Budget 2020 may bring good news for the taxpayers by announcing a flat tax rate without exemptions. Finance Minister Nirmala Sitharaman may announce a reduction in Income tax slab and new Income tax slab for individuals with the high-income bracket in the budget 2020-21.

Personal income tax may reduce in consonance with the reduction in corporate tax after the evaluation of the proposals for budget 2020 expectations to invigorate the consumption and bring back the healthy economic conditions.

It is anticipated that the rate of personal income tax may get altered by the Modi government through an announcement of relief for salaried people in the budget to be presented in February. As per the sources, the way the Modi government had reduced the rate of corporate tax a few months ago, the income tax rates on personal income

All the proposals and recommendations will be thoroughly examined, before taking the matter of providing tax relief to the highest level. The government will assess its effects on the Indian economy and the loss to the exchequer, before finally presenting the budget on February 1 which may bring tax relief for the people with low to medium income.

A person associated with the matter said, “All options are being examined… Any such move needs to be examined in the context of gains it can bring to the overall economy vis-a-vis the cost it entails.”

Alternate actions, besides income tax cuts, includes schemes like PM-KISAN or increased expenditure on the infrastructure sector. Just as the government has attempted to benefit the farmers of the country, relief on income tax can be given on the same lines to deal with the economic slowdown.

Amendments in the tax structure will be beneficial only for 30 million persons who are taxpayers, stated the person, also underlined the balance to be kept between the cost to the exchequer and the benefits by the consumption increase.

At the same time, the person said, “infrastructure sector spending has a multiplier effect”.

Already, the Government of India (GOI) has relinquished INR 1.45 lakh crore by cutting down the corporate taxes. However, this was a part of direct tax reformation to draw investments. On the other side, this rate cut in corporate taxes germinated appeals for rate cuts in personal income tax as the relief in the regard was absent in the last budget.

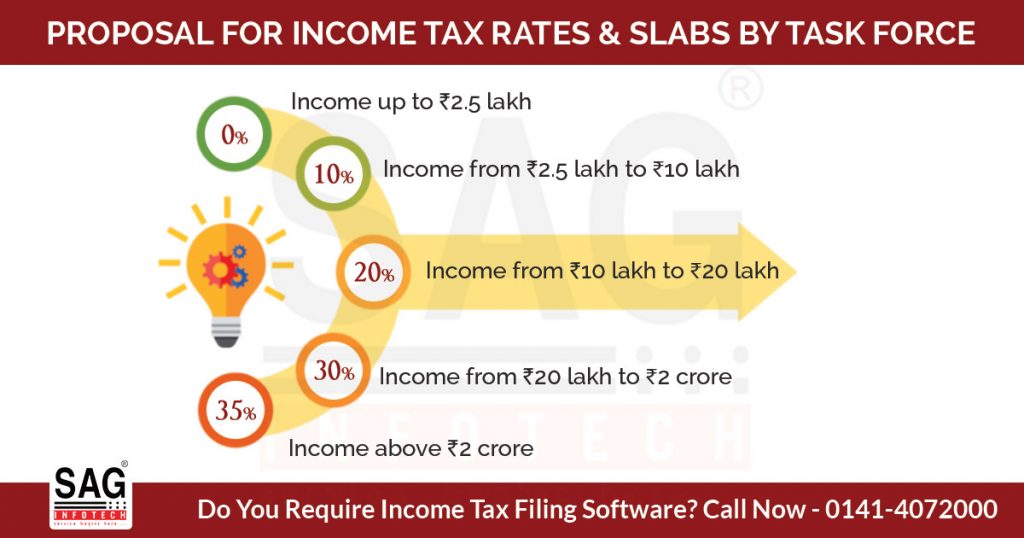

Read Also: All About Proposal Made for Income Tax Slabs & Rates by Task Force

As per the sources, the Modi government can fix an income tax rate of 10% for annual income between INR 2.5 lakh to INR 10 lakh in the budget 2020. For taxpayers with income between INR 10 lakh to INR 20 lakh, the income tax rate can be reduced to 20%. People earning between INR 20 lakh to INR 2 crore may have to pay a tax of up to 30% and above this income bracket, the income tax rate may increase to 35%.

However, the exemption limit for income tax may remain unchanged. Currently, it is INR 2.5 lakhs. Income above INR 2.5-5 lakh is taxed at 5%; between INR 5-10 lakh is taxed at 20%, and above INR 10 lakh is taxed at 30%. For many years, there has been stability in the tax rate slabs despite the relief at the lower end been given by the GOI through rebates.

Conversely, individuals with high-income discovered the upturn in the liability discharged by paying a surcharge. Elimination of the surcharge on incomes at the upper limit has been recommended by the task force. Currently, individuals earning more than INR 50 lakh needs to pay an additional surcharge of 10-37%, based on their income.

The direct tax task force