The due date of Vivad Se Vishwas Scheme 2024 has been extended by the income tax department from December 31, 2024, to January 31, 2025. The scheme assists the taxpayers in settling the current dispute via filing a lesser income tax.

If the due date does not get extended then the taxpayer would be required to file a 10% additional tax to apply for the scheme. The due date extension has arrived as a great relief for the taxpayers who did not apply for the Vivad Se Vishwas Scheme 2024 till now.

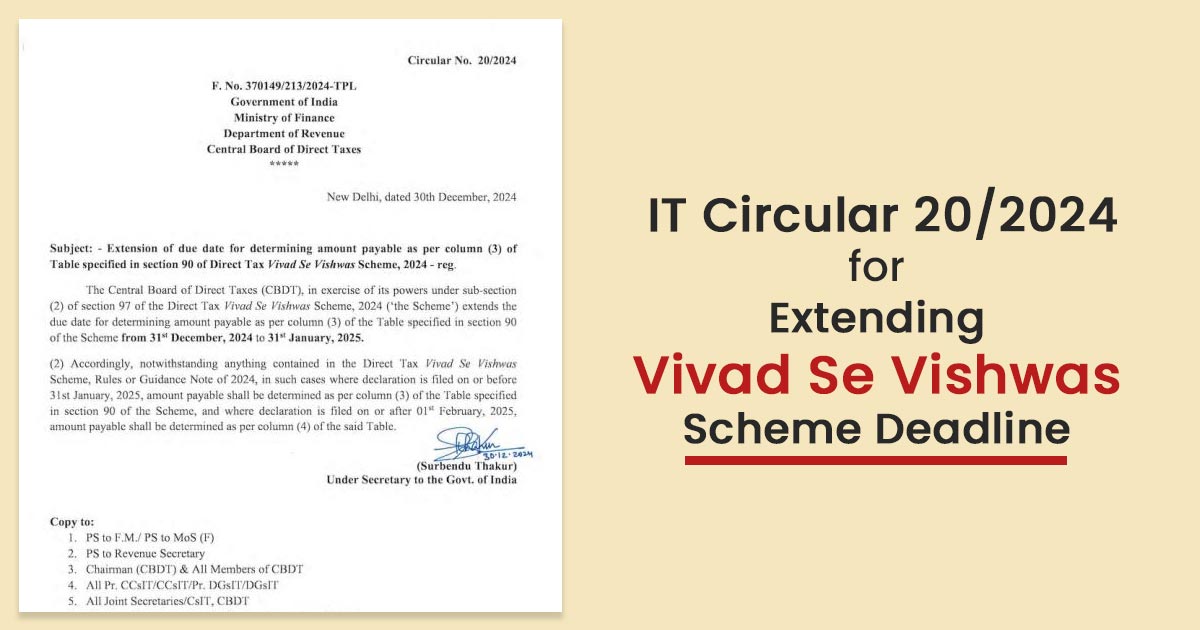

“The Central Board of Direct Taxes (CBDT), in the exercise of its powers under sub-section (2) of section 97 of the Direct Tax Vivad Se Vishwas Scheme, 2024 (‘the Scheme’) extends the due date for determining the amount payable as per column (3) of the Table specified in section 90 Of the Scheme from 31 December 2024 to 31 January 2025,” The Income Tax Department cited in a circular dated December 30, 2024.

From February 1, 2025, an additional 10% tax will be payable on applying for Vivad Se Vishwas Scheme 2024

The Income Tax Department in the circular in circular mentioned that “Accordingly, notwithstanding anything contained in the Direct Tax Vivad Se Vishwas Scheme, Rules or Guidance Note of 2024, in such cases where the declaration is filed on or before 31 January 2025, amount payable shall be determined as per column (3) of the Table specified in section 90 of the Scheme, and where declaration is filed on or after 01 February 2025, Amount payable shall be determined as per column (4) of the said Table.”

Tax experts cited that some taxpayers are in the process of applying VSV, an extension of 31 days shall furnish an effective relief to compute the impact under VSV and submit the applications to solve the income tax issues under the plea, if it is more effective.

