The Central Board of Direct Taxes (CBDT) has introduced a convenient way for taxpayers to access the Annual Information Statement (AIS) directly through the Income Tax Portal. This development enables individuals to obtain the statement by using their unique direct tax number, which has been issued by the income tax division.

To facilitate easy access to the AIS, there are now two options available:

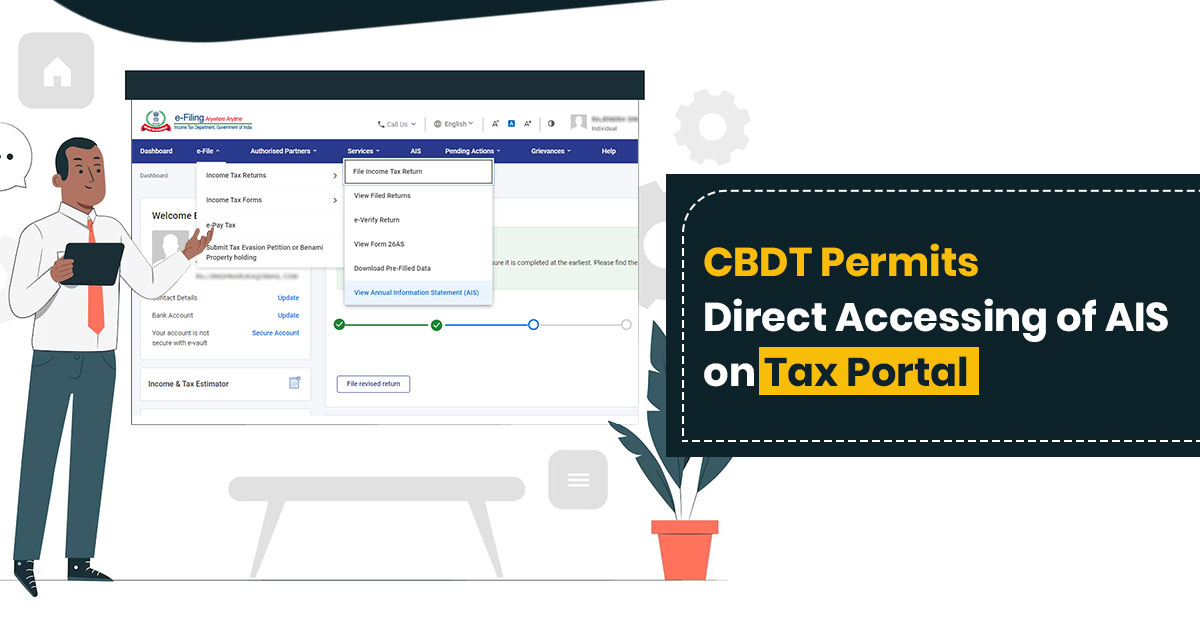

- AIS Tab: Users can locate a dedicated tab specifically designed for accessing the Annual Information Statement(AIS).

- E-file > View AIS for Income Tax Returns: Alternatively, taxpayers can navigate to the E-file section and select the option to view the AIS about their income tax returns.

The Annual Information Statement, commonly referred to as AIS and presented in the format of Form 26AS, provides taxpayers with a comprehensive breakdown of their information. It offers insights into various aspects such as Tax Deducted at Source (TDS), Specified Financial Transactions (SFT), and other relevant details. Importantly, the AIS includes both the reported value and the modified value, which is the value after taking into account any feedback provided by the taxpayer for each component.

The AIS serves as an expanded version of Form 26AS, encompassing details related to real estate acquisitions, high-value investments, as well as TDS/TCS transactions conducted throughout the fiscal year.

Furthermore, the AIS incorporates information regarding dividends, rental payments, stock and real estate transactions, overseas transfers, interest on deposits, GST turnover, and other income sources.

To cater to different requirements, the Annual Information Statement is available for download in three file formats: PDF, JSON, and CSV. It consists of two parts, namely Part A (providing generic information) and Part B (focusing on TDS/TCS information).

Utilising the AIS is of utmost importance when filing income tax returns(ITR). Tax professionals must exercise extra diligence in submitting their clients’ taxes within the stipulated deadline, especially as the due date approaches. The recent upgrade aims to streamline the process of reviewing the data reported to the Income Tax Department and accessing the Annual Information Statement.

In a recent news release concerning the e-verification scheme, the CBDT has advised income taxpayers to file revised forms if they have either underreported their income or failed to report it together.

It is worth noting that the Income Tax Department plans to levy penalties on 33,000 individuals who have not filed updated returns to address discrepancies between the Income Tax Return and the Annual Information Statement.