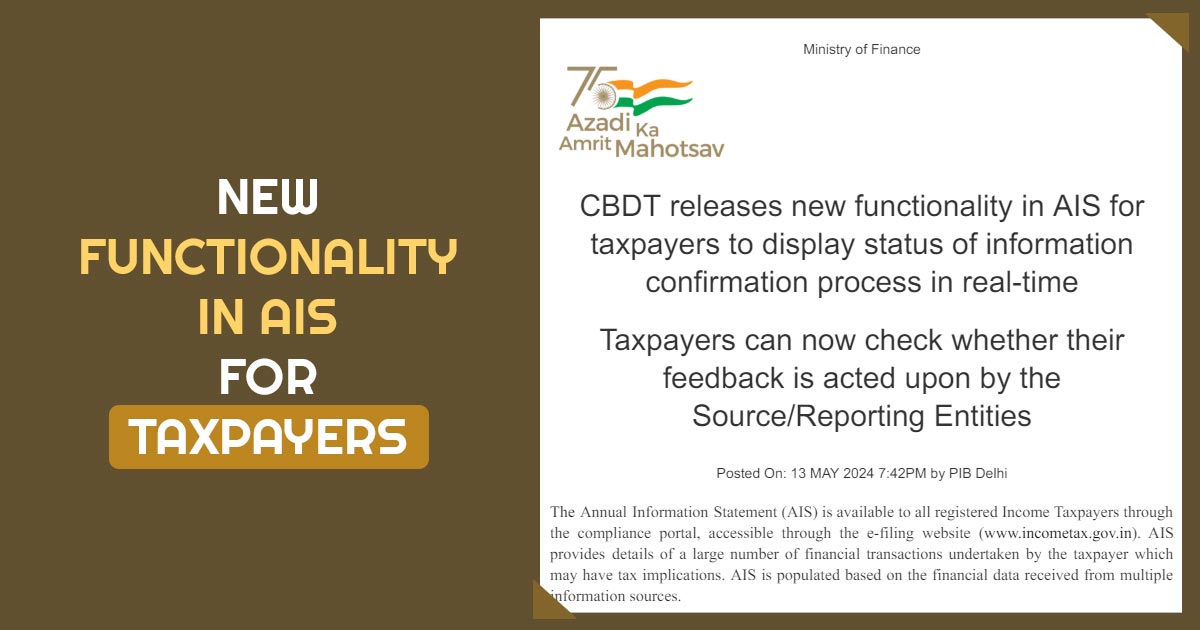

A new feature has been introduced by the income tax department within the Annual Information Statement (AIS) to enable assessees to track the status of the information confirmation process. The same development has the objective of increasing the clarity and preciseness in tax reporting by furnishing the assessees with insights into their financial transactions that impact their tax liabilities.

Financial Transactions Insight

The Annual Information Statement (AIS) aggregates the financial information obtained from distinct sources to provide taxpayers with a complete overview of their financial measures. It comprises of distinct array of transactions where the taxpayers have been engaged, each borne tax implications.

The Procedure of Interactive Feedback

AIS’s notable feature is its interactive feedback procedure, authorizing the taxpayers to furnish comments on each listed transaction. The same feedback procedure acts as an important tool for taxpayers to verify the preciseness of the data sourced from external entities. Tax heads on finding out the differences initiate the procedure of rectification with the respective information sources.

Managing Past Challenges

Former experiences like issues faced by the taxpayers for jointly held fixed deposits have prompted authorities to develop innovative solutions. AIS infuses tools to manage these challenges. The system renders transparency on whether the feedback furnished via the assessee has been considered by the respective information sources. If the feedback is accepted partially or in full, the responsibility lies with the source to correct the information by proposing a correction statement.

The information confirmation feature is operational for data furnished through the tax deductors or collectors and reporting entities, the Central Board of Direct Taxes (CBDT) underscores. It shows tax authorities’ proactive strategy to ensure the preciseness and reliability of the financial information used for the tax assessment objectives.

Facilitating Verification Procedure

The income tax department through merging an automated feedback procedure within AIS has the objective to facilitate the procedure of verification and improve compliance. The same initiative does not just promote clarity but indeed empowers the assessees to actively take part in ensuring the preciseness of their tax-concerned information.

Read Also: Have You Checked AIS After ITR Filing, Reason Will Shock