The Madras High Court directed reconsidering the issue of Input Tax Credit (ITC) under Goods and Services Tax (GST) reversed as of the discrepancy in GSTR 3B returns and GSTR 2A. On the condition of 10% pre-deposit, the order was set aside.

The applicant, Rishab Industries is engaged in wholesale and retail trading of plastic scraps and related items. The applicant claims that their GST compliance consultant was unable to keep them informed of the proceedings leading to the challenged order.

The counsel of the applicant furnished that the applicant’s annual return shows that the difference between the applicant GSTR 3B and the auto-populated GSTR 2A amounts to only Rs. 19,341.

Claiming that on the furnished chance, the applicant can elaborate the same difference and contest the tax demand, he conveyed that applicants wish to remit 10% of the disputed tax demand as a condition for remand.

Mrs. K. Vasanthamala, illustrating the government, said that the impugned order was preceded via an intimation dated 19.05.2022, an SCN on 08.06.2023, and a personal hearing notice on 28.06.2023.

A single bench of Justice Senthilkumar Ramamoorthy remarked that the ITC that the applicant claimed was reversed because of the discrepancy between their GSTR 3B returns and the auto-populated GSTR 2A.

But, considering the minimal discrepancy and the applicant’s willingness to challenge, the court believed the same is just and required to grant the applicant a chance to challenge the Madras HC tax demand on its merits.

Accordingly, on 15.09.2023 the impugned order was set aside, and the case was remanded for reconsideration. The applicant was asked to remit 10% of the disputed tax demand within 2 weeks, including furnishing a response to the SCN within the same period.

Read Also:- How to Respond GST Notice for GSTR 3B & GSTR 2A Mismatch?

Upon receipt of the response of the applicant and satisfaction of the remittance condition, the 1st respondent – The Assistant Commissioner was asked to furnish a reasonable chance to the applicant along with the personal hearing and furnish a fresh order within 3 months.

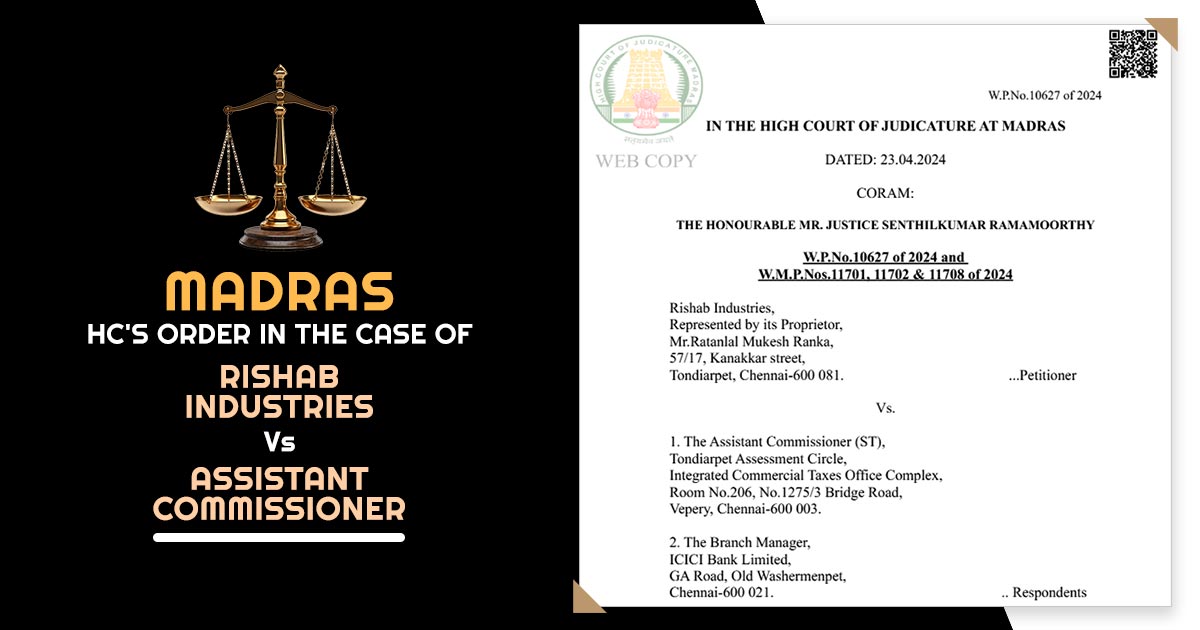

| Case Title | Rishab Industries vs Assistant Commissioner (ST) |

| Case No.:- | W.P.No.10627 of 2024 |

| Date | 23.04.2024 |

| Counsel For Petitioner | Mr.S.Ramanan |

| Counsel For For R1 | Mrs.K.Vasanthamala, Govt. Adv. (T) |

| Madras High Court | Read Order |