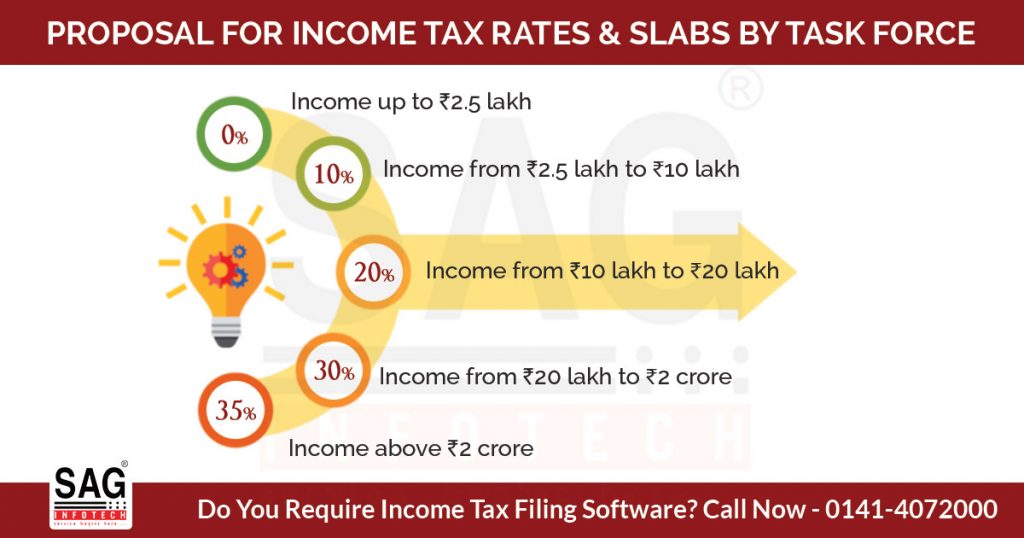

The current three tax rate slabs of 0%, 5%, 20% and 30% are anticipated to be extended to five of 0%, 10%, 20%, 30% and 35%, on the recommendations of the exclusive task force which was appointed by the Government of India (GOI).

This special task force submitted its report on the new Direct Tax Code to the Finance Ministry on new Direct Tax Code, looking forward towards the replacement of the current Income Tax Act.

The government-appointed force wants some changes in the Income Tax Act which has its roots back in 1961. Although the demand has not been made for increasing the exemption limit beyond ₹2.5 lakh of the current but demands for the addition of tax brackets has been made by them.

Read Also: Revisit History of Income Tax Slabs (1944-45 to 2018-19) in India

The recommendations made by the task force include lesser income tax liability at 10% and 20% on annual income between ₹5 lakh to ₹10 lakh and ₹10 lakh to ₹20 lakh, respectively. Besides, the proposal for introducing a new 35% tax bracket for annual income more than ₹2 crore along with the surcharge has also been made.

According to the reports, no changes have been suggested for the 5% tax bracket or the current rebate of ₹12,500 and 30% Income tax slab rate will remain the same for annual income between ₹20 lakh to ₹2 crore.

Current Tax Slabs with Rate vs Recommended by the Task Force

| Current IT Slabs | Current Applicable Rate | Task Force IT Slabs | Task Force IT Rates |

|---|---|---|---|

| Income up to INR 2.5 lakh | 0% | Income up to INR 2.5 lakh | 0% |

| Income from INR 2.5 lakh to INR 5 Lakh | 5% (Rebate – INR 12,500) | Income from INR 2.5 lakh to INR 10 Lakh | 10% (Rebate – INR 12,500 up to INR 5 Lakh) |

| Income from INR 5 lakh to INR 10 lakh | 20% | Income from INR 10 lakh to INR 20 lakh | 20% |

| Income more than INR 10 lakh | 30% | Income from INR 20 lakh to INR 2 crore | 30% |

| Income Above INR 2 Crore | 35% |