New discussions will take place by the Central and State government to fiddle with the goods and services tax (GST) after the presentation of Union Budget on 1 February 2020, told by a government official having direct knowledge about the matter.

Finance ministers of central government along with that of state governments will dig out the ways to cope with revenue deficiency and GST compensation to states in the coming Fiscal Year beginning from 1st April. Besides, finance ministers will also put heads together to overhaul the GST slabs rates Grab the information of revised GST slab rates on consumer products in India, Although the GST council finalized the slab rates like 5%, 12%, 18% and 28%. Read More.

The Centre and states, together, will find a solution to resolve the GST structural errors which are leading to deficiency in GST collection.

Initially, many GST related rate cuts & exemptions were introduced with an intent to neutralise the revenue but it led to revenue deficiency which is a contrast to the original plan.

Rate cuts in GST on consumer goods have resulted in a situation where taxes paid on raw materials is more than taxes paid on finished goods in order to claim more refunds by the way of availing excess payments made.

Warnings have been arrived by the GST experts that any structural alterations in GST are going to disturb whole industry, instead of bringing stability.

“It would be prudent to allow the economy to stabilize before embarking on any changes as businesses would prefer stability and certainty in tax policies when they are grappling with global economic headwinds,” stated M.S. Mani, partner at Deloitte India.

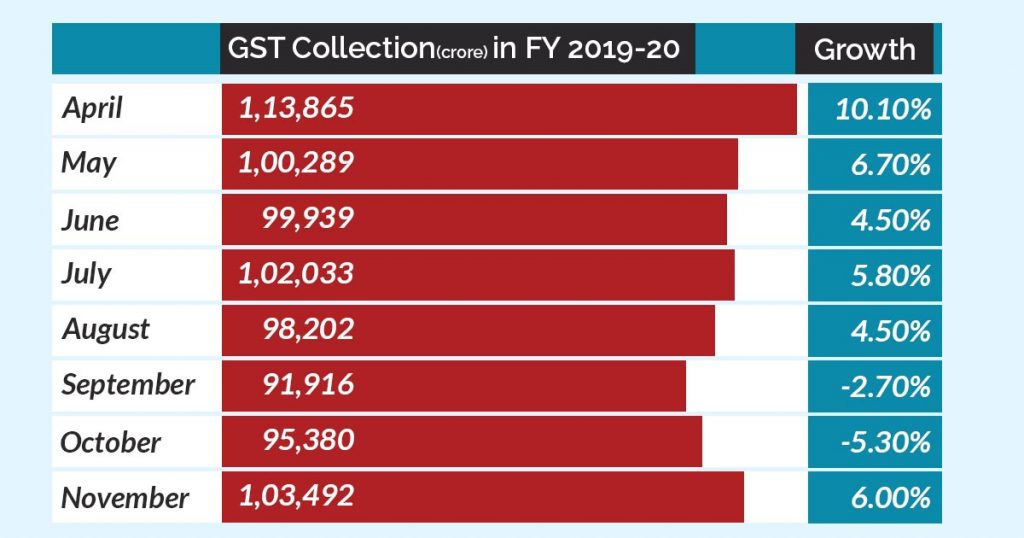

Read Also: 6% Rise in GST Collection in November Shows Signs of Economic Recovery

Availability of adequate revenue to recoup the losses associated with GST is another important issue which will be pondered upon by the centre and state-level finance minster as the stability of GST as well as the relation between centre & state relies on it.

It is anticipated that the Budget 2020 will actualize the suggestions made by the Fifteenth Finance Commission (FFC). The interim report submitted by FFC to President Ram Nath Kovind and finance minister Nirmala Sitharaman at the beginning of the month throws light on dividing the tax revenue between Union and state governments.

Currently, the Centre shares 42% of the whole tax revenue with the state, however, if it goes down, it may lead to clashes between centre and state.

The Centre wants States to abbreviate their compensation dues, however, states are not interested in doing so and that’s why the State Ministers did not respond ardently to the suggestion of cutting the compensation by states, made by FFC to the GST Council meeting

The way this problem is sorted out will affect the final report of FFC for the five years completing FY26.

“It is easy to say states’ revenue loss should be met, but when there is not enough revenue, what is to be done? Now, there is a recognition among all that these issues need to be discussed,” said the official cited earlier.

A presentation was made on revenue patterns by officials at the GST Council’s meet, held on 18 December. In the same meeting, the officials suggested for the reconstruction of GST slabs and rates, but, States on this matter as well did not respond enthusiastically.

The GST Council cancelled the proposal made by officials related to the shuffling of GST rate slabs because of the economic downturn and the fact that increase in rate on goods under the lower rate slabs will increase the price burden for the common man.

In the last meeting, the GST council had wrapped up that the increase in the rate of cess on products under the highest tax rate slab of 28% will not be adequate enough to boost the revenue to the point that it would offset the shortfall.

However, products like cosmetics, perfumes, cosmetics and vacuum cleaners which were displaced from 28% slab to the 18% slab may become a focal point of any rate increase in future.

So far, the decisions related to rate cuts & other reliefs provided to businessmen & traders have resulted in the relinquishment of approx INR ₹1 trillion per year by the exchequer, including the rise in the threshold for – GST registration to INR 40 lakhs from INR 20 lakhs, – compensation scheme to INR 1.5 crores from INR 75 lakh and decline in the tax rate to 1% from 2% to producers under that scheme.