On July 30, 2020 Thursday, the Central Board of Indirect Taxes and Customs ( CBIC ) released a notification and introduced the “Schema for E-Invoice” for imposing the e-invoicing. It is for electronically-authenticated invoices, which will be implemented from October 1, 2020, only for entities businesses having a turnover of ₹ 500 cr.

As per the Rule 48(4) of the CGST Rules, 2017, Government is empowered to do the amendments. This time it made some amendments in Notification No.13/2020-Central Tax, dated the 21st March, 2020, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 196(E), dated the 21st March, 2020. Meanwhile the amendments were recommended by the Council.

In the first paragraph of Notification No.13/2020-Central Tax, dated the 21st March, 2020 the words “a Special Economic Zone unit and” will be inserted just before the words “those referred to in sub-rules”, and the words “five hundred crore rupees” will replace the words “one hundred crore rupees”.

The earlier released notification exempted a certain class of registered persons from issuing e-invoices or capturing dynamic Qr code. Here the certain class of registered persons includes banking company, insurance company, financial institution, passenger transportation service non-banking financial institution, GTA, etc.

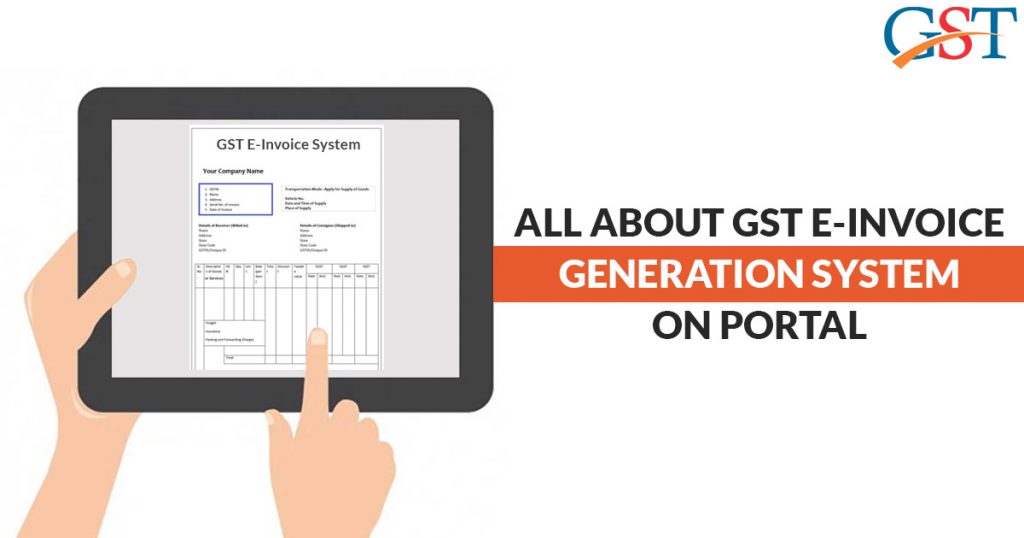

Read Also: All About GST E-Invoice Generation System on Portal with Applicability

The Notification said that “an invoice issued by a registered person, whose aggregate turnover in a financial year exceeds five hundred crore rupees, other than those referred to in sub-rules (2), (3), (4) and (4A) of rule 54 of said rules, and registered person referred to in section 14 of the Integrated Goods and Services Tax Act, 2017, to an unregistered person (hereinafter referred to as B2C invoice), shall have Dynamic Quick Response (QR) code: Provided that where such registered person makes a Dynamic Quick Response (QR) code available to the recipient through a digital display, such B2C invoice issued by such registered person containing cross-reference of the payment using a Dynamic Quick Response (QR) code, shall be deemed to be having Quick Response (QR) code.”