Rent paid by a company to its Directors in their capacity is not levied to service tax under the Reverse Charge Mechanism (RCM), New Delhi Principal Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) ruled.

As a manufacturer and exporter of guar gum powder, PSV Polymers Pvt Ltd actively leverages CENVAT credit on its inputs and input services. The department’s audit unearthed specific financial transactions by the appellant: 75.43 lakh remitted to foreign agents for export procurement services spanning April 2010 to September 2014, and 5.32 lakh paid as rental for a godown owned by a Director, covering the period of July 2010 to August 2015.

An SCN has been issued by the department alleging that the service tax was subject to be filed under the Reverse Charge Mechanism on both these payments and raised a demand of Rs. 9.98 lakh, including interest and penalties.

The counsel of the applicant claimed that the rent was filed before the Director in his capacity as the owner of the godown, and not in his official capacity, and under RCM, no service tax was subject to be paid. Counsel said that accurately, all transactions were recorded in their books and the payments were made via the banking channels, specifying no intention to evade tax.

The counsel of the revenue said that after Notification No. 45/2012-ST, companies must file service tax on services obtained via Directors, along with the rent payments.

Read Also:- CESTAT Kolkata: 12% Integrated GST Applicable on Dabur’s ‘Lemoneez’ Imports

The two-member bench, Binu Tamta (Judicial Member) and Hemambika R. Priya (Technical Member) referred to earlier rulings in Cords Cable Industries Ltd. and Varaha Infra Ltd., where it was ruled that the rent filed before the Directors in their capacity as owners of the premises does not levy the service tax under RCM. The tribunal, with the same logic, ruled that no service tax was required to be paid on the rent in this matter.

The limitation issue hasn’t been analysed by the tribunal, though it cited that in revenue-neutral circumstances, the extended duration of limitation is not applicable. After that, the impugned order was set aside, and the appeal was permitted.

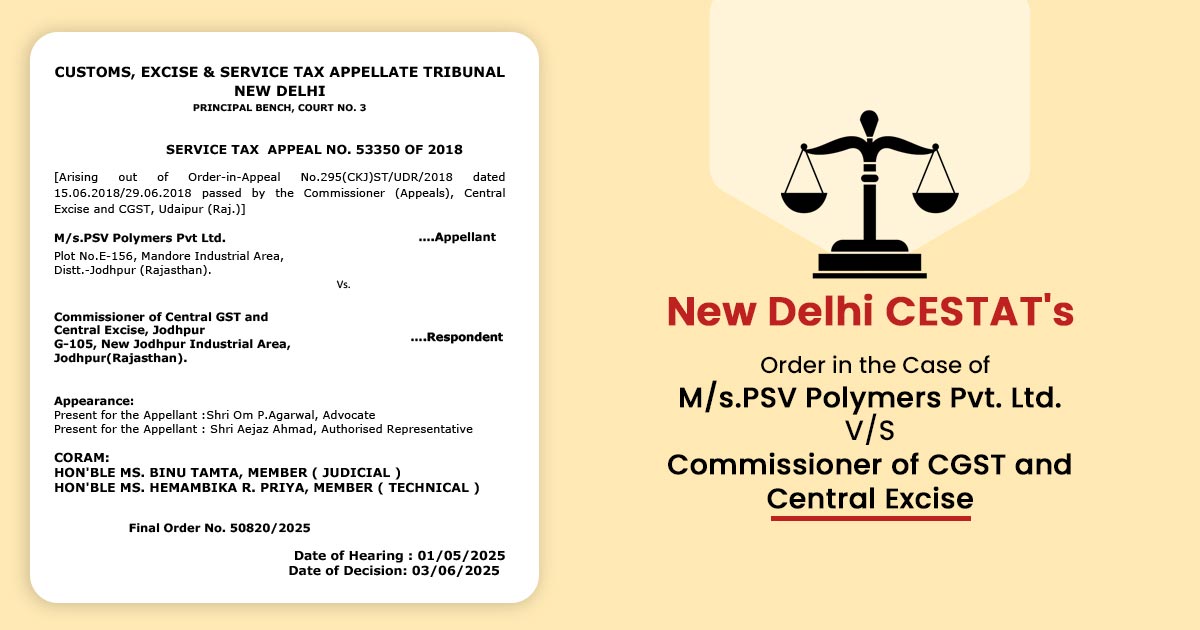

| Case Title | M/s. PSV Polymers Pvt. Ltd. V/S Commissioner of CGST and Central Excise |

| SERVICE TAX APPEAL NO. | 53350 of 2018 |

| Counsel For Appellant | Shri Om P.Agarwal, Advocate |

| Counsel For Respondent | Shri Aejaz Ahmad, Authorised Representative |

| New Delhi CESTAT | Read Order |