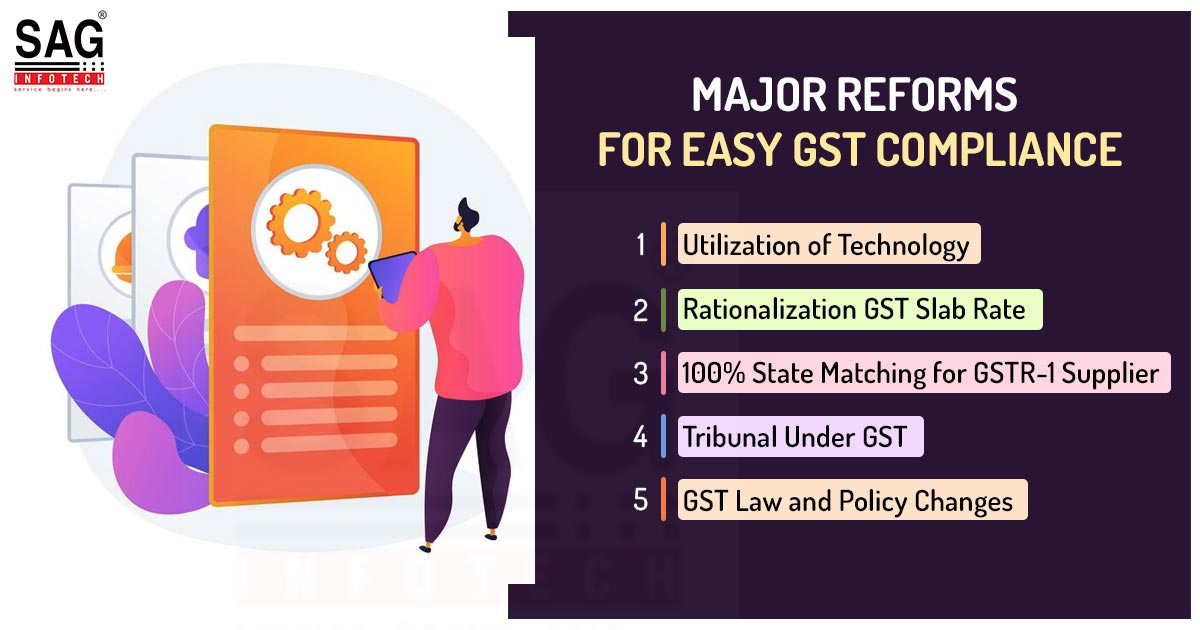

As India has entered into the year 2022 after a disastrous year and a quarter because of a pandemic and the tax structure is the basic part of the regeneration plan. When it comes to GST ( Goods and Services) which has been already going ahead while establishing its position and has been asked time and again by professionals and traders owing to many lags and vague provisions.

In the current year, 2022 might see a rejig of the GST provisions and slabs rate while considering the demands of the organizations, however also looking on meeting and its tax targets, supplied under the encouraging economic revival from the pandemic.

Technology Driven Council

As we step into digitalization, it will become the only way toward major shifting to a virtual economy tax administration. It will have a massive impact on the way India imposes taxes on offshore virtual economy organizations having a customer base here which has also been a huge problem for foreign organizations.

Moreover, with the current prominence on combining of returns to state advantages of Input Tax credit within GST, tax entities will be laying more emphasis on the utilization of technology via data analytics and enforcement of abidance, tax authority variety of information from the third parties, and emerged communication between controllers and investigating agencies.

As the tax authority has been capable to detect tax evasion in the way of the fake bill with the assistance of IT tools, it is believed that technology – relied on tax administration would acquire more significance in the nearby future.

GST Rate Slab Rationalization

The rate rationalization is actually something that we were taking up in our conversations from the advent of GST. Whereas, the rationalization of GST tax rate slab features and advancing effectiveness of the indirect tax system in the nation will be a prime focus for the policymakers. It is believed that the recent 4 rate slab structure will be deducted to three Slab structures by cancelling huge immunities.

This exchange will also step toward correction of inverted duty structure on several goods besides enhancing GST collection. But, the inflationary ritual might make the authority vary in cases where GST rates on specific goods are be enhanced as part of rationalization.

Customs Duty Amendment to Assist Aatma Nirbharta

The government is expecting to proceed to lower custom duty on raw stuff parts and components to be utilized by Indian manufacturers and similarly emerge duties on import of accomplished goods in support of the scheme of Make in India. And this is all they do while focusing on offering momentum to indigenous production.

Better Strategy for Compliance Burden

While doing the business for MSMEs and SMEs there has been a major hue and cry on the aspect. The MSME sector description for 30% of India’s GDP donates to 40% of exports from India. Meanwhile, the sectors are asking for the advancement in compliance burden at each angle, with the least statutory compliance.

Apparently, as the initial stage toward lowering in compliance burden, it has been stated that taxpayers with a yearly total turnover of approx Rs 5 crores are not needed to file the reconciliation statement in form GSTR-9C for FY 2020-21 ahead. Moreover, the taxpayers holding aggregate turnover up to Rs 2 crores aren’t needed to file yearly returns in form GSTR-9 for FY 2020-21.

But in juxtaposed toward these steps, the emerged barriers for profiting ITC with the insertion of the state of 100% matching of GSTR-1 of the supplier and GSTR-2A/2B of the recipient, will specifically include the submission burden on the taxpayers.

A taxpayer can definitely lower its output tax liability via using tax paid on the inputs utilized in their trade. Therefore, applying such restrictions enhances the compliance efficacy for taxpayers. Hence, it is not sufficient to be self- compliant, if in case the supplier is not compliant, the buyers’ ITC asserts will not be permitted.

Tribunal Under GST

A tax structure in India won’t work unless a proper apply forum. The lack of a GST Tribunal within the GST laws has been way more difficult which has been correctly identified by the Supreme Court as well. This causes various unresolved arguments, where there is no chance to appeal alternatively overburdening the High Courts. Meanwhile, the non-existence of a whole appellate mechanism later after more than 4 years of the launching of GST is a tough question to the Government’s priority and resolution of this concern.

The Bottom Line

It is apparent that the GST landscape has moved via law and policy changes, automation of compliance, and so on. The authority has made various changes under the self-certification of audit reports, making a compliance-driven procedure via the interplay of GST return, e- waybills and the e-invoicing system. Although, there are numerous aspects that the administration should work towards in the coming year where they mark the concerns of the industry to acquire its target smoothly of continuing the business in India.