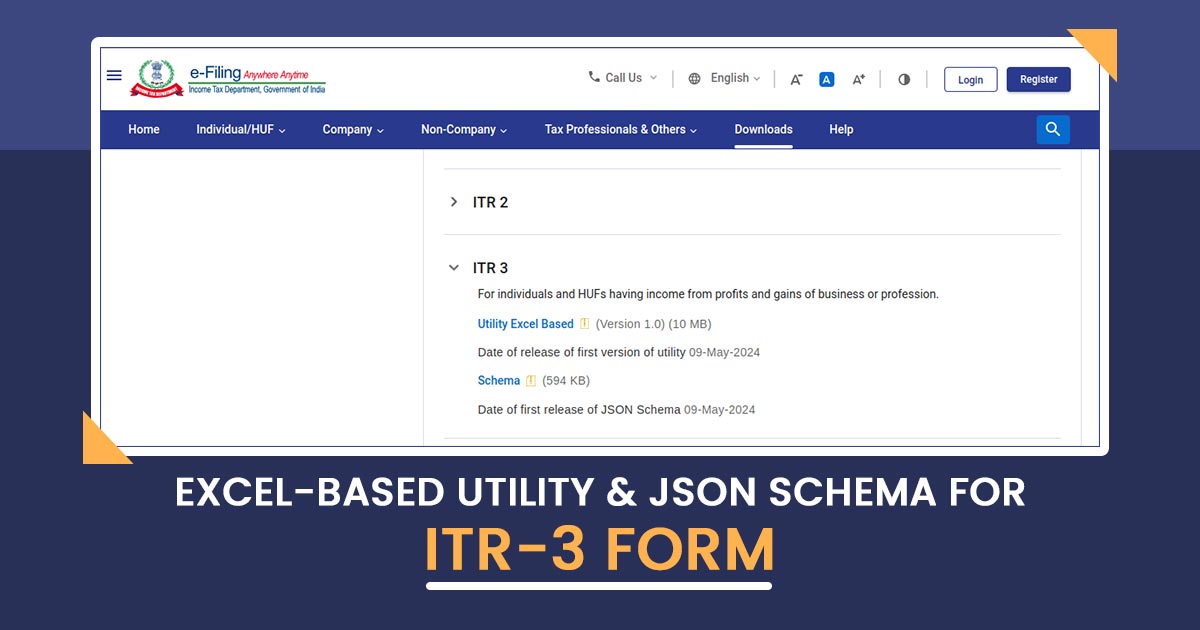

For filing income tax return-3 (ITR-3) for the financial year 2023-24 (assessment year 2024-25) the income tax department has released offline, online, and Excel utilities.

It directed that the taxpayers who come beneath the ambit of ITR-3 for FY 2023-24 (AY 2024-25) have the flexibility to choose between offline (Java), online, or Excel-based utilities to meet their tax obligations.

To download the e-filing ITR portal’s ‘Downloads’ section these utilities are accessible.

July 31, 2024, is the due date to file ITR for FY 2023-24 (AY 2024-25) apart from those necessitated to hold an audit of income tax.

Which Utility to Opt For?

Offline utility (Java): It has been tailored for the people who are dealing with the data for filing like those mandated to maintain the books or subjects to the tax audits. Through the use of the same utility, one could save the draft ITRs.

Online utility: It is ideal for the assessees who are asking for an easier process, in which the majority of the data gets auto-populated on logging into the e-filing ITR portal. The same option proposes convenience and efficiency.

Excel utility: It is set as an alternative for users who face challenges with the Java-based utility. The same proposes flexibility, users should practice caution at the time of the data manipulation to prevent Excel utility corruption, provided its dependency on MACRO-enabled operations.

Eligibility for ITR-3 Standards

ITR-3 is made for individuals or Hindu Undivided Families (HUFs) deriving income from business or profession.

The individuals who are obligated for tax under the head “Profits and gains of business or profession,” comprising of distinct income such as interest, salary, bonus, commission, or remuneration from a partnership firm, are required to file ITR-3.

It is important to learn that ITR-3 is pertinent to individuals or HUFs with business or professional income and cannot be used by entities that do not have such income streams.

Online ITR filing

A dedicated portal for e-filing income tax returns has been made by the income tax department.

For e-filing the return of income the taxpayers can log on to https://www.incometax.gov.in/iec/foportal.

The taxpayer who secures the salary income requires Form-16 issued via their employer. When they have made an interest on the FDs, or savings bank accounts and TDS has been deducted on it, they need TDS certificates i.e., Form 16A issued via deductors.

To verify TDS on salary and TDS other than salary they shall require Form 26AS. Through the e-filing portal, Form 26AS can be downloaded.

Taxpayers who are residing in rented premises require rent-paid receipts for the calculation of HRA (if they have not submitted it to their employer).