Peculiarities are there in the provisions of VSV and the Central Board of Direct Taxes (CBDT) has already furnished two sets of FAQs (last on 16th December). The extension shall assist the taxpayers in comprehending the scheme and applying for it if it is more advantageous (particularly to buy peace of mind and to lower the expected cost of litigation).

Tax experts said that the same extension furnishes relief before the taxpayers who are under the evaluation process of whether to opt for the scheme or not. The taxpayers could file a Form 1 declaration for the settlement of the dispute till 31 Jan 2025. But this extension is not towards the matters where Form 2 has been furnished and where Form 1 has been filed previously via the taxpayer. The disputed tax payment is required to be made within 15 days from the receipt date of Form 2.

Read Also: A Guide to Dispute Resolution Scheme (e-DRS) with Benefits

As per the tax expert key forms under the Vivad Se Vishwas Scheme 2024 are:

- Form-1: The declaration form via which the taxpayers specify their objective to settle the disputes under the VSV scheme.

- Form-2: A “Certificate of Settlement” issued via the Income-tax Department on receipt of Form-1 and successful payment by the taxpayer.

Taxpayers who are filing Form-1 by January 31, 2025, will not be needed to file the extra 10% tax given that they specify their objective to choose for the scheme within the same duration. Under the scheme, the tax will be filed within 15 days of getting Form-2 from the Income Tax Department.

Also Read: Income Tax Dept Denies Using Digi Yatra Data to Track Tax Evaders

This extension shows the devotion of the government to lessen the litigation, simplifying compliance, and fostering a dispute-free tax ecosystem. To use the opportunity the taxpayers are motivated to settle the disputes and ensure compliance within time.

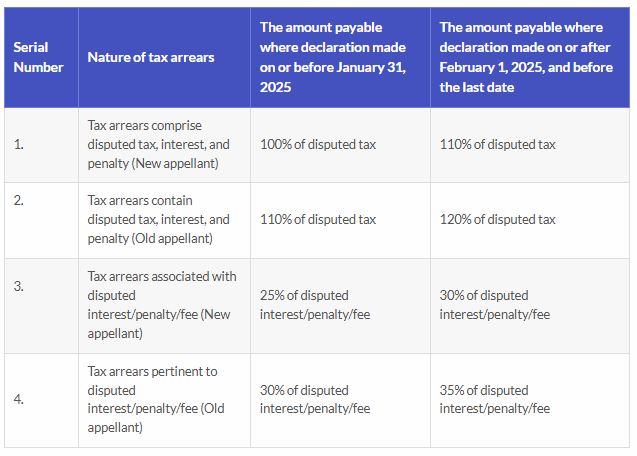

Tax experts cited that the deadline to find the amount liable to get paid u/s 90, column (3) of the Scheme’s Table, is extended from 31st December 2024 to 31st January 2025. For the taxpayer, this extension is important intending to take all the benefits of reduced payment rates under column (3). The circular outlines a bifurcation established on the declaration filing date-

- On or before 31st January 2025: The payable amount complies with the reduced rates established in column (3) of the Table under Section 90.

- On or after 1st February 2025: The payable amount will follow the higher rates established in column (4) of the same Table.

The extension aligns with the purpose of the government to solve the tax issues under the Vivad Se Vishwas Scheme. Through the extension of the timeframe, the government makes an assurance of much more participation, particularly from the taxpayers who may be constrained via the original due date.

An opportunity is been provided by the direct Tax Vivad Se Vishwas Scheme 2024 announced in Budget 2024 to the taxpayers for settling their uncertain tax disputes with the Income Tax Department. As per the scheme you would be required to pay the disputed tax amount and a particular percentage of the same disputed tax amount including a disputed tax amount with the application form.

After the particular tax amount gets deposited before the government including with the application form, the income tax department shall exempt all the other penalties, and penal interest amount and close the tax dispute matters.

within how many days we can that addional 10% interest (what is last day) . please provide with the proper resource