APL Apollo Tubes Limited filed a writ petition, which was dismissed by the Allahabad High Court, which asked to contest a GST demand order of Rs 778.83 crore.

It was ruled by the court that the company needed to exhaust the available regulatory appeal procedure before approaching the High Court.

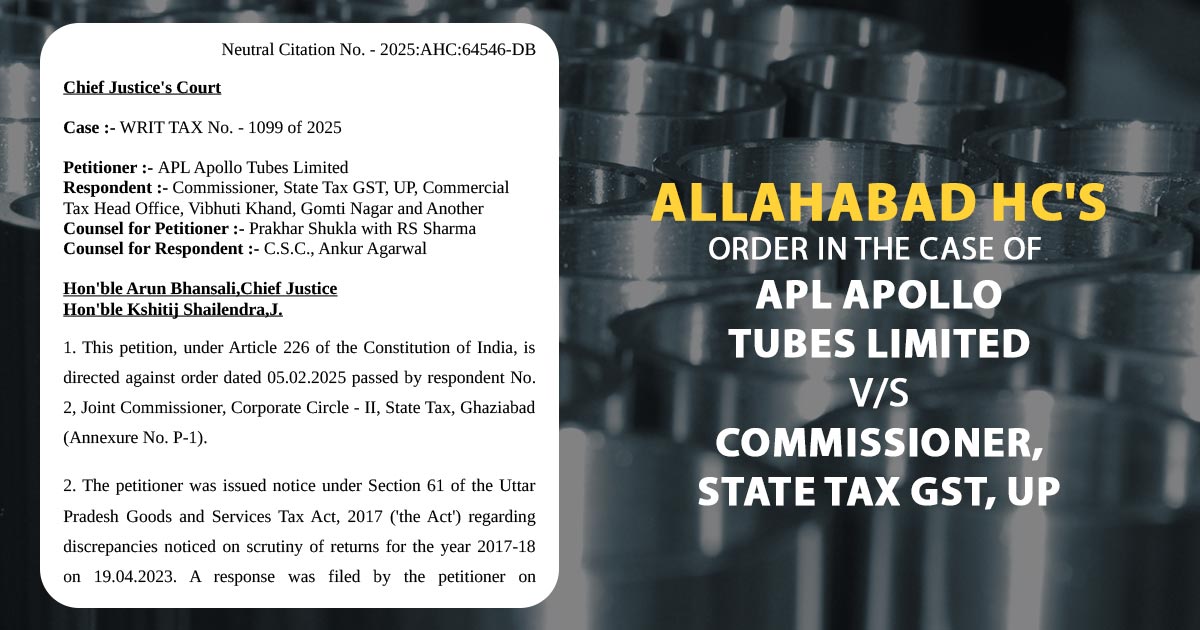

The case is concerned with the GST assessment order on February 5, 2025, issued via the Joint Commissioner, Corporate Circle-II, Ghaziabad, who had discovered the discrepancies in the GST returns of the company for the FY 2017–18.

APL Apollo evaded the turnover of Rs 778.83 crore under the concluded order and asked the company to file tax, penalty, and interest as per that.

A scrutiny u/s 61 of the Uttar Pradesh Goods and Services Tax (UPGST) Act, 2017 discloses two issues:

Let’s take a look at how duty credit scrips are reported differently in GSTR-1 and GSTR-3B!

An amount specified under Column 5O of GSTR-9C, which was explained inappropriately in monthly or annual returns.

The department considered the company’s elaboration for the duty credit scrips; it discovered an explanation that does not have the subject of turnover adjustment under Column 5O.

The problem is with the transactions engaged in high-sea sales and purchases, which were allegedly not reported effectively. U/s 74 a notice was furnished after that, and post considering the response and hearing of the company, the tax authorities passed the challenged order.

Under Article 226 of the Constitution, contesting this APL Apollo approached the HC alleging a breach of natural justice and asking to quash the assessment.

But the division bench, including Chief Justice Arun Bhansali and Justice Kshitij Shailendra, does not discover any merit in bypassing the statutory appeal route.

Read Also: Allahabad HC Penalises SGST Joint Commissioner Ghaziabad in GST Demand Case

The court mentioned that “pleas of violation of natural justice and jurisdiction remain unsubstantiated and cited that “no extraordinary or exceptional circumstances” were incurred to explain the interruption under writ jurisdiction.

The Supreme Court decisions, such as Jaipur Vidyut Vitran Nigam Ltd. vs. MB Power (MP) Ltd. (2024) and Radha Krishan Industries vs. State of Himachal Pradesh (2021), highlight the concept that the constitutional writ powers conferred by Article 226 should be employed judiciously. The Court emphasised that such powers should be utilised sparingly, especially in circumstances when an alternative statutory remedy is available.

Allahabad High Court Final Ruling

“In view of the above discussion, we do not find any reason to invoke our extraordinary jurisdiction in the present case. The petition is, therefore, dismissed, leaving it open for the petitioner to avail alternative remedy in accordance with law.”

The order sought that APL Apollo Tubes Limited pursue the appellate authority under the GST Act, which has the chance of contesting the assessment to the GST appellate authority.

| Case Title | APL Apollo Tubes Limited vs. Commissioner, State Tax GST, UP |

| Case No. | WRIT TAX No. – 1099 of 2025 |

| Counsel for Petitioner | Prakhar Shukla and RS Sharma |

| Counsel for Respondent | C.S.C., and Ankur Agarwal |

| Allahabad High Court | Read Order |