The Madras High Court has instructed the government tax department to send out a circular encouraging taxpayers to hire only qualified professionals for handling their Goods and Services Tax (GST) matters.

Justice Krishnan Ramasamy mentioned that, “This Court comes across similar instances in several cases, extending ill advice to the clients by the consultants, who are all not qualified persons. Such kind of ill-advice leads to the fact that the clients are not in a position to appear before the Officers concerned with a suitable reply supported by documents, which is purely on the negligence on the part of the consultant.”

Taxpayer/applicant received a Show Cause Notice. The taxpayer submitted an irrelevant response due to the poor advice from the consultant.

Therefore, the Assistant Commissioner passed the impugned order. Also, the taxpayer’s account was frozen by the bank, which resulted in a halt to the taxpayer’s company.

Due to the workload, the poor advice of the unqualified consultant has been given, as they advise many clients, the bench added.

The taxpayer must be provided proper circular for the engagement of a qualified consultant, the bench asked the department.

Read Also: How to Respond to a GST Notice for Dual Jurisdiction (SGST & CGST)

The bench cited that, “This type of wrong advice given by an unqualified person cannot be accepted. The respondent department is directed to issue note/circular to the assessees to engage consultants and get advice from qualified consultants. Otherwise, the assessees file petitions directly through employees or relatives.”

The taxpayer has been given one more chance by the bench for the above, and it set aside the impugned order.

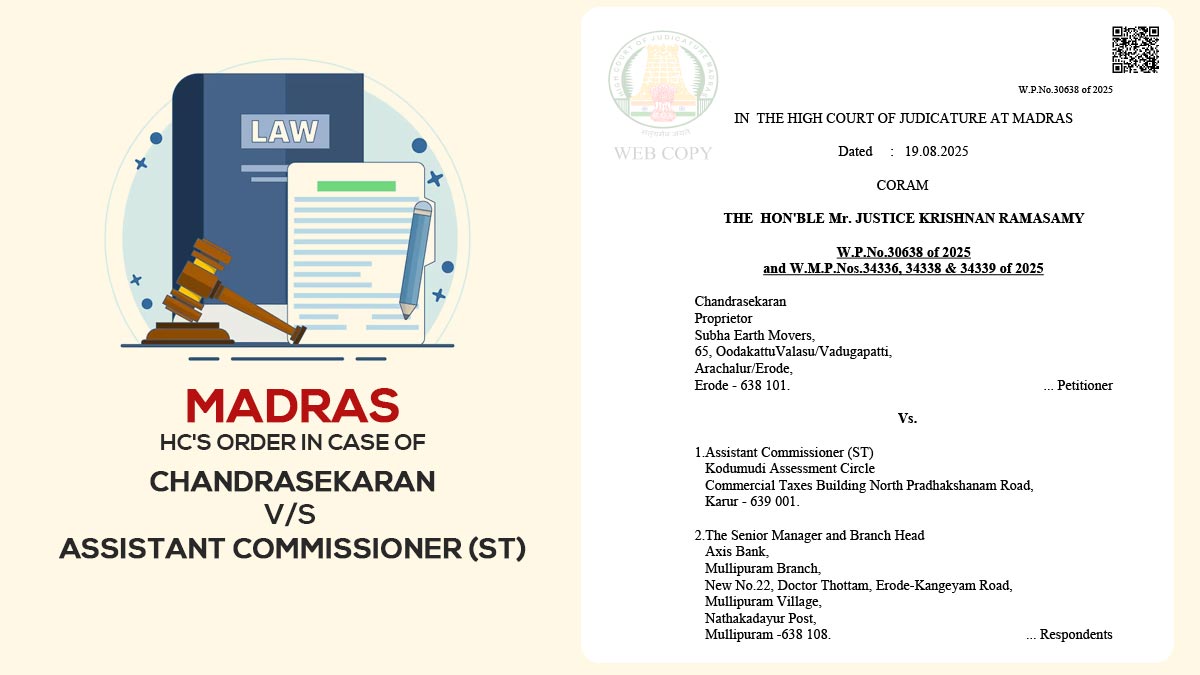

| Case Title | Chandrasekaran vs Assistant Commissioner (ST) |

| Case No. | W.P.No.30638 of 2025 W.M.P.Nos.34336, 34338 & 34339 of 2025 |

| For Petitioner | M/s.R.Ananthi |

| For Respondent | Ms.P.Selvi, Government Advocate (T) |

| Madras High Court | Read Order |