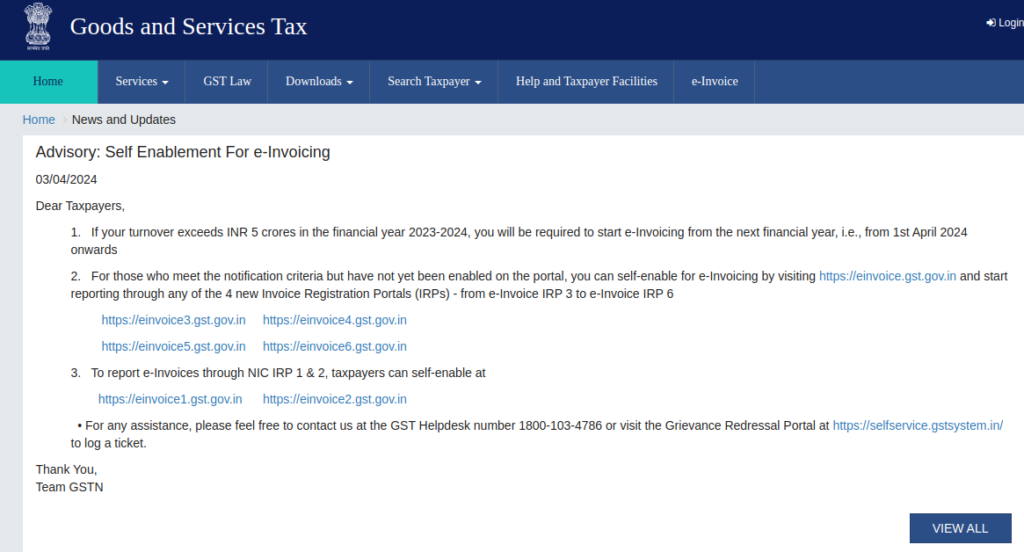

GSTN recently issued a new advisory to mandate generating GST e-invoices from 1st April 2024.

Entities who meet the government advisory basis can self-enable GST e-Invoicing by visiting the portal (https://einvoice.gst.gov.in),. Businesses can begin reporting via any of the four newly introduced IRPs, namely e-Invoice IRP 3 to e-Invoice IRP 6, accessible through the specific URLs.

- https://einvoice3.gst.gov.in

- https://einvoice4.gst.gov.in

- https://einvoice5.gst.gov.in

- https://einvoice6.gst.gov.in

Additionally, the taxpayers can select to self-enable their GST E-invoice reporting via NIC IRP 1 and 2 by visiting the following link

- https://einvoice1.gst.gov.in

- https://einvoice2.gst.gov.in

If you need any help or any related queries while setting up your process of self-enablement, don’t hesitate to contact the GST Helpdesk by phone at 1800-103-4786. You can also visit the Grievance Redressal Portal at https://selfservice.gstsystem.in/ to submit a ticket and get a quick resolution.

The same opt in the same year financial year to the companies whose turnover is over Rs 10 cr and then to Rs 5 cr. The same would be chosen to prevent revenue leakage and provide simple rules.

Free Demo of GST E-invoicing Software

The same action has the motive to digitize the higher volume of the transactions, effective clarity in the sales reporting, lower errors, and mismatches, automate the data entry work and rectify compliance.

GST Network (GSTN) renders the invoices, which seem to be ready for the subsequent phase in the 3 to 4 months, the council notified that.

Latest Updates for GST E-invoicing 5 Crore Limit

- GST Advisory for E-invoice system transition is mandatory for assessees with turnover between 5 to 10 crores. read more

GST E-invoice Limit for B2B

In Oct 2020 GST E-invoicing (electronic billing) was initiated and was made essential for companies that have a turnover of Rs 500 cr or exceeds, The same limit was drawn down lower to Rs 100 cr and then after that, it gets Rs 50 cr in 2021 for the business-to-business (B2B) transactions.

The assessee should generate the invoices on their internal system or billing software and then notify the same to the invoice registration portal (IRP) — a requirement to get an input tax credit (ITC).

GSTN Preparation for New Portals

A GSTN would execute the process of empanelling at least six enrollment portals to ease the higher volumes of transactions. The same would have one invoice registration portal for all the businesses.

Invoice registration services will be uninterrupted by increasing portals as they provide adequate IT infrastructure and an ecosystem. In addition, it allows taxpayers to choose between different portals’ services. Moreover, it aids in balancing the load on any IRP portal that faces challenges due to long queues due to heavy load.”

A GST official said last week that the GST Council had been informed of the development of the empanelment to increase the portals and had approved the move.

As per the official data, of the 219,000 eligible, GST identification numbers (GSTINs) with a turnover lying between Rs 20 crore and Rs 50 crore, 153,000 would generate the invoices. Likewise, those who have a turnover of Rs 50-100 crore generate 48,217 invoices among the 86,963 GSTINs.

Main Reasons for Lowering the GST E-invoice Limit

By lowering the threshold, revenues will be plugged and credit reconciliation will be improved on the buyer’s end. There is a problem with matching data on physical invoices, as well as human error. Credit availability will be increased as a result of this mitigation.

Beneath the e-invoicing, the firms that used to generate an IRP via a government portal and the same must be shown to the council at the time of goods movement.

Read Also: GST E-Invoicing Guide for Business T.O. 20CR with Exemption

From e-invoicing, sectors such as transportation, insurance, banking, other financial institutions, non-banking financial companies, goods transportation agencies, and passenger transportation services are exempted. Hence the units in the special economic zones.

There is new factory started from 1st April-2024 and our 5 Crore turnover will be completed in April-24 itself, then E-invoice become applicable to us from which date. As E-invoice condition is previous year turn over should be more than 5 crore.

“As per the new update, from 1st August 2023 the e-invoicing is mandatory for businesses with annual aggregate turnover of over Rs.5 crore in any preceding fiscal year from 2017-18 onwards.”

Sir Due to Confusion/mistake We have not raised invoice though e-invoice portal and now i want to generate e-invoice for the month of Aug To Dec’23 on e invoice…can we do , i have alleday filled R-1 and 3B on time for that period and also all the invoice report on time but not raised e invoice

Since you have filed GSTR-1 already so raising e invoice for the same period is of no relevance

IF EXCEED CURRENT FY. TURNOVER MORE THAN 5 CR. , need to provide e-invoice from this date?

Hello everyone, I have a question about the applicability of E-invoicing for a firm. If the firm’s turnover was below 5 crore in the previous financial years and exceeds 5 crore in November 2023 of the financial year 2023-24, when will E-invoicing become applicable for the firm? Will it be from December 2023 or from April 2024? Plz Suggest.

Crazy people. Y start in middle of the year that too in an add month, August?. What will they lose or will heavens fall, if it is started from new fy that is 1st April.

if i am selling exempted goods or tax free goods and my turnover is above rs 5 cr in that case whether e invoicing will be applicable ?